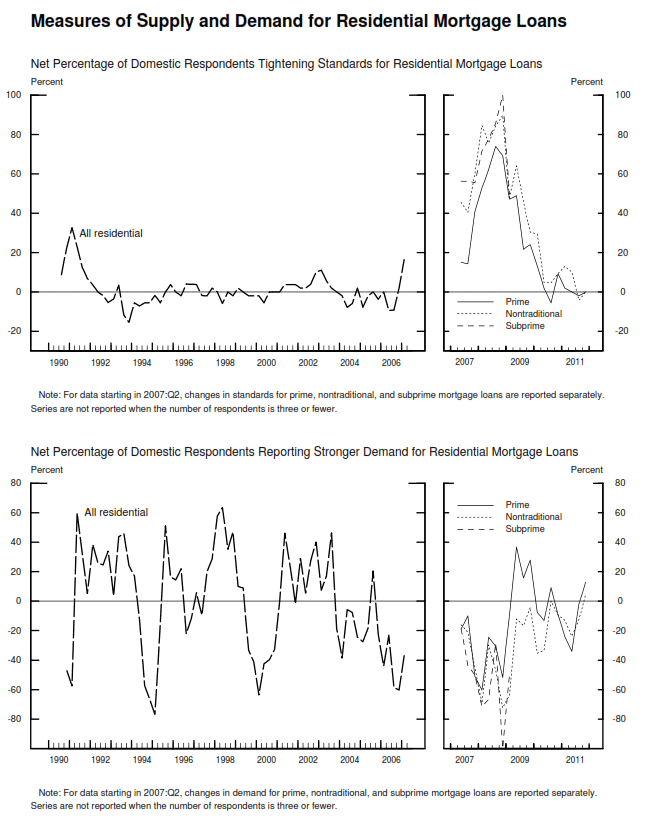

The October Senior Loan Officer Opinion Survey on Bank Lending Practices conducted by the Federal Reserve found few changes in the supply of, and demand for residential loans over the past three months. The survey addresses all types of commercial, industrial and residential lending among large banks. Fifty-one domestic banks and 22 U.S. branches and agencies of foreign banks responded to the October survey.

Loan officers were asked whether their bank's credit standards for approving applications for home mortgages had changed with respect to prime loans, nontraditional loans such as option, interest only, and Alt-A products; and subprime loans. Forty-four of 48 banks reported that their credit standards for prime loans had remained basically unchanged over the period while 2 reported some tightening of standards and 2 reported some easing. More than half of the banks queried responded that their banks did not do non-traditional loans, but of the 21 that did all reported that their credit standards had remained basically unchanged. The responses to the same question regarding subprime lending were too few to include in the report.

The survey asked whether, apart from seasonal variations, the demand for newly originated residential mortgages had changed over the three month period. Fifteen banks reported a moderately stronger demand for prime mortgages and eight said demand had been moderately weaker; the remaining 24 reported little change.

Demand for nontraditional mortgages was moderately stronger according to five banks and moderately weaker at four institutions. The remaining 13 reported no change while 26 respondents said their banks did not originate such loans. Again there were too few responses in the subprime category to tally.

Fifty banks responded to the same set of questions regarding revolving home equity lines of credit. Forty-seven banks reported no appreciable changes in credit standards for these loans over the past three months; one said standards had tightened somewhat and two said they had eased somewhat.

Demand for home equity loans was substantially the same for 32 banks, moderately weaker for 15, and substantially weaker for one. Two banks said that demand had strengthened moderately.

Domestic banks continued to report little change in their standards on commercial real estate (CRE) loans, which were widely described in a special question in the previous survey as being at or near their tightest levels since 2005. Forty or 78 percent of all banks reported little change. However, a large fraction of foreign respondents reported having tightened standards on CRE loans, in a substantial shift from the net easing reported by those institutions in the prior two surveys. Thirteen banks or 25 percent reported moderately greater demand for CRE loans, 32 reported no change and four reported moderately weaker and two substantially weaker demand.

The Fed always includes a set of special questions in its survey and the current set, dealing with lending to firms with European exposure may be of interest.

About one-half of the domestic bank respondents, mostly large banks, indicated that they make loans or extend credit lines to European banks or their affiliates or subsidiaries, and about two-thirds of the foreign respondents indicated the same. Among those domestic and foreign respondents about two-thirds reported having tightened standards on loans to European banks over the third quarter. Many domestic banks indicated that the tightening was considerable.

About three-fifths of the domestic respondents, mostly large banks, and all foreign respondents indicated that they make loans or extend credit lines to nonfinancial firms that have operations in the United States and significant exposures to European economies. Among those domestic and foreign respondents, a moderate fraction indicated that they had tightened standards on C&I loans to such firms. These loans reportedly constituted a small portion--less than 5 percent--of outstanding C&I loans at a majority of domestic respondents, and greater exposures were reported only by large banks. Such loans typically accounted for larger portions of the foreign respondents' lending.

Small net fractions of domestic respondents indicated weaker demand for credit from European banks (and their affiliates or subsidiaries) and from nonfinancial firms with significant exposures to European economies.