The Departments of Treasury and Housing and Urban Development released the August version of their monthly Housing Scorecard this afternoon. The Scorecard is a summary of housing data from various sources such as the S&P/Case-Shiller house price indices, the National Association of Realtors® existing home sales report, Census data, and RealtyTrac foreclosure information. Most of the information has already been covered by MND.

According to the scorecard homeowner equity has risen to its highest level since the third quarter of 2008 and 1.3 million borrowers have been lifted above water, largely due to rising home prices. Equity jumped $406 billion or 5.9 percent to $7,275 billion in the second quarter of 2012. Combined with a sharp increase in the first quarter, equity has risen $863 billion or 13.5 percent so far this year and the number of underwater borrowers has declined by 11 percent to 10.8 million.

The Scorecard includes by reference the monthly report on the Home Affordable Modification Program (HAMP). The current report covers information through August.

More than one million homeowners have received permanent modifications through HAMP since the program began in the spring of 2009 and the number of borrowers who have started trial modifications is nearing two million and distressed borrowers continue to enter the program. Since the last HAMP report there have been 14,582 new trials started for a total of 1,912,439. In the last month 16,509 trials have been converted to permanent status for a cumulative total of 1,076,747. There are 831,661 borrowers who still have active modifications; the remainder have either redefaulted, been cancelled for other reasons, or have paid off their loans,

A number of other programs are active under the HAMP brand and have experienced activity over the last month.

The 2MP program works to modify second mortgages. These had previously presented a significant obstacle to the success of HAMP. During the month the program either modified or extinguished 3,863 second liens and to date have done so for 93,865 homeowners.

The Home Affordable Foreclosure Alternatives (HAFA) Program offers incentives for homeowners to exit homeownership through a short sale or a deed-in-lieu of foreclosure. In 20 percent of HAFA agreements the homeowner had started a HAMP trial but was either disqualified or later requested a HAFA agreement. During the report month, 10,831 borrowers completed a HAFA agreement, the majority of them short sales. Since the program began there have been 71,403 HAFA resolutions, 69,615 of them short sales.

The Treasury's MHA Unemployment Program (UP provides temporary forbearance to homeowners who are unemployed. Borrowers must be considered for a minimum of 12 months forbearance. The program served 871 homeowners during the month and a total of 26,197 since it was implemented.

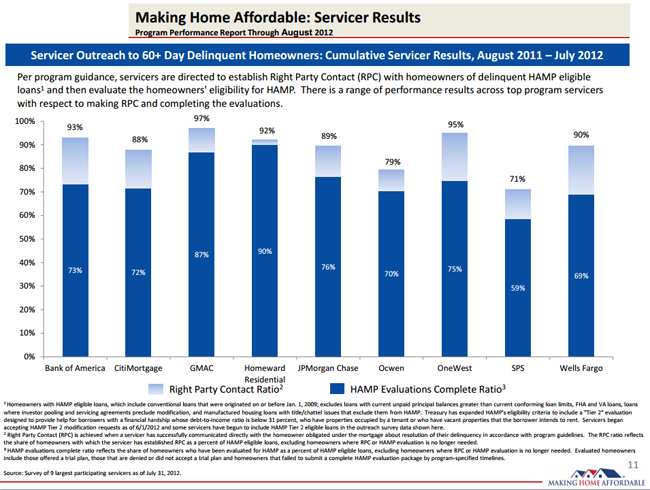

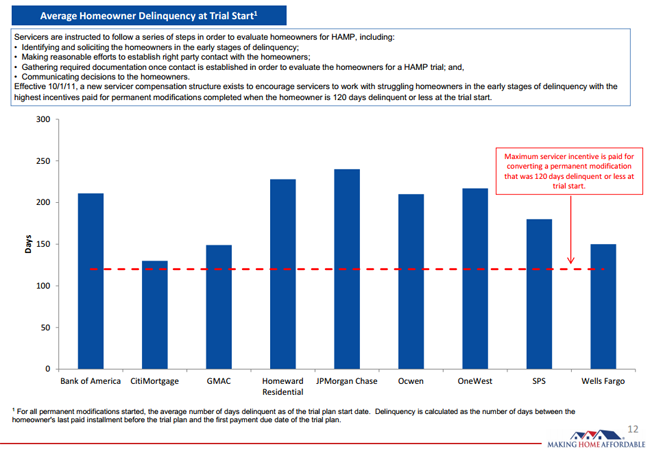

The performance of servicers participating in the program has improved in a number of respects after what is generally considered to have been an inauspicious beginning. Revisions made to both borrower requirements and servicer standards in June 2010 have resulted in most servicers now responding to borrower requests, implementing trials, resolving problems, and converting trials to permanent status in a timely manner. Here are details provided by HAMP for some of these metrics.