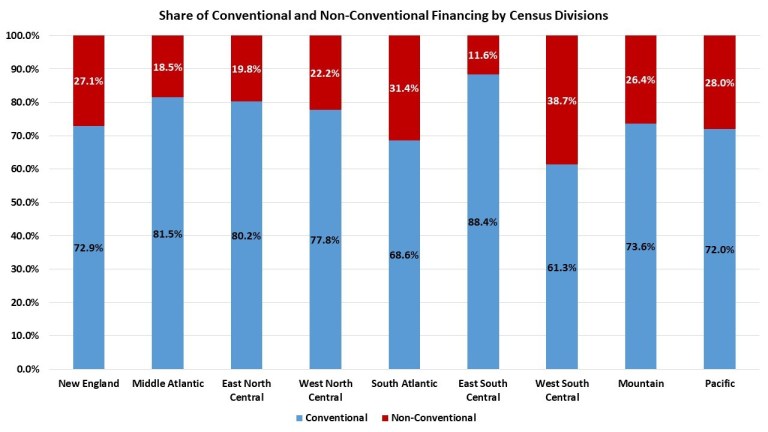

More than a quarter of new home purchases in 2018 were financed through non-conventional sources. Data from the Census Bureau's Survey of Construction shows that, while the new home market was dominated by loans from Fannie and Freddie Mac, other funding accounted for 28.6 percent of new home purchases. Danushka Nanayakkara-Skillington analyzed the data for an entry in the National Association of Home Builders' Eye on Housing Blog.

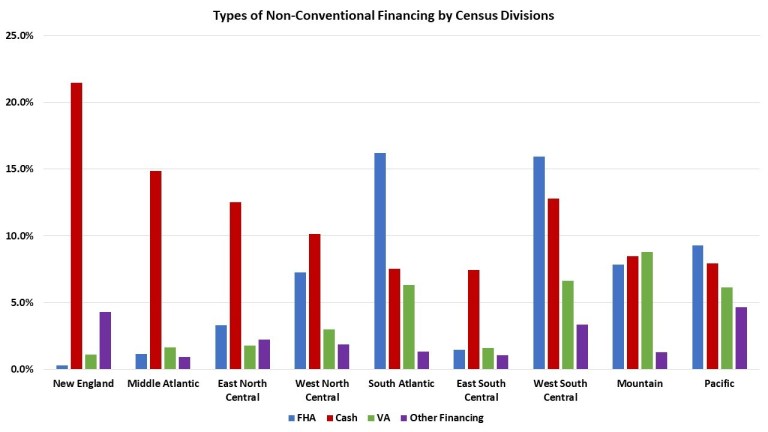

FHA-backed loans were the most prevalent form of non-conventional financing in the new home market last year with an 11.0 percent share, followed by all-cash at 10.0 percent. VA-backed loans accounted for 5.6 percent and other financing for 2.1 percent. That latter category included loans from the USDA's Rural Housing Service, Habitat for Humanity, loans from individuals, and state or local government mortgage-backed bonds.

The reliance on non-conventional forms of financing was highest at 38.7 percent in the West South Central where FHA loans made up 16 percent of all loans. FHA was also the dominant non-conventional source in the South Atlantic and Pacific divisions. Cash financing was highest in the New England division census division at 21.5 percent and lowest in the South Atlantic division at 7.5 percent.

VA loans were relied on the most in the Mountain division where they accounted for 8.8 percent of loans. They represented only 1.1 percent in New England.