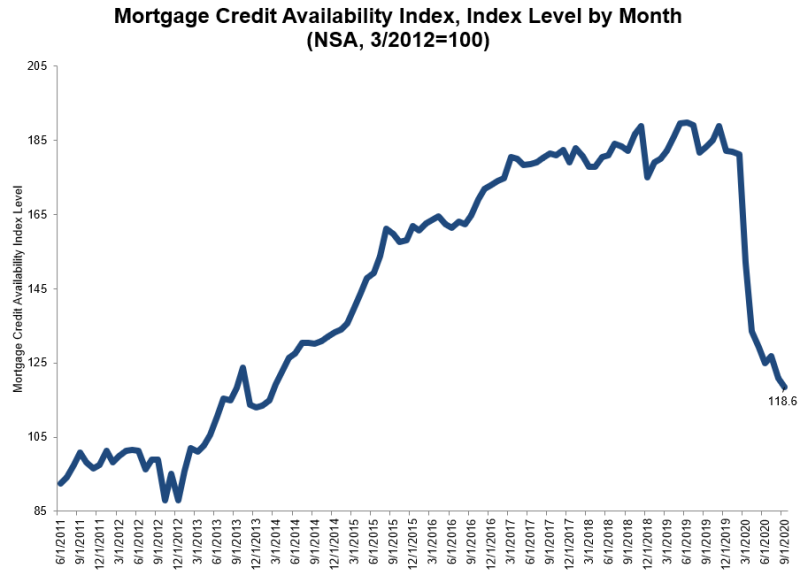

Mortgage credit tightened again in September, reaching a second successive six-year low. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) dropped another 1.9 percent to 118.6. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The new number is down 63.3 points from the level it reached in January before interest rates started an unprecedented decline and servicers were instructed to grant forbearances to existing borrowers.

Three of the four components of the MCAI declined compared to August. The Conventional MCAI decreased 6.1 percent and its two components, the Jumbo MCAI and the Conforming index fell by 2.1 percent and 9.5 percent, respectively. The Government MCAI increased by 1.4 percent.

"Mortgage credit supply decreased in September to its lowest level since February 2014, driven in part by a 9.5 percent decline in the conforming loan segment. This reduction was the result of lenders discontinuing conforming ARM loan offerings in advance of the September 30, 2020, application deadline for GSE-eligible, LIBOR-indexed ARM loans," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "Across all loan types, there continues to be fewer low credit score and high-LTV loan programs. The housing market overall is on strong footing, but the data show that lenders are being cautious, given the spike in mortgage delinquency rates in the second quarter, as well as the ongoing economic uncertainty."

The MCAI and each of its components are calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via a proprietary product from Ellie Mae. The resulting calculations are summary measures which indicate the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.