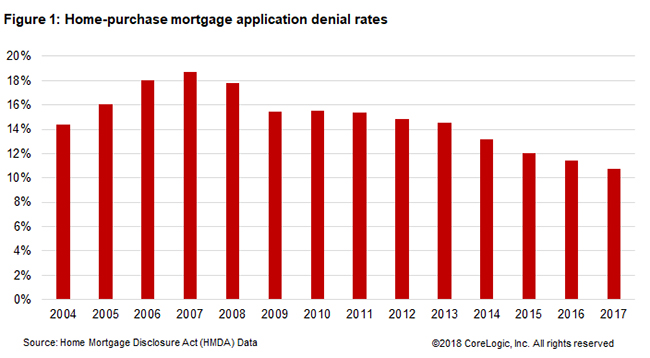

Mortgage denial rates ebb and flow with the economy, with lenders appetite for risk, and sometimes with the pressure lenders feel to make loans. Denial rates in 2017 continued to diminish as they have done since the economy began to improve in 2013 and were the lowest in any year since at least 2004. Using data collected from lenders under the Home Mortgage Disclosure Act (HMDA), CoreLogic estimates only about one in ten mortgage applications were denied last year.

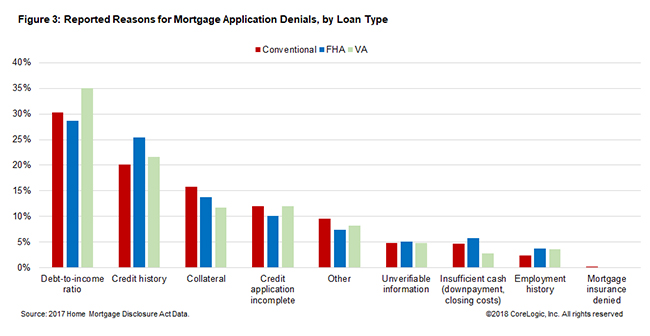

Poor credit used to be the primary reason that lenders turned borrowers away, but Yanling Mayer, writing in the CoreLogic Insights blog, says that, in the current credit cycle that has changed. The tight inventory of starter and lower-priced homes has pushed the prices of those homes up faster, impacting affordability more on that end of the market. That decline in affordability has disproportionately hit the less affluent. The 2017 HMDA data shows that borrowers' debt-to-income (DTI) ratio is now the primary reason for denial of mortgage applications, accounting for 30.3 percent of the 412,000 first-lien applications turned down last year. This is up from 28.8 percent and 28.2 percent in 2015 and 2015 respectively. Credit history is the second, and not even a close one, reason for denial

There is some variation among loan types when it comes to percentages, but DTI is the number one problem with applications for all three of the major types. It accounts for 30.2 percent of conventional denials, 28.6 percent of those for FHA loans, and 35 percent of VA rejections.

CoreLogic's loan application data indicates that increasing denials for DTIs is not due to a change in underwriting emphasis but rather that DTIs have been increasing. Figure 4 shows the 25th percentile, median, and 90th percentile of the DTI in purchase applications. There has been a gradual, yet steady, rise in that measure, from 35.1 in 2012 to 37.7 in 2017 and 38.6 in 2018 year-to-date. In 2017, about 25 percent of applications had a DTI at 30 or lower, while 10 percent of applications had a DTI of at least 49. Mayer says CoreLogic's data doesn't indicate the final disposition of an application, but the steady DTI uptrend is consistent with rising HMDA loan denials related to the debt-to-income ratio.

Mayer concludes that the DTI uptrend is likely a reflection of the erosion of affordability as home prices have risen much faster relative to wage growth. The latest analysis by CoreLogic shows the principal-and-interest payment on the median home has risen by 14% over a year ago. In the event of a negative income shock, higher DTI loans are at a greater risk of default.