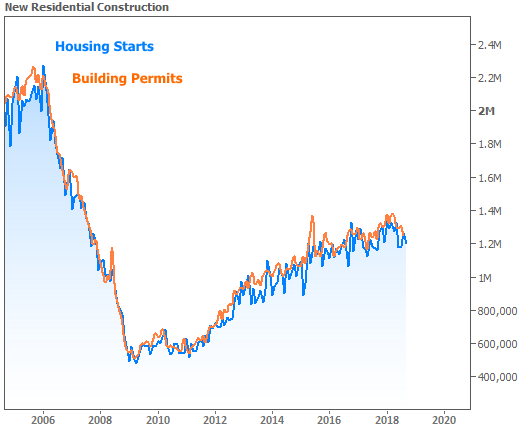

All three reports on residential construction activity in September were disappointing, but no more so than any of the other housing data that speaks to the ongoing process of leveling-off. While there had been some erosion expected from the August numbers, the actual data did not meet analysts' expectations. Upward revisions to August permitting took some of the sting out of that report, but the opposite happened with housing starts. Results were particularly poor in the South, likely resulting from the impact of Hurricane Florence.

Permits for residential construction were issued at a seasonally adjusted annual rate of 1,241,000 units. This is 0.6 percent lower than the August estimate of 1,249,000 and 1.0 percent below the annual rate of 1,254,000 the previous September. The August number was an upward revision from the 1,229,000 units previously reported, wiping out some of that month's original 5.7 percent loss.

Analysts polled by Econoday had expected permits to be at a rate of 1,272,000 units. Estimates ranged from 1,230,000 to 1,287,000.

Single-family permits did rise, they were up 2.9 percent to an annual rate of 851,000 and the August estimate of 820,000 was revised upward by 7,000 units. Single family permits are now 2.4 percent ahead of those in September 2017. Multifamily permitting fell 9.3 percent from August and is behind last year's performance to precisely the same degree.

On a non-adjusted basis there were 96,600 permits issued in September compared to 116,900 the previous month. There were 64,700 single family permits issued, down from 78,500 a month earlier.

For the year-to-date (YTD), there have been 1,001,100 permits issued, a 4.1 percent increase over the same period in 2017. Single family permits total 663,800, a 5.6 percent gain.

Housing starts in September were at a seasonally adjusted annual rate of 1,201,000, 5.3 percent below the lowered August estimate of 1,268,000. August was originally reported at a 9.2 percent monthly gain at a rate of 1,282,000 units. Housing starts are 3.7 percent above those reported in September 2017.

Econoday's forecast for September's starts had a range of 1,179,000 to 1,250,000 units. The consensus was 1,216,000

Single-family starts were down 0.9 percent to an annual rate of 871,000 compared to the revised August estimate of 879,000, a number originally reported as 876,000 units. Single-family starts are up 4.8 percent year-over-year. Multifamily starts were off 12.9 percent from August but 4.5 percent higher than a year ago at 324,000.

There were 106,100 residential units started during the month, 74,200 of which were single-family units. The August numbers were 112,600 and 79,600 respectively. Unadjusted numbers YTD are 972,200 total residential units, a 6.4 percent improvement over the same period in 2017. Single-family starts have increased by 6.0 percent to 687,700 for the first nine months of the year.

Completions overall and those of single-family units were both down from August, by 4.1 percent and 8.7 percent, but they remained higher than a year earlier by 7.0 and 8.6 percent. The annual rate of residential completions was 1,162,000 and for single family units, 844,000. Completions were up significantly for units in building with five or more units. The annual rate of 312,000 was 10.2 percent higher than in August and up 3.3 percent annually.

On an unadjusted basis there were 101,700 units brought on line in September 73,200 of which were single family. The comparable numbers in August were 111,700 and 81,900. Thus far in 2018 there have been 891,700 homes completed, 621,700 of them single family, for YTD increases of 6.5 percent and 8.8 percent compared to 2017.

At the end of September there were an estimated 1,129,000 units under construction, 522,000 of them single-family houses. In addition, there were 166,000 outstanding permits under which construction had not yet begun, 93,000 of them are for single family homes.

In the Northeast permitting was down 9.8 percent from the August level and slowed by 23.3 percent year-over-year. Housing starts increased 29.0 percent and are 18.8 percent higher than a year earlier. Completions rose by 27.0 percent and 41.3 percent for the two periods.

Permitting in the Midwest fell by 18.9 percent for the month and 18.5 percent on an annual basis. Starts were down 14.0 percent from both earlier periods. Completions were also down for the month, by 8.9 percent, but were up 2.8 percent from September 2017.

The South had a small uptick of 0.6 percent in the rate of permitting compared to August and is running 6.9 percent above last year. Starts were off from August by 13.7 percent but were 4.4 percent higher than the prior September. Completions were 13.6 percent lower than August and down 7.1 percent year-over-year.

The West posted a strong 11.1 percent gain from the prior month and a 2.4 percent increase last September. Starts rose 6.6 percent compared to August and 7.9 percent on an annual basis. Completions increased by 11.0 percent and 34.5 percent respectively.