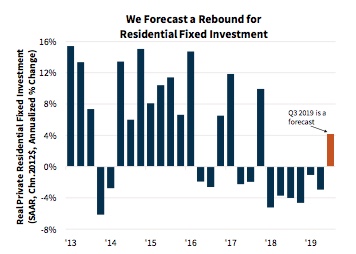

Even though the pace of home building remains below where the industry would like it to be, Fannie Mae says it helped drive residential fixed investment into the black in the third quarter. The company's Economic and Strategic Research Macroeconomic Forecast Team says it would be the first time that component will make a positive contribution to the gross domestic product (GDP) since 2017.

The team had previously forecast a positive contribution from residential fixed investment, but data has come in stronger than anticipated and they have revised it upward to 4.2 percent annualized in the third quarter. This strength should carry into the fourth quarter, putting the remainder of the year on a solid footing. "What had been a drag on the economy for almost two years will now likely be a near-term source of strength. While the effect has been somewhat modest relative to historical experience, lower interest rates are now clearly supporting the housing market," they say. This strength will help to counteract a slowdown in other GDP components, especially business fixed investment and business inventory buildup.

In its October Economic Summary, the company says, despite its optimism about residential investment, it has still revised its GDP forecast for the third quarter down two-tenths of a point to 1.7 percent annualized. They expect inventories and business investment to rebound in the fourth quarter and they remain with their earlier estimate of 2.2 percent growth for the entire year. They also increased their projection for 2020 from 1.6 to 1.7 percent.

That last revision, they say, "means a more positive outlook for housing." They expect a 1.0 percent increase in home sales this year and about the same for 2020. Housing starts will also increase in both years, although they will remain lower than their historic norms.

Home prices are also showing signs of strength. The CoreLogic National House Price index accelerated year over year in August after decelerating for fifteen of the past sixteen months. The July reading of the Case-Shiller house price index also came in roughly flat on an annual basis after a similar period of deceleration. However, expectations for growth in the Federal Housing Finance Agency's (FHFA's) Home Price Index have been revised down for this year as home price growth has been less sensitive to interest rate declines than previously expected. This means there are probably still affordability constraints out there. While appreciation is expected to continue its deceleration, low interest rates may mitigate earlier expectations.

Following a 2.5 percent jump in July, August existing single-family home sales pushed upward by 1.3 percent to 5.49 million annualized units, the strongest pace since March 2018. At the same time, new home sales rose 7.1 percent over the month to the second-highest level since November 2017 and the third-highest of the economic expansion. This recent strength led to Fannie Mae's upward revision to its third and fourth quarter home sales forecasts. They now expect total home sales in 2019 will be 0.9 percent higher than in 2018.

The August decline in purchase mortgage applications and July's pending sales index still suggest a pullback in sales for September but the company believes they will regain strength entering the fourth quarter. The August reading of the pending sales index, which leads sales by about 45 days on average, rose 1.6 percent, and purchase mortgage applications in September rebounded, rising 7.3 percent over the month.

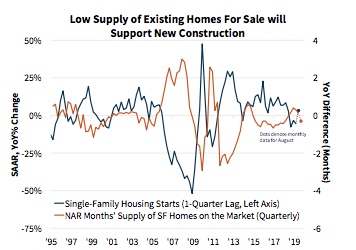

Still, they say existing sales are likely near their peak pace for the time being, due to inventory issues. The months' supply of single-family homes for sale fell back to 4.0 months, the lowest August reading since tracking started in 1982. Lower interest rates may still encourage additional homeowners to put their homes on the market as they no longer feel locked into their current mortgage rate, but so far there is little evidence of this occurring. There will probably be only a modest quarterly increase in fourth-quarter existing home sales, and modest softening moving into 2020 as economic growth is projected to decelerate while supplies remain tight.

While the lack of inventory may hamper home sales, it could stimulate construction. They expect total home sales numbers to increasingly rely on those for the new homes needed to meet demand. Single-family housing starts rose for the third consecutive month in August to the second strongest pace since May 2018 (although they declined by 9.4 percent in September) suggesting an uptrend in new home construction. Permits were also up in August to the highest level since February 2018 and the National Association of Home Builder's index measuring home builder sentiment has also moved higher. While there are still shortages of labor and land, the industry appears to have the capacity to maintain a comparatively heightened level of production.

Multifamily housing starts also jumped in August, surging 32.8 percent over the month, nearly reversing the declines of the prior two months and permits were also up. Starts will probably fall back over the upcoming quarters, the pace of construction is likely to remain quite strong in light of continued low vacancy rates, growing renter household formation, and low interest rates.

The company has also increased its forecast of purchase mortgage originations in 2019 and 2020 to $1.28 trillion and $1.29 trillion, respectively. Total originations for 2019 are expected to rise 15.4 percent from 2018 to $2.04 trillion. Next year there will be a decline of 9.0 percent in total originations to $1.86 trillion as projected declines in refinance activity outpace essentially flat purchase activity, with the refinance share dropping from 37 percent in 2019 to 31 percent in 2020.

There has been some contention among members of the Federal Open Market Committee (FOMC) over their September rate cut. Seven members see an additional rate cut this year and five members believe the cut in September was a policy error. Despite the growing rifts among the committee, continued trade tensions, weak manufacturing, and the Fed's unwillingness to disappoint financial markets have led Fannie Mae to move its forecast for the next rate cut forward from the December meeting to the one this month followed by another cut in January. The Fed will then pause for the remainder of next year.