Growing numbers of severe weather events throughout the U.S. may be giving new meaning to "location, location, location" in the housing world. CoreLogic senior economist Kathryn Dobbyn writes in the company's blog "housing Pulse" that the $8 billion in property damage caused by severe weather in the U.S. in 2013 is causing the housing industry to think about the risk of any given location's exposure to natural disasters which are only expected to continue to increase in both frequency and intensity.

In some parts of the country, such as Florida's hurricane prone Atlantic coast or the Mid-West's "Tornado Alley" the risk of unexpected property damage is always there and the mortgage industry has relied on required insurance to mitigate its risks. But for a variety of reasons, costs, a lack of understanding of the risks, or the absence of a requirement to insure against most specific risks (floods being the exception), many homeowners don't maintain adequate coverage, especially for less common or widely known risks. Disasters like Hurricane Sandy have highlighted this but until recently very little could be done to quantify differences in the risk of a natural disaster from one property to the next.

Dobbyn says it is now possible however to pinpoint these risks at the individual property level, thus helping to protect the homeowner and reduce or prevent losses by the mortgage lender. While she is clearly promoting a new CoreLogic service with her article, the concept and the technology behind it are interesting enough to overlook the salesmanship.

She says that recent advances in spatial and natural hazard sciences make it possible for example to measure wildfire risk based on the topography and type of ground cover around a home or to predict the likelihood of a property flooding during a hurricane based on the severity of the storm. From this science her company has developed a property-specific natural Hazard Risk Score (HRS) that reflects the overall risk of any one disaster or a weighted score for several natural hazards occurring at the same location.

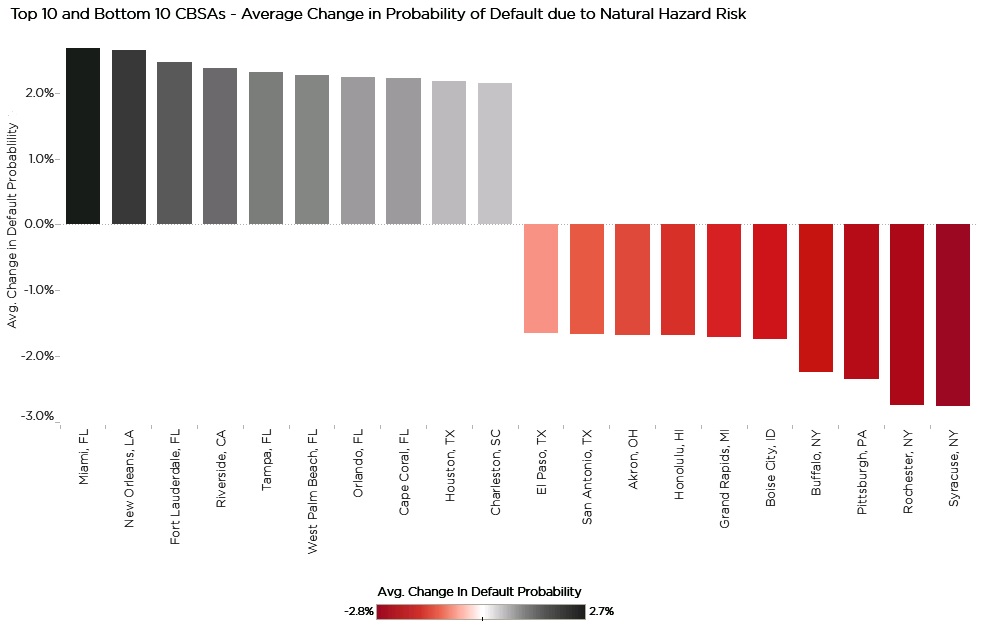

From this what she calls more accurate prediction of the possibility a mortgage will default based on standard measures of mortgage default risk (e.g., creditworthiness, ability to pay, loan terms and down payment) CoreLogic has estimated a default model that adds in the risk of natural hazards. The company used a random sample of more than 3 million first-lien loans that were active at some point between January 1995 and March 2014, including prime, subprime and government loans and were able to measure the reduction and the increase in the average probability of default for markets with a natural hazard risks less than and greater than the national average hazard risk.

It found that seven of the riskiest ten markets are in Florida with its multiple hazards including wildfires, storm surges, flooding and even sinkholes. The safest markets are in a variety of locations, but non-coastal New York State had three of the five safest. The typical increase or decrease to account for natural hazard risk is about 2 to 3 percent, which Dobbyn says is "certainly not inconsequential when one considers that mortgage default rates, recent history excepted, are very low to begin with."

As long as Americans continue to grow in numbers and continue to like living along the coasts the housing stock will be increasingly susceptible to natural disasters and now CoreLogic maintains that mortgage risk can be assessed by a property's specific location and its propensity for natural disasters.