Freddie Mac and Fannie Mae have released guidance to their lenders on changes to their loan products occasioned by the expansion and extension of the Home Affordable Refinance Program better known as HARP2.0. The changes apply to Freddy Mac's Open Access Relief Refinance Mortgages, both Same Servicer and Open Access versions and to Fannie Mae's Refi PlusTM and DU Refi PlusTM loans. The changes will be effective for loan applications dated on or after December 1 however the effective dates relative to Note dates and GSE settlement dates vary for some of the changes as noted in the actual guidance.

The changes discussed below are from the information issued by the GSEs and apply to loans with LTV both greater and less than 80 percent. The changes outlined below are those articulated by Freddie Mac but they generally apply to Fannie Mae loans as well and where differences exist they are summarized below. Affected parties should review the relevant documents (http://www.freddiemac.com/sell/guide/bulletins/pdf/bll1122.pdf for Freddie and https://www.efanniemae.com/sf/guides/ssg/annltrs/pdf/2011/sel1112.pdf for Fannie) in their entirety for complete descriptions of the changes in requirements and applicable dates. The changes include but are not limited to removing the maximum LTV ratio of 125 percent for fixed rate mortgages (FRM) sold under fixed-rate Cash and fixed-rate Guarantor (the 105 percent maximum LTV for adjustable rate mortgages (ARM) will not be affected) and extending the expiration date for the program to December 31, 2013.

Sellers who are using the requirements currently in effect may continue to sell to Freddie Mac if the mortgage application date is prior to December 1 2011, the Note date is on or before January 31, 2012, and the settlement date with Freddie Mac is on or before April 30, 2012. These settlement dates vary slightly for Fannie Mae.

The following revisions will be effective for mortgages with settlement dates on or after January 3, 2012. The key change is the elimination of the requirement that the Seller represent and warrant that the mortgage being refinanced met certain Freddie Mac eligibility requirements in its Purchase Documents. Other changes include:

- Adding a Borrower benefit provision allowing the Relief Refinance Mortgage to be originated for the purpose of reducing the monthly payment. In the case of Fannie Mae the benefit may also be the extension of the loan term.

- Requiring at least one Borrower have a source of income and that the Seller verify it.

- Eliminating the use of either the appraisal or Automated Valuation Model (AVM) from the earlier mortgage.

- Limiting the determination of property value based on a new AVM to Home Value Explorers;

- Allowing a single 30-day delinquency within the previous 12 months on the mortgage being refinanced but not within the previous 6 months.

- Removing the requirement that the occupancy or the old and new mortgage be the same.

- Revising the age requirement for the HVE model estimate from no more than 180 days on the settlement date to no more than 120 days on the Note date.

- Revising requirements where the new mortgage increases the P&I payment by more than 20 percent. These requirements are spelled out by Fannie Mae to include a minimum credit score of 620, maximum DTI ratio of 45 percent and verification of income sources and necessary assets to close (if needed.) In the event there is more than one product option available the borrower must be qualified using the one with the lowest payment to determine if the 20 percent rule applies.

- Adding specific requirements regarding solicitation, advertising, and other communication with borrowers.

Section 46.26 of the Guide has also been updated to reflect changes to Freddie Mac's post funding quality control review of mortgages.

Effective for mortgages with settlement dates on or after March 15, 2012 an HVE can be used to determine the property value of certain two-unit properties as well as one-unit properties.

Fannie Mae has spelled out addition LTV criteria for HARP2.0 eligibility. The maximum LTV is eliminated for both 30-year and 15-year FRM. Loans with amortization terms greater than 30 years through 40 years will be limited to an LTV of 105 percent as will ARMS with initial fixed period or five years or more and terms of 40 years or less. Fannie Mae also removes the requirement that the borrower on the new loan meet the standard waiting period and re-establishment of credit criteria following bankruptcy or foreclosure.

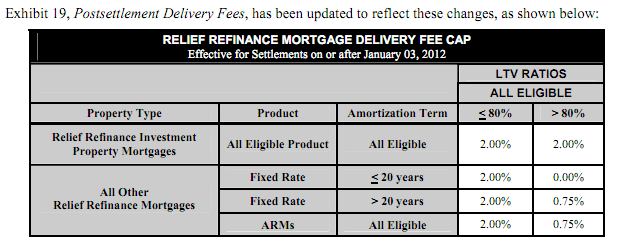

Delivery fee caps are being adjusted for mortgages with settlement dates on or after January 3, 2012. The fee for all mortgages with an LTV less than 80 percent and for Investment Properties remains unchanged at 200 basis points. The delivery fee mortgages with LTV rations greater than 80 percent has been reduced to:

- 0 basis points for Non-Investment Property fixed-rate loans with 20 years or less amortization;

- 75 basis points for non-Investment Property fixed rate mortgages with amortization greater than 20 years;

-

75 basis points for non-Investment Property

mortgages that are ARMs.