The Departments of Treasury and Housing and Urban Development have released their joint October 2011 Housing Scorecard. The report is essentially a summary of data on housing and housing finance released by public and private sources over the previous month and/or quarter. Most of the data such as new and existing home sales, permits and starts, mortgage originations, and various house price evaluations have been previously covered by MND.

The scorecard incorporates by reference the monthly report of the Making Home Affordable Program (HAMP). HAMP reports that 25,974 homeowners have entered into HAMP loan modification trials since its last report in September. This brings the cumulative number of trials begun since the program was initiated in April 2009 to 1,714,012. Of these trials, 766,203 were cancelled in the trial stage, 90,835 remain in trial status, and 856,974 trial modifications have been converted to permanent status, 40,141 of these in the last month. A total of 720,612 permanent modifications are still active.

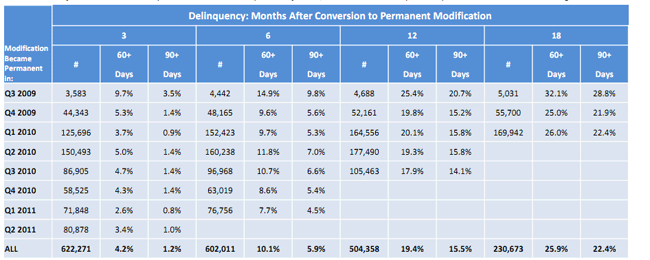

The program now has data on 622,271 permanent modifications that have been in force long enough to collect at least some information on recidivism and, as HAMP has previously stated, the delinquency rate continues to improve with each generation of modifications. As can be seen from the table below, there has been a definite downward trend in delinquency for most loans over those in earlier vintages after the same period of seasoning.

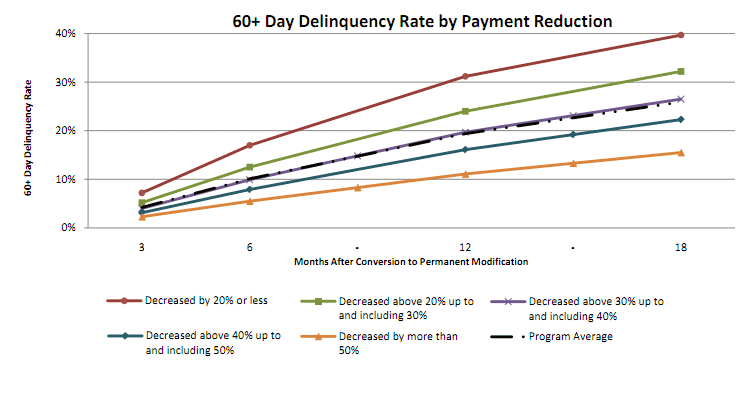

Not surprisingly, there has been a strong correlation between reduced payment and success of the modification. For example, loans that received a 20 - 30 percent reduction in payment have a serious delinquency rate (90+) of 28.1 percent after 18 months; a modification resulting in a 50 percent or greater payment reduction has a rate of 12.9 percent. The table below compares various loan reductions against a 60+ delinquency.

The program continues to improve its numbers in terms of shortening the length of what are supposed to be three month modification trials but which, in the earlier days of the program, often dragged on for many times that length. The average duration of the trial period for those converted to a permanent HAMP modification has decreased from 5.3 months for trials started prior to June 1, 2010, to 3.5 months for trials started after June 1, 2010 when substantial changes were made to the HAMP guidelines. All servicers but Chase, which is averaging 4.6 months, are actually below that 3.5 month average.

In September the number of active trials that had lasted for more than six months was down from 27,345 in August to 19,793. In September 2010 there were 76,500 trials that had been in existence for six months or more. Bank of American and Chase are noteworthy in this category. While the two services together were responsible for 40.5 percent of all trials initiated over the life of the program, they hold 61.57 percent of the extended trials. Nine of the 12 largest servicers have reached the 80 percent benchmark in converting to permanent status those trials started after June 30, 2010. SPS has the best record at 90 percent, Chase the worst at 72 percent.

HAMP is responsible for several smaller foreclosure avoidance programs. Servicers have started 32,078 agreements under the Home Affordable Foreclosure Alternatives (HAFA) program and completed 18,557. Just over 500 of the completed transactions were deeds-in-lieu of foreclosure, the remainder were short sales.

The Second Lien Modification Program (MP2) has started 45,705 modifications of junior liens and has extinguished 6,332 and modified 38,658.

HUD says of HAMP, "Even as new delinquencies continue to fall, eligible homeowners entering HAMP have a high likelihood of earning a permanent modification and realizing long-term success. Eighty percent of eligible homeowners entering a HAMP trial modification since June 1, 2010 received a permanent modification, with an average trial period of 3.5 months. After six months in the program, more than 94 percent of homeowners remain in their HAMP permanent modification. Homeowners in HAMP permanent modifications have saved an estimated $8.8 billion to date."