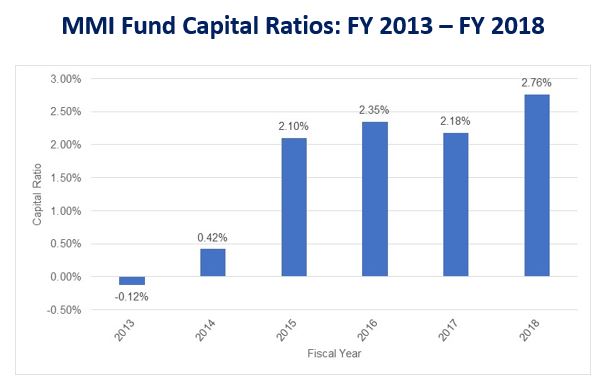

The Federal Housing Administration (FHA) said on Thursday that its Mutual Mortgage Insurance Fund (MMI Fund) exceeded its congressionally mandated minimum reserves in FY2018 for the fourth year in a row. In its 2018 Annual Report to Congress the agency said its Capital Reserve Ratio was 2.76 percent at the end of the year, an 0.58 percentage point increase from FY2017. The Economic Net Worth of the fund was $34.8 billion an increase of more than $8 billion from the previous year. The figure is comprised of Total Capital Resources of $49.24 billion and a negative Cash Flow NPV of -$14.38 billion.

FHA is required to maintain reserves to cover estimated losses plus a capital cushion of 2.0 percent of all Insurance-in-Force (IFF). This 'Capital Ratio' is calculated by dividing the Fund's Economic Net Worth by total IFF of $1.26 trillion. The MMI Fund supports FHA's single-family mortgage insurance programs, including all forward mortgage purchase and refinance transactions, as well as mortgages insured under the Home Equity Conversion Mortgage (HECM), or reverse mortgage program.

"The financial health of FHA's single-family insurance fund is sound," U.S. Housing and Urban Development Secretary Ben Carson said. "FHA is in good hands, guarding against excessive risks, protecting the American taxpayer, and remaining true to our core mission to facilitate safe and affordable mortgage options for qualified borrowers."

Losses during the financial crisis drove the MMI Fund below its required minimums, forcing both increased fees to borrowers and an eventual cash infusion from the U.S. Treasury, the first in FHA's three-quarter century history. The Fund posted its first profit after the crash, $4.8 billion, in 2014, and at that point its parent agency, the Department of Housing and Urban Development warned that the required minimums would not be met for another two years. However, with the rapidly recovering housing market, it did jump above the 2.00 percent cushion the following year.

The report says that FHA endorsed over one million forward mortgages in FY 2018 (including 776,284 purchase loans) totaling $209 billion in unpaid principal balances. The average loan amount was $206, 041. First-time homebuyers accounted for 641,921 or 82.7 percent of all FHA forward purchase loans. The average credit score declined slightly, from 676 in FY 2017 to 670. Almost exactly one-third of forward loan lending was to minority homebuyers

While the value of FHA's forward mortgage portfolio is growing, FHA warns that its reverse mortgage portfolio continues to decline, representing a continuing drain on the MMI Funds from its books of business for 2018 and earlier. The fiscal condition of FHA's forward mortgage portfolio is also materially better than the HECM portfolio. Excluding HECMs, FHA's FY 2018 forward mortgages have a capital ratio of 3.93 percent and a positive Economic Net Worth of $46.8 billion. By contrast, the 2018 HECM portfolio has a negative capital ratio of 18.83 percent and a negative economic net worth of $13.63 billion.

HECM endorsements declined 12.6 percent since last year, with 48,327 new mortgages endorsed. Total Capital Resources in the HECM portfolio totaled $2.11 billion for FY 2018, which was offset by a negative $15.75 billion in Cash Flow Net Present Value.

Last year FHA implemented a set of changes to mortgage insurance premiums and Principal Limit Factors (PLFs) for reverse mortgages and followed with changes to appraisal requirements this year. The agency said it will continue to monitor the impact of the changes on new HECM endorsements and the performance of the portfolio.

FHA Commissioner Brian Montgomery added, "As we look to the future, FHA must continue to seek the right balance between facilitating access to mortgage credit and managing risk. Our number one mission is to make certain FHA remains a stable and reliable resource for first-time and minority homebuyers, and other underserved borrowers."

Through a statement from its new President and CEO Robert D. Broeksmit, the Mortgage Bankers Association (MBA) said it welcomed news of the continued improvement in the Capital Reserve Ratio and that FHA is continuing to closely monitor its forward book of business as it continues to perform well. But, Broeksmit added, "The drain on the fund presented by the HECM program continues a trend that MBA has highlighted previously and remains a topic of concern. Reverse mortgages are an important financial tool that, if used properly, can allow the growing number of retirees to age in place. MBA applauds the recent steps FHA has taken to stabilize and improve the HECM program, and policymakers should continue considering ways to insulate the forward program from the volatility in the reverse program."