Like Fannie Mae, Freddie Mac's economists are viewing the disruptions from the recent hurricanes as short-lived. The 33,000-job loss in September, for example, was largely attributable to a steep month-over-month drop in hiring in the leisure and hospitality industry, almost certainly an effect of the storms. The already tight supply of homes was exacerbated by the hurricanes, with total home sales for August at a weak 5.9 million units.

Freddie Mac's economists devote most of this month's Outlook to looking at the potential impact in the shorter and longer terms. Moody's Analytics' preliminarily puts the economic losses in Texas and Florida from Harvey and Irma at almost $168 billion. Roughly $51 to $56 billion worth of residential real estate was affected by Hurricane Harvey and $30 to $40 billion by Hurricane Irma. The preliminary cost of Hurricane Maria to Puerto Rico is estimated to be between $45 billion and $95 billion, and residential real estate is expected to be the biggest driver of losses; between $25 and $55 billion.

The damage to homes will certainly put more pressure on the already-tight housing inventory. The Census Bureau's Building Permits Survey estimates that about 13 percent of the country's total housing permits are issued in those counties in Florida and Texas that were included in the FEMA Hurricane Disaster Declaration.

The September Outlook noted two reasons why builders are not building enough houses; the tight construction labor market and high development costs. There is a significant gap in skilled construction workers because of an inability to attract young workers, the opioid crisis and increased immigration enforcement. Similarly, land-use regulations have become more burdensome in the U.S., making developable land costlier.

The housing situation is likely to further deteriorate in Puerto Rico which was already facing a debt crisis, population losses and infrastructure issues. On the mainland, Freddie Mac expects there will be three results from the recent hurricanes in the housing market.

Inventory will be tighter while

house prices will see short-term growth

The damage in Texas from Harvey is similar to that caused by Hurricane Katrina in New Orleans in 2005. Freddie Mac's House Price Index shows the annualized quarterly appreciation in New Orleans jumped from about 11 percent in the second quarter of 2005 to about 18 percent in the fourth quarter. This was driven by tight inventory in those areas affected by the storm and people looking to buy in dry and unaffected neighborhoods. However, prices later declined as many long-term New Orleans residents permanently relocated elsewhere.

Harvey, as of early reports, destroyed more than 15,500 homes in Houston alone and 270,000 homes were either damaged or destroyed in the storm's path. If those displaced from these homes look to buy a house, there will probably not be enough inventory to keep prices steady, especially since the market was already tight before Harvey hit.

Rebuilding activity will be slow due

to tight labor market

There will, of course, need to be massive rebuilding, but Texas was already in the middle of a building boom and having trouble filling construction jobs. A survey from the Associated General Contractors of America, indicates that 69 percent of contractors in the state were having such problems pre-hurricane, due in part to a crackdown on the undocumented workers that make up an estimated 28 percent of Texas' construction workforce. It is estimated that the Houston metro area alone could need as many as 20,000 construction workers to handle the upcoming rebuilding.

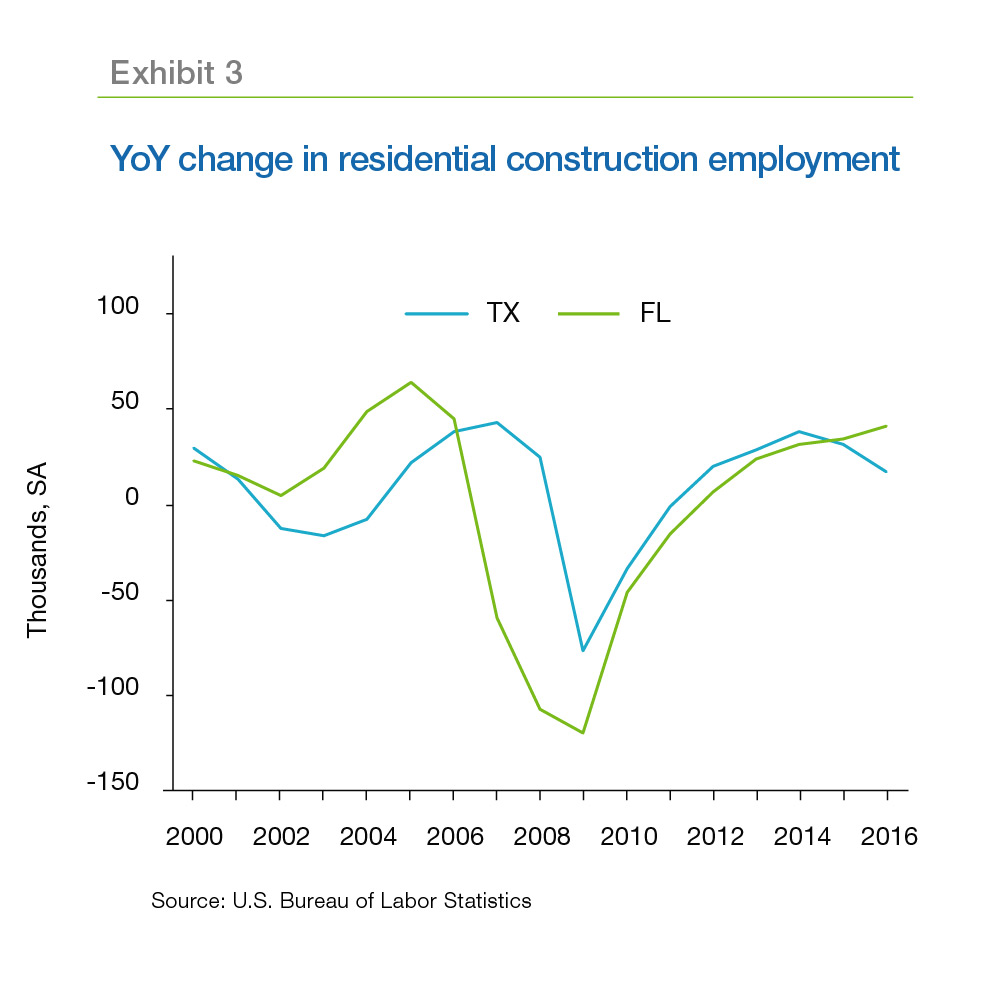

Even with the 28,000 new construction jobs added nationwide in August, the total remains below the pre-recession peak. In Texas, while the construction sector regained all the jobs lost to recession, worker shortages held back growth, and the construction sector is still lagging in Florida. Freddie Mac says it expects a labor shortage to put serious pressure on building and rebuilding activity in Irma and Harvey affected areas.

Delinquencies will increase

Freddie Mac recounts an analysis from Black Knight's Mortgage Monitor estimating there were 1.18 million mortgaged properties in the affected areas in Texas and 3.1 million in Florida, and there were three times as many properties affected in Florida than in Texas. Black Knight estimated that delinquencies could rise 16 percent in the hurricane-affected areas, meaning as many as 300,000 borrowers could become delinquent (30 days past due), and another 160,000 could become seriously delinquent (90 days past due).

After Hurricane Katrina, 9.5 percent of the homeowners in Mississippi and 13.5 percent of the homeowners in Louisiana were seriously delinquent. However, homeowners in Houston and Florida have more equity in their homes than did those hit by Katrina, so they are less likely to walk away. CoreLogic, estimates homeowners in the Houston-Sugarland-Baytown MSA and homeowners in the Naples-Immokalee-Macro Island MSA each have around 50 percent equity in their homes.

Freddie Mac says it doesn't expect a huge national impact from the hurricanes but they won't help with tight inventories. Building activities in the affected areas may slow down as labor and capital gets drawn into rebuilding and delinquencies can be expected to rise, but the economies of Texas and Florida should bounce back. "For Puerto Rico, however, it seems like recovery will be a long haul."

2016 Home Mortgage Disclosure Act

The 2016 Home Mortgage Disclosure Act was released at the end of September. Freddie Mac provided the following findings based on its analysis of the data.

- The dollar volume of mortgage originations rose 19 percent from 2015 to $2,024 billion. Purchase originations rose 14 percent to $1,002 billion, refinance originations rose 24 percent to about $954 billion, and home improvement volume increased 37 percent to about $68 billion.

- The origination volume sold to the GSEs was about 71 percent of conventional, conforming, first lien originations, essentially unchanged from 2015.

- Non-depository mortgage companies had a 53 percent share of first-lien owner-occupied purchase loans, and 51 percent of those refinances. This was up from 50 percent and 48 percent respectively in 2015.