In a recent post on its blog CoreLogic points out it is the rare appraiser who comes up with a perfect comp - i.e. a house of the same size and condition, close to the subject property, with similar amenities and that has recently sold. Therefore adjustments must be made. And in fact they are made in 99.8 percent of appraisals.

Adjustments credit or debit the subject property for the existence or absence of given features. Jon Weirks, writing the Insights article, uses the example of a deck being one thing that distinguishes the subject from a close comp. The comp has one, the subject does not. The appraiser would determine the value of the deck and subtract it from the comparison property's sale value - arriving at an approximation of what that comp would have sold for without a deck. Conversely if the subject had a deck and the comp did not, the value of the deck would be added to the sale price of the comp.

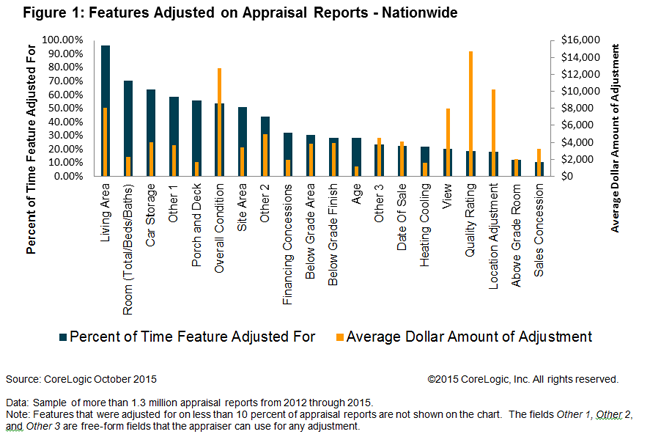

The company recently studied a sample of 1.3 million appraisal reports made between 2012 and 2015 to find the adjustments that are the most common and the adjustments that have the greatest impact on appraised value and found 20 features which were common subjects for adjustment. Jon Weirks writes in Insights that the frequency of an adjustment is indirectly correlated to the financial impact. In fact, four of the top five most adjusted features resulted in relatively low average dollar adjustments

Differences in living area was the most common adjustment, affecting 96.4 percent of appraisals and with an average impact of about $8,000. Other features that were adjusted on 50 percent or more of appraisal reports were Room, Car Storage, Porch and Deck, Overall Condition and Site Area. For example, Room adjustments were very common at 70.4 percent but had minimal value influence, recording an appraisal adjustment of only $2,246 on average. Conversely, a Quality Rating adjustment had the highest value influence, with an average adjustment of $14,748, but accounted for only 18.7 percent of all adjustments.

Weirks says, "Although the adjustment features that result in the highest value adjustment levels (Condition, Quality and Location) are harder to quantify, appraisers are professionals who can do this and adjust their reports appropriately to reflect the most precise appraisal for the home."