Cash-out refinancing is currently a larger share of the refinance market than at any time since the financial crisis. However, the Urban Institute (UI) says even though those refinances were one of the main contributors to the crash, the present trend doesn't worry them.

Cash out loans, defined as those where the new loan is at least 5 percent larger than the loan it replaces, made up 77 percent of total refinances in the second quarter of 2018. According to Freddie Mac, which tracks its loans that are refinanced into another Freddie Mac product, this is the largest share since 2008.

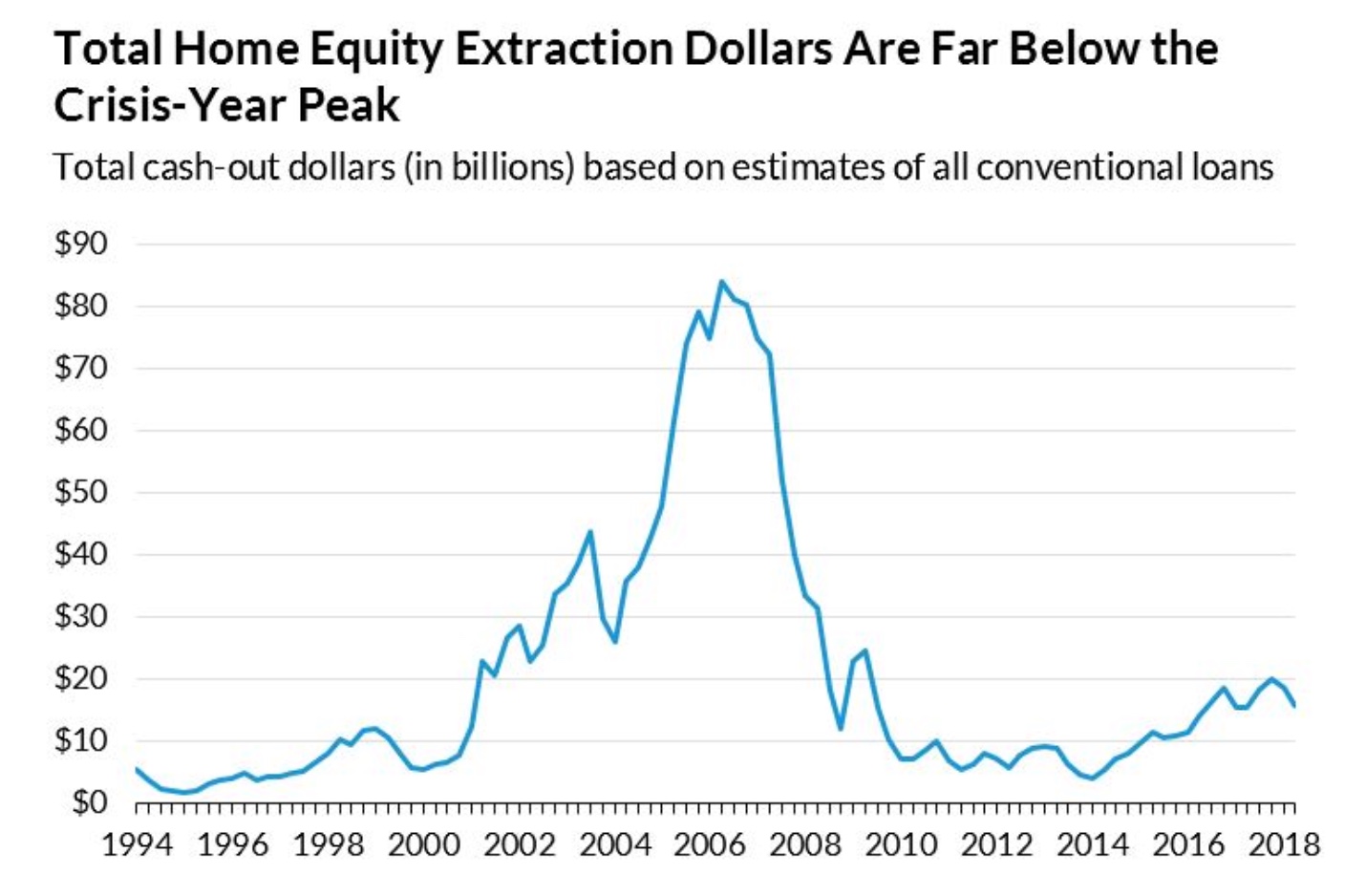

Despite the high percentage of loans, the dollar volume of equity that is being withdrawn is still well below the crisis peaks. Homeowners cashed out $15.8 billion in equity during the second quarter of this year, far below the $75 to $85 billion in the pre-crisis years.

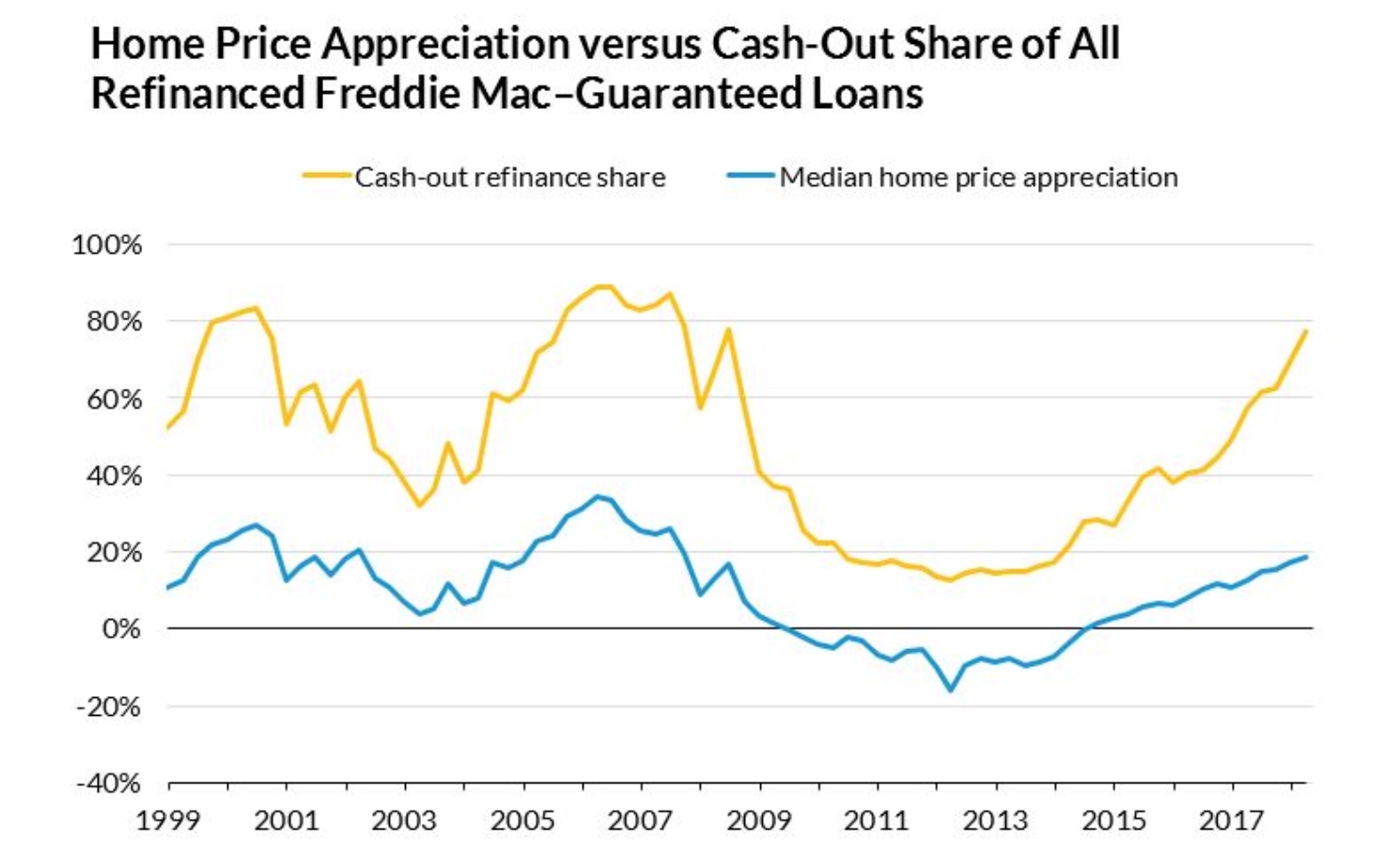

UI authors, Edward Golding, Sarah Strochak, and Laurie Goodman say the recent surge is not a concern for several reasons. First, cash-out refinancing is strongly correlated historically with increasing home prices and rising interest rates. Homeowners refinance either to lower their rate and monthly payment (a rate/term transaction) or to extract equity. Rising rates tend to depress rate/term refinances while the 6 to 8 percent annual growth of home prices over the last several years provides an incentive for cash out refis.

UI says the information that cash out refis are at the same level as in 2008 may seem alarming and needs to be put in context. The share of all refinance activity, after driving the mortgage market for several years, has now shrunk to the lowest point in years. Refinance originations currently make up less than 30 percent of total loan production for Freddie Mac. Interest rates recently hit an eight-year high so many homeowners who took out purchase loans or refinanced earlier have mortgages with rates lower than the prevailing ones. They would gain nothing from a rate term refinancing, thus shrinking that share of the market. Therefore, the cash-out share is growing but doing so within a shrinking overall market. When one looks at the cash-out refinance share of all loans, going back to 1994, one sees that today's share is not out extraordinary and in some cases is even lower similar periods of rising interest rates and strong home price appreciation.

Refinancing is just one way that equity can be extracted. Homeowners have the option of home equity lines of credit (HELOCs), regular second mortgages, and for seniors those widely advertised reverse or home equity conversion mortgages. As another sign that the current cash-out activity shouldn't be a concern, UI notes that use of these alternative products is not growing. The Federal Deposit Insurance Corporation says HELOC volume is down 8 percent on an annual basis and Freddie Mac says some of the cash-out refinancing it sees is debt consolidation.

As noted earlier, borrowers are not extracting nearly as much of their equity as they did in 2006 when cash-out dollars peaked at 31 percent meaning of that equity. Today homeowners are taking out an average of 21 percent and the average since the housing crash has been 8 percent. Guarantors are on top of the situation as well; Fannie Mae, Freddie Mac, and the Federal Housing Administration have lowered the maximum loan-to-value ratio for cash-out refinances, reducing the amount of cash that can be extracted. All and all, the combination of low refinance volume and the fact that borrowers are taking out less equity when they cash out means that the volume of cash-out dollars remains low.

The UI authors conclude that, while cash-outs may have the highest share of refinances in the post crisis era, this is not a potential problem. It follows historic patterns when, as home prices rise, homeowners take advantage of it. They tap that equity to make home improvements, pay for educational and health care expenses, maybe even indulge in a few luxuries. "Of course, prudent underwriting of the risks is always important," they advise, right now it appears that the underwriting is being done prudently.