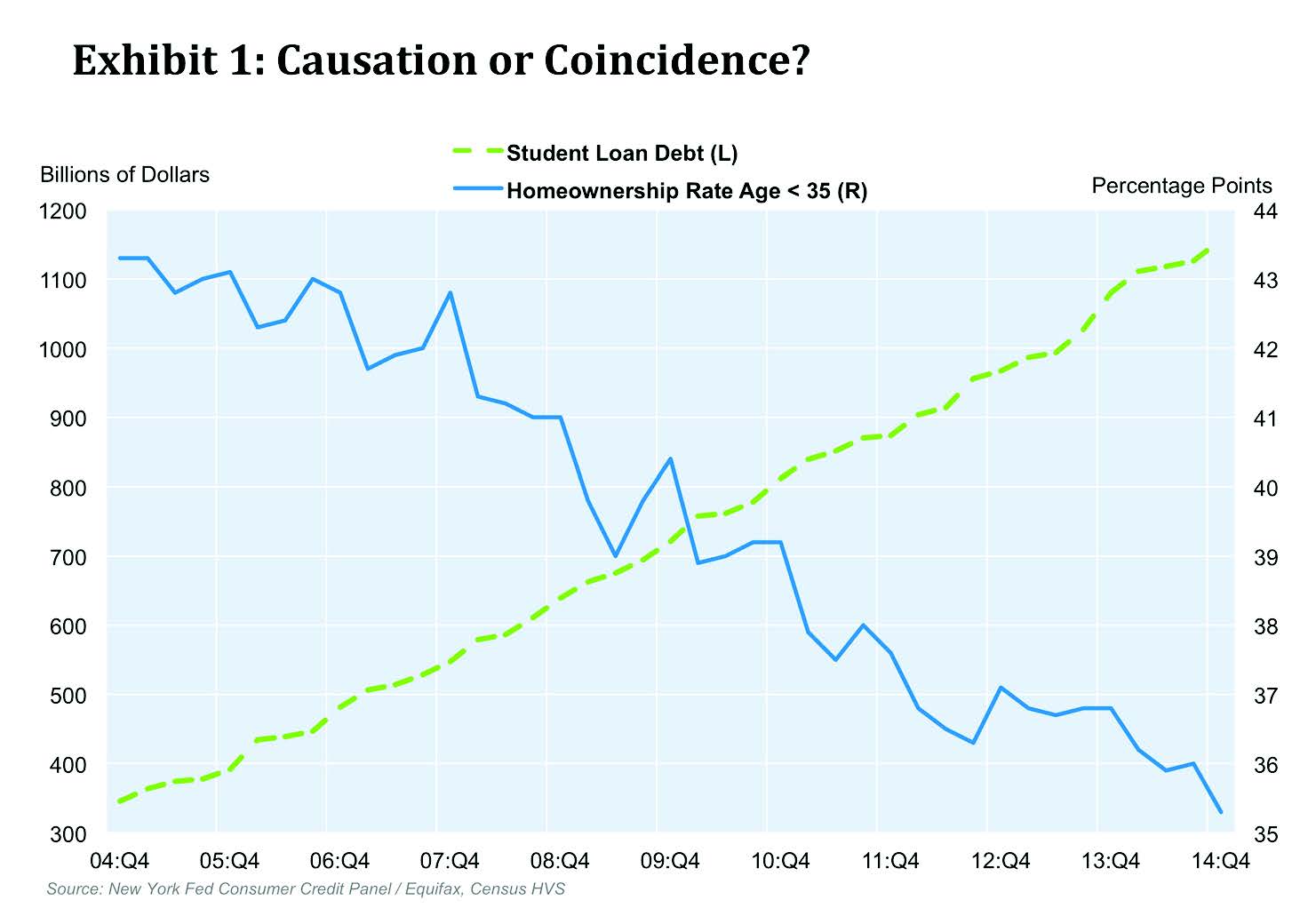

Once the recession ended and unemployment, which had especially impacted Millennials, returned to normal levels, that age group was expected to increase the homeownership rate. Instead, even as a larger chunk of that generation - roughly those born between the early 1980s and early 2000s - enter the age when preceding generations became homebuyers, the homeownership rate overall has continued the steady decline that began in 2004 and the rate for those under age 35 has fallen from 44 percent to 35 percent..

Freddie Mac says that many theories have been advanced for the slower-than-average entry of Millennials into homeownership. Some analysts argue that the reduced employment opportunities at what should have been the start of their careers delayed and perhaps permanently reduced their career development and wealth building while others attribute it instead to the generation's different attitudes towards marriage, family, and renting than their predecessors.

The company, in its current edition of its Insights and Outlook says perhaps the drop in homeownership rates among those under 35 and the dramatic rise in student debt are not coincidental. The lack of jobs during the recession reduced the opportunity cost of higher education. Many young people who might, in better times, have entered the workforce opted instead for college or technical school to better prepare for a time when jobs returned and many college grads went on to grad school both to increase their employability and to defer repayment of their existing student loans.

These decisions generated explosive growth in student debt and the overhang of this debt may be making it harder for the generation to accumulate down payments or to qualify for a mortgage. Additionally the types and compensation of available jobs have often not lived up to expectations. Finally, student loans have had high delinquency and default rates, and these rates nearly doubled between 2000 and 2011, damaging the credit of many borrowers and presenting an additional barrier to home ownership.

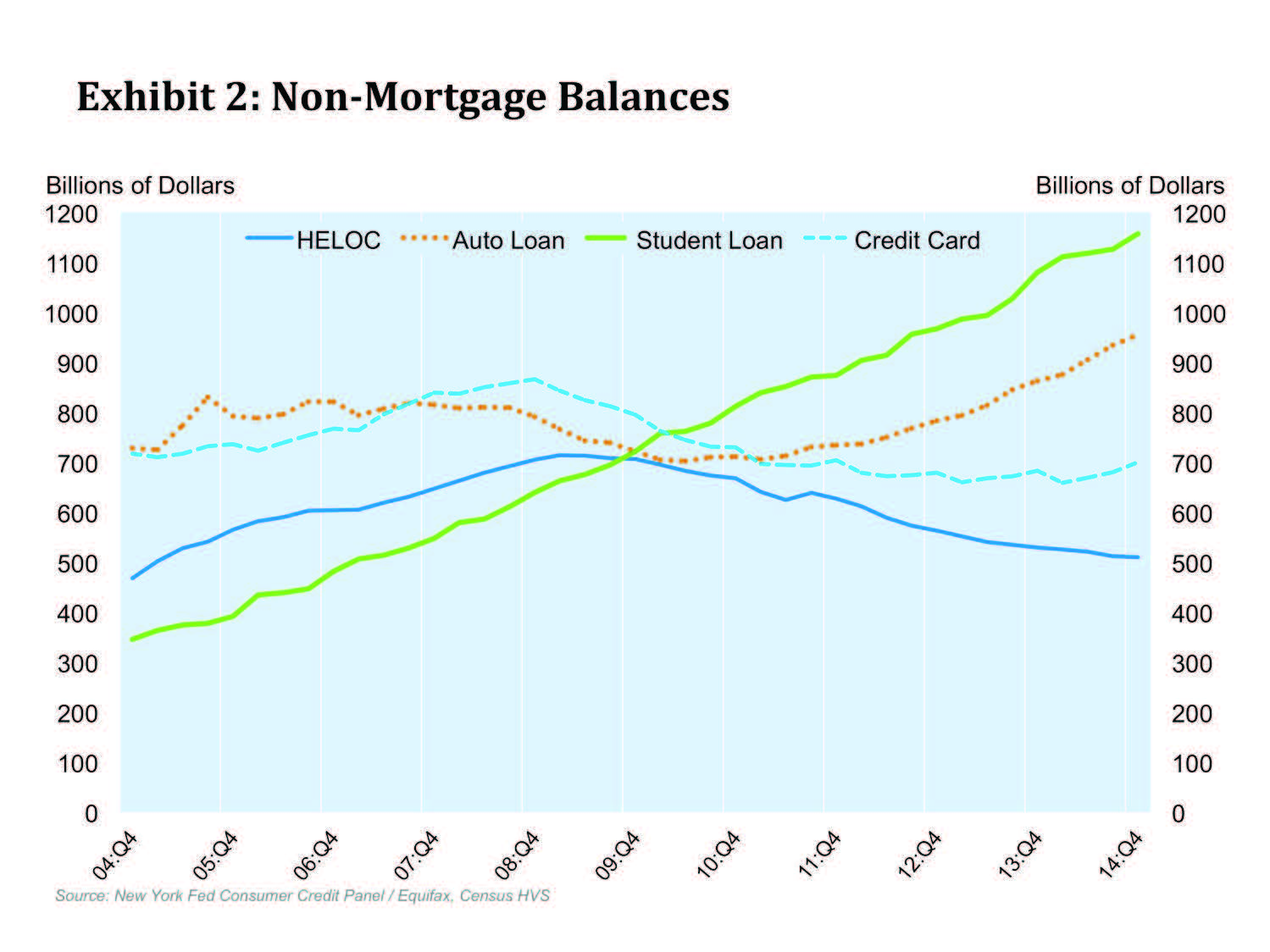

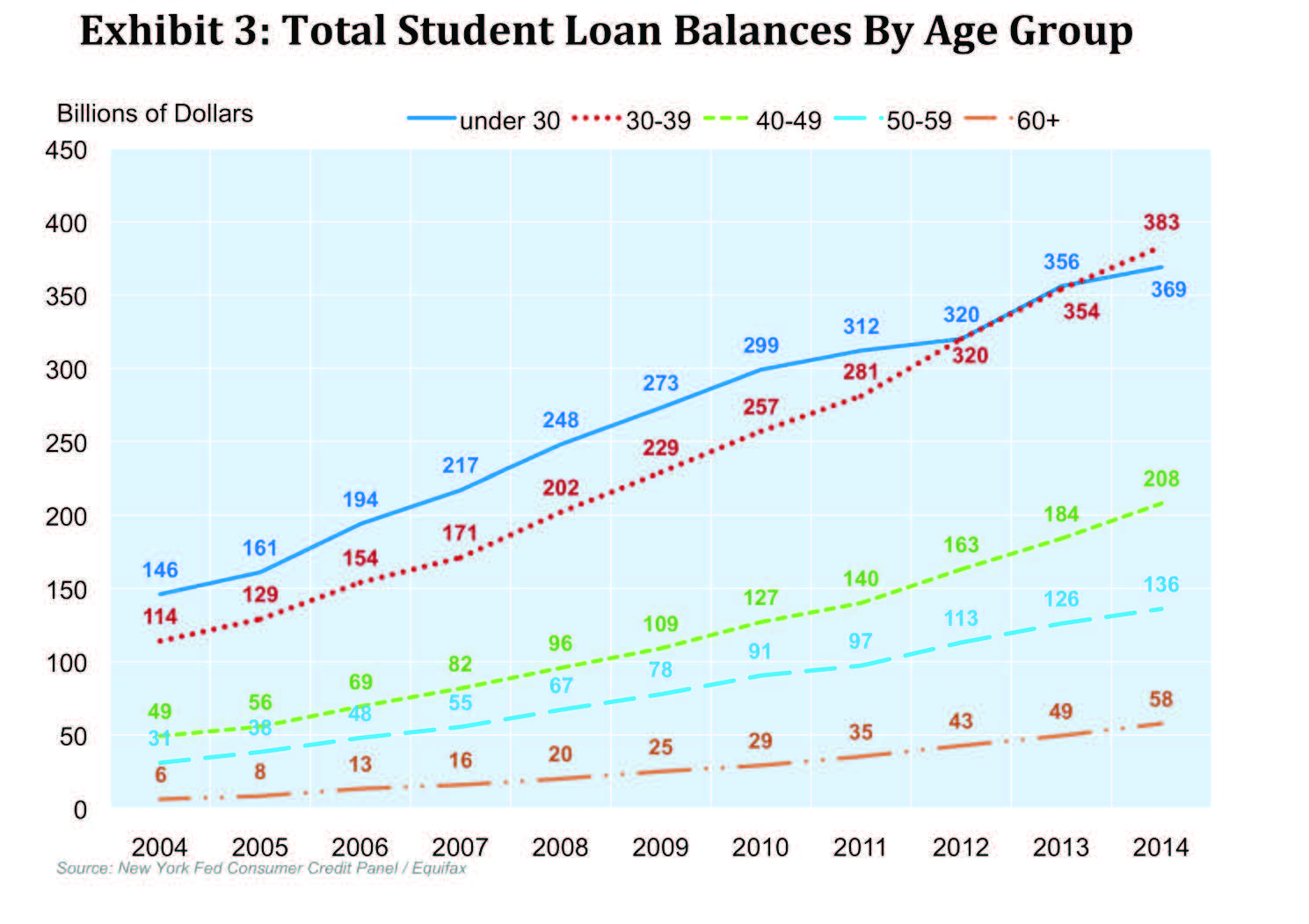

Freddie Mac's economists say they can't prove the growth in student loan debt is a significant factor in the decline of homeownership rates among Millennials, but there are "tantalizing clues" in the data. In the fourth quarter of 2004 student loan debt stood at $346 billion, less than home equity lending, credit card debt, or student loans. Then with the start of the recession the other three types of debt declined and only auto loans have returned to pre-recession levels. But during the same period student loan debt tripled to $1.2 trillion in the fourth quarter of 2014. While levels grew for all age groups, the greatest concentration of balances was along those under 30 and between 30 and 39 years of age.

The distribution of this debt is very uneven. While some households have none, over half of those with debt have balances in excess of $10,000 and nearly two million households owe more than $100,000.

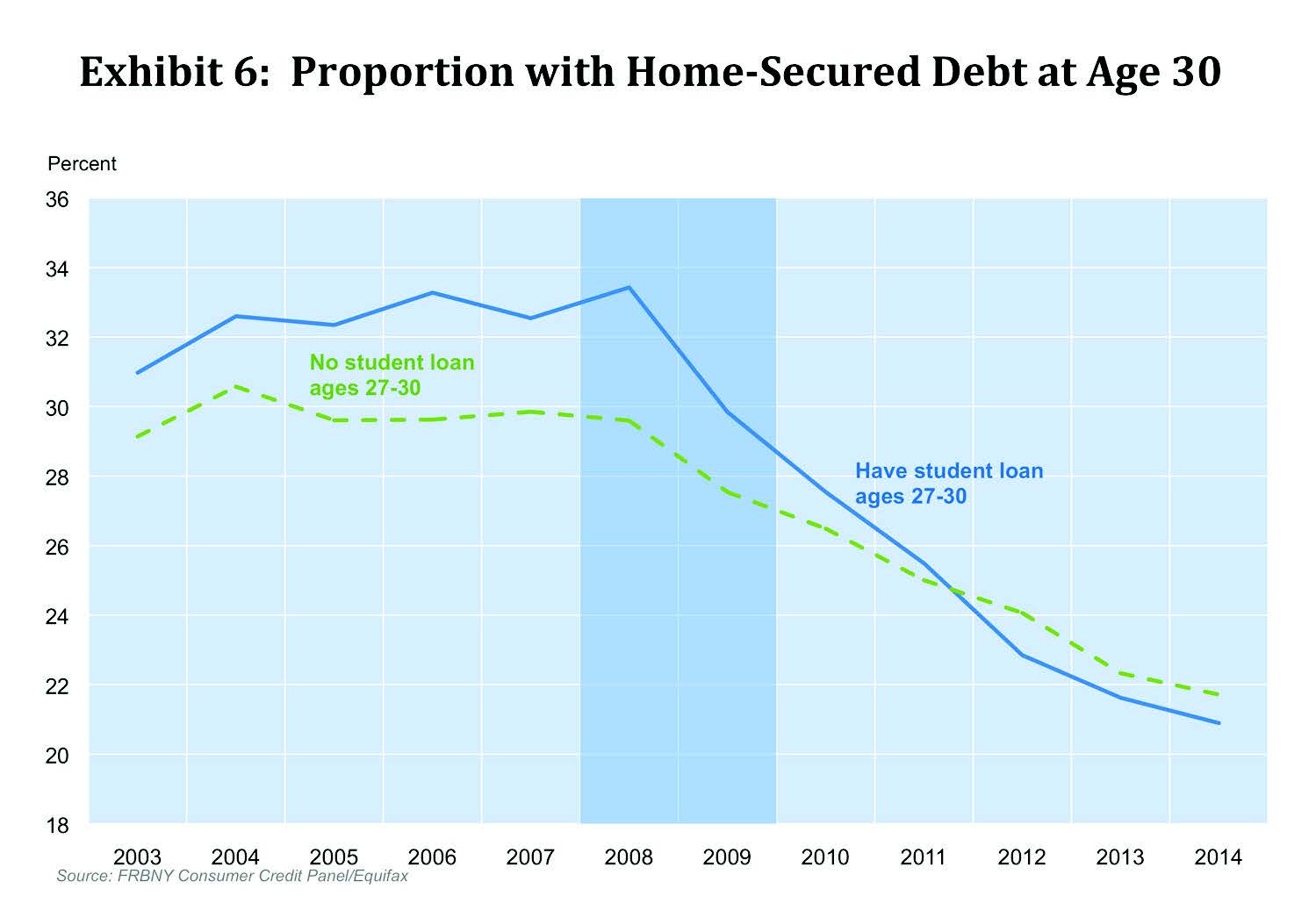

College graduates have historically had higher incomes than non-graduates and that typically supports a higher rate of homeownership. Prior to the Great Recession, associated student loans did not appear to depress homeownership and the rates of 27 to 30 year olds with students loans (a sign of at least some college) were 2 to 3 percentage higher than those with no student loans. That gap began to close during the recession and reversed in 2011. By 2014 the homeownership rate of student loan borrowers was about 1 percentage point lower than that of non-borrowers. However, student loan debt alone can't account for the homeownership rate among Millennials which has dropped 5 to 6 percentage points for those both with and without that burden.

A Zillow report notes that student debt has only a small impact on homeownership among persons who obtain a degree but also that higher student loan debt balances reduced the probability homeownership for those who did not complete these studies. A recent Brookings Institution paper found that most of the increase in student loan defaults is associated with the rise in the number of borrowers at for profit schools and, to a lesser extent, two year colleges and certain other non-selective schools while default rates have remained low among those attending four-year and non-profit private schools. The holds true for most graduate borrowers despite the recession and relatively high loan balances with the low-default group comprising the vast majority of the federal student loan portfolio.

Freddie Mac says that the Brooking paper reinforces the Zillow findings - the probability of home ownership is associated with the type of degree. Advanced and professional degree holders have a greater than 65 percent chance of owning a home while those with no degree have about a 30 percent probability.

These findings have implications, Freddie Mac says, for mortgage lending and it may be useful to think of student loan borrowers as divided into three groups.

- Borrowers who completed their degrees and have earnings matching their expectations. Absent a difficulty in accumulating a down payment, student debt is not a significant deterrent to homeownership although these individuals may be delaying for other reasons.

- Graduates whose return on their education investment is less than anticipated. Their relatively low earnings in the face of student debt may hinder homeownership.

- Borrowers who may be less well-off than when they started school. Their job prospects have not improved through education but they have significant debt and/or delinquencies and default on that debt may have damaged their credit scores.

Freddie Mac's analysis concludes by saying that the low homeownership rate of Millennials is still something of a puzzle that cannot be explained solely by student loan debt but that debt does play a role, especially where debt balances are high. Recent data has also confirmed that student borrowers are not alike and those who attended schools with less certain educational benefits have not fared well and those who did not complete their studies fared worst of all.