While a lot of attention is now focused on Millennials, the country is still aging. A new report from the Harvard Joint Center for Housing Studies looks at how the growing population of elderly is poised to change the characteristics of homeownership and the need to prepare for the ramifications. The first part of the report, Housing America's Older Adults 2019, details the aging of the population as Baby Boomers increasingly reach retirement age - the leading edge of the second largest generation in history is now 73 years old - and where and with whom they reside.

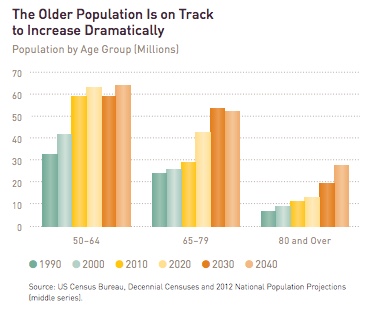

The number of households headed by persons 65 years of older increased from 27 million in 2012 to 31 million in 2017. The next younger age cohort, those aged 50 to 64 grew only by 770,000 to about 35 million. Over the next 20 years, the number of household heads over the age of 80 will be the fasting growing sector and the share of Americans in the oldest age groups will rise from 26 percent in 2018 to 34 percent by 2038.

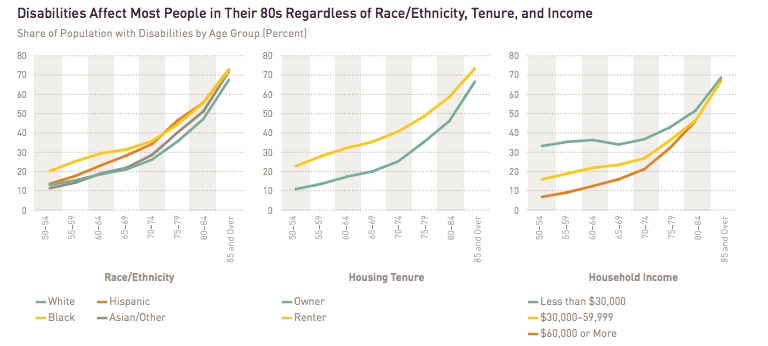

As the number of over age 65 households grow, so will their diversity, with Hispanics driving much of the shift. Hispanic households will increase from a 7 percent share in 2018 to 12 percent over the next 20 years and older black households will increase from a 10 percent to a 12 percent share and other minorities from 5 to 7 percent. The white household share will decline 8 points to 70 percent.

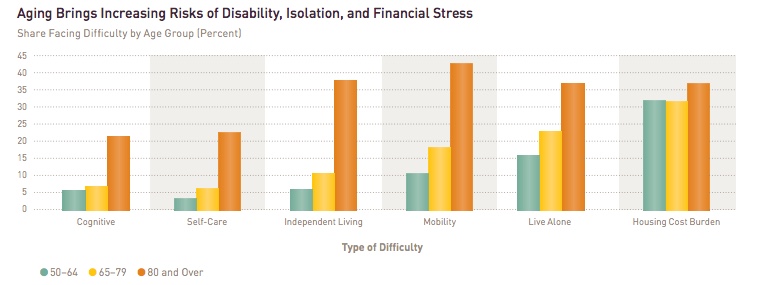

Older households are small, with 35 million out of 50 million living either alone or with a spouse or partner. Some 42 percent of households in the over 65 age group consisted of a single person, a share that is expected to increase sharply with age, reaching 57 percent for those over the age of 80. This is noteworthy, the study says, because many individuals in that age range have lower incomes and higher rates of disabilities than couples of the same age. As the number of single person elderly households increases so will the demand for affordable housing units with supportive services.

Multi-generational households are also growing in number - from 6 million in 2007 to 9.8 million in 2017 - 20 percent of the older population. Among older adults in these households, those 79 or longer were still in their own homes while those over age 80 lived in the homes of their children. Relatively few older adults live with roommates or in group quarters such as skilled nursing facilities. The latter numbers have declined in recent years with many nursing facilities focusing on short-term post-acute care although the majority of nursing home residents receive long-term care.

Older adults homeowners overwhelmingly live in single-family detached houses (80 percent), and the majority of these homes are at least 40 years old which may present maintenance issues. Older renters, however, live in multifamily housing. Forty-five percent of renters aged 65 to 79 lived in apartment buildings with 2 to 49 units and 21 percent lived in larger complexes. Only 22 percent rented in single family homes. The percentage of those above the age of 80 who live in large apartment buildings is much higher and among all older renters who relocated in 2016 and 2017 40 percent moved into large apartment buildings, probably because those facilities are more likely to offer accessibility features such as elevators and single-floor living than are garden style apartments or smaller multifamily buildings.

The number of older households living in low density communities has been rising rapidly. Both owner and renter households have contributed to the 61 percent growth between 2000 and 2017 of those that live in the least dense third of metro areas to a total of 9 million. Large percentages of older renters and owners also live in non-metro or rural locations. The same pattern has been mirrored by the 55 to 64-year old cohort, suggesting that the concentration of older adults in low-density areas is likely to continue. This will present major challenges for residents and service providers. Single-family houses predominate in these areas and residents need to be able to drive to do errands, socialize, and receive services. Homecare workers must often travel long distances and there are shortages of primary healthcare providers in many rural areas.

Older households are not very mobile. Only 3.6 percent of the 65-79-year-olds and 2.9 percent of those over age 80 changed residences in 2017 and 2018 compared to 5.3 percent of those between 50 and 64 and 13.6 percent of those under 50. Renters move more frequently than owners, often because their housing costs are less stable. If their generational mobility rates remain stable, the number of moves by older adults will increase with the population. This will create a need for suitable housing options near those areas where older people currently live. Programs and policies that help with home modification and maintenance to allow more seniors to age in place will be important and whether they move or stay put, millions of older households will need improved transportation options and more access to supportive services.

The financial conditions of today's and tomorrow's seniors are strongly connected to housing options. We will summarize the reports conclusions in these areas in a subsequent summary.