While mortgage performance continues to be the best in many years, with the national delinquency rate down to 3.53 percent and record low foreclosure starts and completions, Black Knight's September data shows a few disquieting numbers. The company's Mortgage Monitor for the month shows that delinquency rate improvement has slowed, probably to be expected with the numbers so close to rock bottom. Still, when delinquency data from hurricane-impacted areas is excluded, the six-month average rate of decline has narrowed to less than 1 percent in recent months. The company says this suggests that, while performance remains strong, we may be nearing the trough in the national delinquency rate, if we haven't already reached it.

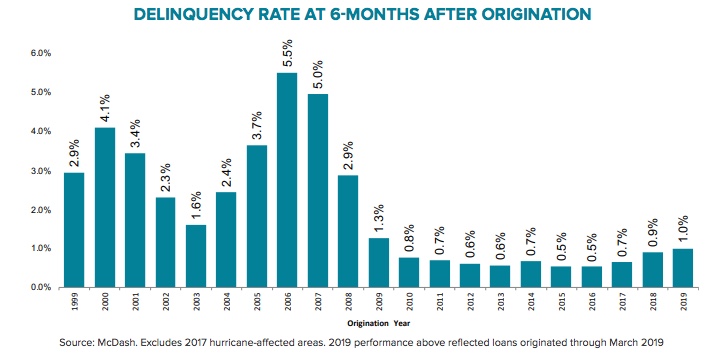

Possibly a little more unsettling, early-stage delinquencies among recently originated loans are trending higher. The numbers are still low but about 1 percent of loans originated in the first quarter of 2019 were delinquent six months after they closed. While way below the 2.93 percent average in 2000 to 2005, that number has tended up by more than 60 percent over the last 24 months and is the highest rate of loans in that category since 2010.

The change has been most evident in purchase loans and to a lesser degree among cash-out refinances. The delinquency rate among newly originated rate/term refi mortgages has remained relatively flat.

Black Knight notes that the early delinquency rate among recent vintage Fannie Mae and Freddie Mac (the GSEs) mortgages remains well below both the GSEs' own long-term numbers (60 percent less) and the larger market (by 40 percent), they have also been moving higher. The 0.6 percent rate among recent vintages has gone up two-tenths of a percent over the past 24 months. The pattern is different as well; performance is stronger among newly originated purchase loans than either type of refinances.

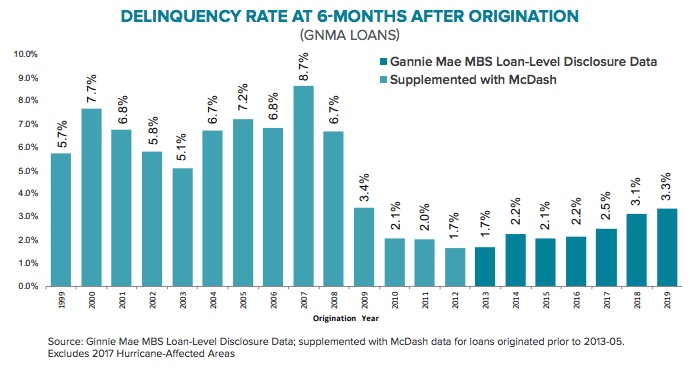

The sharpest increases in early stage delinquencies have been among GNMA-securitized loans. While they remain at roughly half their 2000-2005 averages, loans originated through government programs (FHA, VA, USDA) have reached a delinquency rate of 3.3 percent within 6-months of origination over the last year, with purchase loans accounting for the majority and primarily those made to first time buyers.

Debt-to-income (DTI) ratios among GNMA purchase loans peaked at 43.2 percent in January. Given average closing timelines, those loans would reflect the period in late 2018 when 30-year fixed rates peaked near 5 percent and home affordability had hit a nine-year low. Strangely enough, Black Knight says, first-time buyers actually had lower-than-average DTIs. Given the relatively stable performance of repeat homebuyers who face the same affordability challenges as first timers it suggests that falling credit scores may have more impact on performance than DTIs. (This is in line with recent research from the Urban Institute.) Credit scores were 25 points higher on average among repeat buyers than first time buyers.

Black Knight Data & Analytics President Ben Graboske said, "Though there has been some softening in GSE purchase loan performance, it hasn't been to the extent seen among entry-level buyers. All in all, first-time homebuyer originations combined between the GSEs and GNMA increased by nearly 50 percent between 2014 and 2018. However, whereas first-time homebuyers represent just over 40 percent of GSE purchase loans, they make up 70 percent of the GNMA purchase market.

"That concentration is contributing to a more significant increase in early-stage delinquencies among GNMA loans, which saw 3.3 percent of loans delinquent six months after origination. That's up 1.2 percentage points from two years ago, and though still roughly half the 2000-2005 pre-crisis average, it represents the sharpest increase we've seen in the market in recent years. With a growing population of first-time homebuyers poised to enter the market, this is a trend Black Knight will continue to monitor," Graboske said.

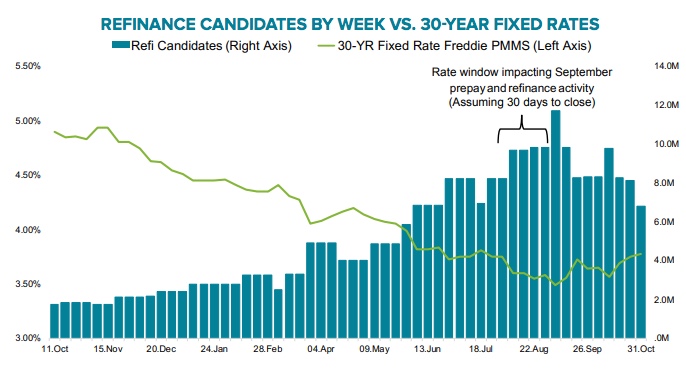

Black Knight also continues to track the impact of the volatile interest rate environment on the pool of homeowners who can qualify for and benefit from refinancing. In the latest example of how sensitive the market is to rates these days, the slight uptick in Freddie Mac's 30-year rate last week, up 3 basis points from the prior week to 3.78 percent, cut the pool of refi candidates to 6.8 million. That is a 30 percent decline from the monthly average of 9.7 million candidates in September and 42 percent below the all-time high of 11.7 million during the week of September 5. However, that pool is still nearly 60 percent larger than in November of last year as rates were nearing their recent high-water mark.

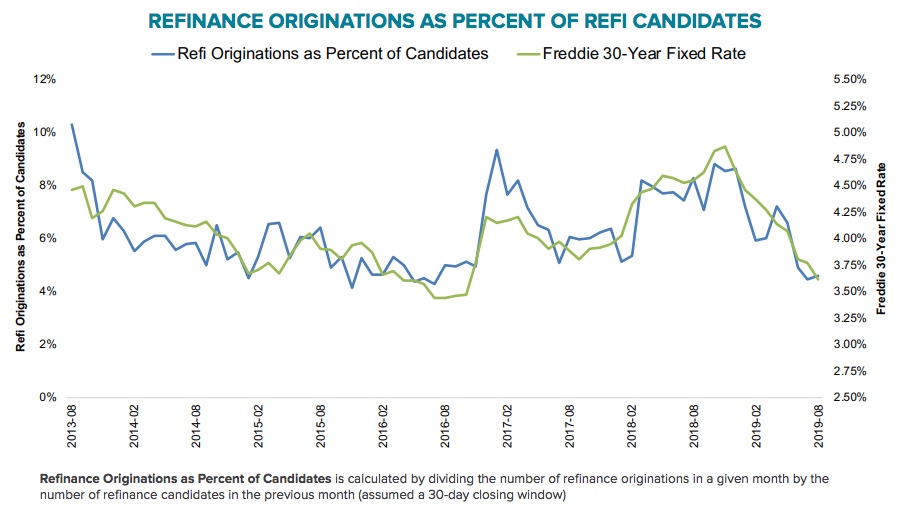

Many of those candidates appear to have seized the opportunity. Black Knight looked at the percentage of refi candidates that have shown up with new loans. They found that, over the past three months, 4.7 percent of the prior month's candidates have refinanced. That is identical to the pull-through rate in the last refi surge when interest rates were similar to those today, April to October 2016. If interest and pull-through rates remain steady, refi closing will likely do so as well and at twice the number as in late 2018, They will then pull back toward the end of the year.

Consistent with the refinance rate, prepayments continued high in September, rising 3 percent month-over-month. Over the last three years the seasonal decline in home sales has lowered prepayments by 11 basis points from August to September so the 5-basis point rise this September represents a potential 15 basis point increase in refinance related prepayments. Prepayments of mortgages originated last year rose another 12 percent in September to 3.4 percent.