The latest Mortgage Monitor report from Lender Processing Services (LPS) shows a housing market where things are improving slowly, while parts of the infrastructure appear to be slipping into dysfunction, especially in those states that utilize a judicial process of foreclosure.

The underlying problems do seem to be easing. Delinquencies dropped one-half of one percent from August to September to a national rate of 8.09 percent, 12.7 percent below the rate in September 2010. On the other hand, newly delinquent loans (loans that had been current 60 days earlier) have increased steadily since June and now represent 1.6 percent of all loans. Still this is only about half the number of new delinquencies entering the system in late 2008 through early 2010. . It is disquieting to note that the states that have had the most persistent high levels of foreclosures - Nevada, Arizona, Florida - are still running well above the national average, with new delinquencies in Nevada now at 3.21 percent. About a quarter of early-stage delinquencies have in arrears for the first time, a figure that has been relatively consistent since the beginning of the year.

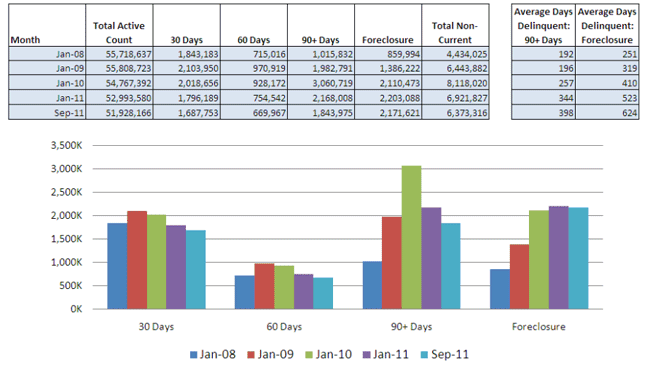

At the end of the reporting period there were 6.4 million non-current loans nationwide, down from 6.9 million in January. Of these, just over 4.1 million are seriously delinquent (over 90 days) or in foreclosure compared to 4.4 million at the beginning of the year.

There were a total of 22,273 foreclosure starts during the month, 11.2 percent fewer than in August and 20 percent less than one year earlier. Loans in foreclosure represent 4.18 percent of all loans in the country, up 1.7 percent from July and nearly 9 percent from one year ago.

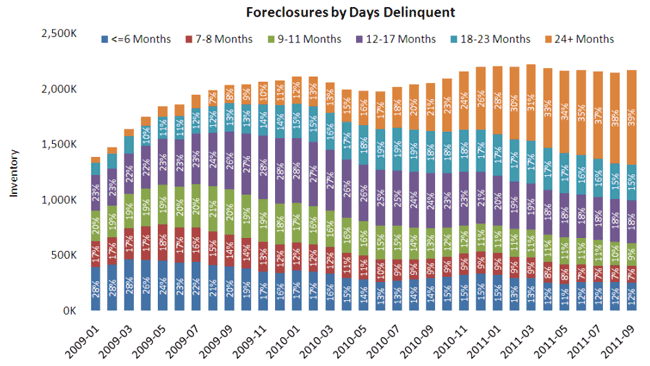

Despite the shrinking numbers throughout the system, the process is stagnating in places and delinquency is becoming chronic. Loans are not being processed out of the system either through foreclosure or cure. In January 2008 a seriously delinquent loan had been delinquent for an average of 192 days, today that average is 398 days, up from 344 just since January. In January 2008 it took 251 days for a loan to wend its way from first delinquency to foreclosure; today that average is 624 days, up 101 days just since the first of this year. Almost 40 percent of loans in foreclosure have not made a payment in two years and 72 percent have not made a payment in at least a year.

The situation is even worse in the 24 states that rely fully

or primarily on a judicial form of foreclosure.

Seven of the top 10 states by percentage of non-current loans are judicial

and the foreclosure inventories in these seven states now account for nearly

seven percent of the entire active loan count.

And not only are delinquencies growing in those states, but so is the

timeline for those foreclosures. The

time from last payment to foreclosure sale in judicial states is now 761 days,

six months longer than in non-judicial states and only 1.6 percent of the

foreclosure inventories in those states are moving to sale compared to 7.3

percent in non-judicial states. Foreclosure inventories as a percent of loans

in non-judicial states at the beginning of 2008 were 1 percent and 2 percent in

judicial states. Today the inventories

stand at around 2 percent in non-judicial states and over 6 percent in judicial

states.

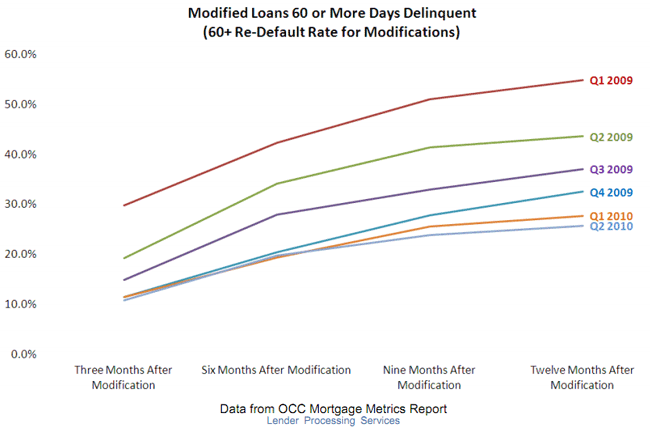

Loans are also not being positively resolved in the volumes they were earlier. Modifications fell from 160,000 in March to 149,000 in June with a big drop proprietary modifications more than offsetting a rise in HAMP conversions. There has been a decided improvement in the success of those modifications, however, with the default rate after 1 year running around 20 percent for loans modified in 2010 compared to 50 percent for earlier modifications at the same age.

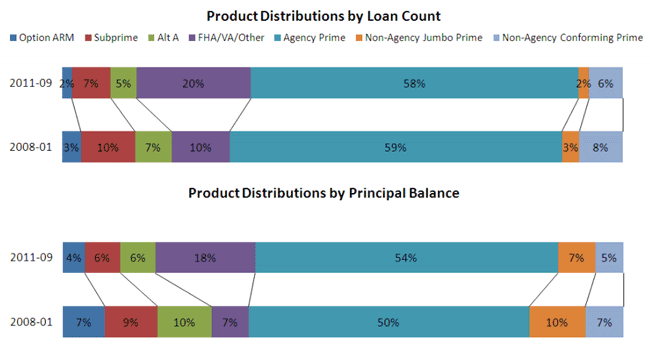

The LPS report notes that the government share of the

mortgage market has increased markedly since the beginning of the mortgage

crisis, with most of that uptick both in numbers of loans and outstanding

mortgage balances coming in the FHA/VA markets as those loans appear to have picked

up the slack as Option, Alt-A, and subprime loans declined.