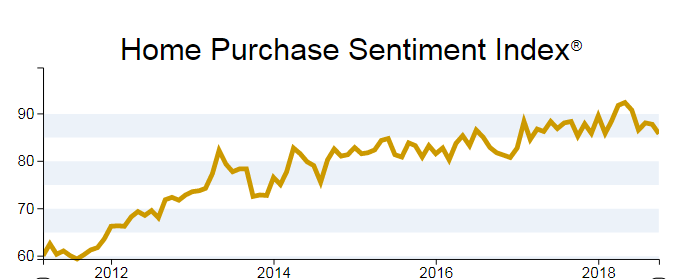

Despite the success of the U.S. economy as of late, housing sentiment seems to have hit a rough patch. Fannie Mae said its Home Purchase Sentiment Index (HPSI) continued to decline in October, moving lower for the third time in four months. The index, based on responses to a portion of questions in the National Housing Survey, fell by 2.0 points to 85.7 with five of the six components posting declines and the fifth unchanged from September.

The net share of Americans who say it is a good time to buy a house fell 5 percentage points to only 21 percent. The net is the result of subtracting negative responses from positive ones. Those saying it is a good time to sell was down by 3 points to 35 percent. That measure has dropped by 9 points since June.

The net share of those who expect prices to continue to rise fell 2 percentage points to 37 percent while the net of those expecting mortgage rates to move lower dropped 1 point to a negative 57 percent.

The fifth component to retreat was the question on job security. The net of those who are confident about not losing their job over the next 12 months fell 1 point but remains at a solid 78 percent.

The component that was unchanged was the net share of those who say their household income is significantly higher than it was 12 months ago. It held steady at 10 percent.

"After hitting a survey high during the spring home buying season, the HPSI has trended downward, declining in October to its lowest level in a year," according to Doug Duncan, Fannie Mae senior vice president and chief economist. "While the October drop was broad-based - all but one of the six HPSI components declined - the net share of consumers who said it's a good time to buy a home posted the largest decrease, tying its second lowest reading in the survey's history. The further erosion of buying sentiment occurred despite generally positive views of the economy. Among those who said it's a good time to buy, 30 percent - a record high - cited favorable economic conditions as the reason.

"Meanwhile, the share of consumers who think the economy is on the right track continued to grow, reaching a new survey high. The contrast between the survey's findings of weak home buying sentiment and overall economic optimism mirrors what we're seeing in the broader economy. While economic growth posted the fastest back-to-back pace in four years in the third quarter, residential investment declined for the third consecutive quarter, a first for the current expansion."

The Home Purchase Sentiment Index (HPSI) distills information about consumers' home purchase sentiment from Fannie Mae's National Housing Survey® (NHS) into a single number. The HPSI reflects consumers' current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making. The HPSI is constructed from answers to six NHS questions that solicit consumers' evaluations of housing market conditions and address topics that are related to their home purchase decisions. The questions ask consumers whether they think that it is a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. Respondents are asked more than 100 questions to track attitudinal shifts. The October 2018 National Housing Survey was conducted between October 1 and October 25, 2018.