Fannie Mae's economists are predicting that economic growth will slow significantly in the fourth quarter to 1.6 percent. This downward revision however is not as dire as it sounds. The company's October forecast was looking for 1.7 percent growth in the third quarter due to an inventory drawdown from the General Motors strike and general weakness in the manufacturing sector. Instead, the third quarter growth in the real gross domestic product (GDP) came in at 1.9 percent. They now see that expected inventory drawdown materializing in this current quarter and that GDP for the year will be 2.1 percent.

The simulative effects of the Budget Act of 2019, improved business investment and continued strength in consumer spending along with a temporary reprieve from trade tensions have moved Fannie Mae's Economic and Strategic Research (ESR) Group to increase their full-year 2020 GDP forecast from 1.7 percent to 1.9 percent. Downside risks include trade volatility, weakness in the manufacturing sector and global uncertainty, specifically the Brexit-driven elections in the United Kingdom and political turmoil in Hong Kong and South America.

Residential fixed investment grew by an annualized 5.1 percent in the third quarter, making a positive contribution to the economy for the first time in seven quarters. The growth came through stronger residential construction, home improvements, and brokers' fees. The ESR Group says it expects this momentum to continue at a more moderate 3.3 percent pace as construction activity and sales remain healthy. Housing market activity however will continue to be constrained by lack of homes for sale.

Sales of existing homes fell in September, as was to be expected after two months of strong growth. Even with a 2.2 percent decline, the annualized rate of 5.38 million units during the month helped third quarter existing home sales to rise to the highest level since the first quarter of 2018. Pending sales rose to a new 2019 high in September so sales are expected to increase in the short term.

The ESR Group predicts that, in the longer term, even as low mortgages rates and strong employment provide a supportive environment, existing home sales may be nearing a plateau. The current sales pace is near a range that they believe to be consistent with recent historic age-adjusted homeowner migration patterns, so they do not expect to see additional "catch-up" migration as happened earlier this decade. This is a partial reason why the availability of existing homes for sale continues to decline, limiting the potential for further growth. These inventory constrains also continue to hold back household formations. Consistent with this view, purchase mortgage applications, while volatile in recent months, appear to be leveling off, and the Fannie Mae Home Purchase Sentiment Index (HPSI) has pulled back modestly over the past two months as fewer respondents believe that the available inventory makes this a good time to buy.

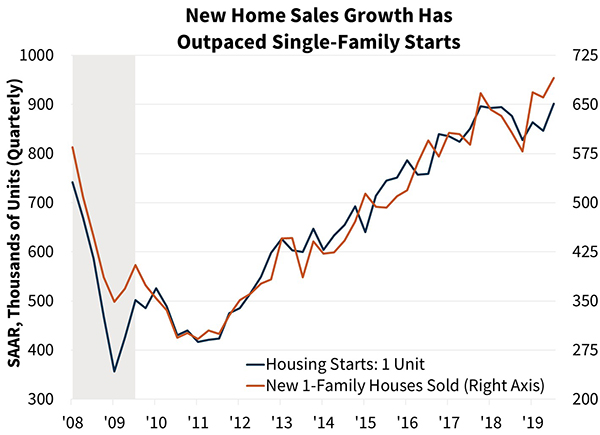

Also new home sales pulled back slightly in September, they have also been improving. For the third quarter the sales pace averaged 691,000 annualized units, the fastest pace since the recession. The Census Bureau's Housing Vacancy and Homeownership Survey reflected this increase in new home sales, with the nationwide homeownership rate rebounding in the third quarter to 64.8 percent after declining during the first two quarters of the year.

Single-family construction is looking more encouraging. There were 901,000 annualized starts during the third quarter, also the highest of the expansion, and permits rose in September for the fifth consecutive month. The Housing Market Index published by the National Association of Home Builders measured an improvement in homebuilder sentiment, increasing in October for the fourth consecutive month to the highest level since February 2018. Nevertheless, a lack of both labor and lots remain a barrier and starts are not growing adequately to match sales. Much of the recent strength in new single-family home sales has come from inventories that accumulated during last year's sales slowdown. That buildup is near depletion and the inventory is now back within its historical norm. The economists expect sales to level off until the supply of new homes gradually catches up and that regional differences in market activity will reflect relative supply constraints. New home sales are likely to continue trending upward in the South while remaining subdued in much of the West and Northeast.

As sales have increased, annual home price appreciation has firmed up following a year of deceleration. While it remains relatively subdued compared to recent years, increasing price growth will dampen recent affordability gains driven by the lower mortgage rate environment.

Mortgage rates have stabilized recently after falling for ten straight months. Freddie Mac's average 30-year fixed mortgage rate rose 8 basis points to 3.69 percent in October, though it remained over a full percentage point below year-ago levels. While mortgage rates are not expected to increase significantly in coming quarters, stabilizing rates will not provide the same support for home purchases that declining rates offered.

Multifamily housing starts fell 28 percent in September, wiping out much of August's 41 percent surge and were down 6.9 percent for the third quarter as a whole. These starts tend to be volatile, however, and multifamily permits over the past two months have been among the highest readings since the past recession. Multifamily construction should remain strong in response to continued low vacancy rates, renter household formation, and low interest rates.

The brighter outlook for home sales led Fannie Mae to increase its forecast for purchase mortgage originations in 2019 and 2020 to $1.29 trillion and $1.30 trillion, respectively. Total originations for 2019 are expected to rise 16.6 percent from 2018 to $2.06 trillion. Looking ahead to 2020, they expect a decline in refinance activity and essentially flat purchase activity to bring down total originations by 9.2 percent to $1.87 trillion, with the refinance share dropping from 37 percent in 2019 to 31 percent in 2020.