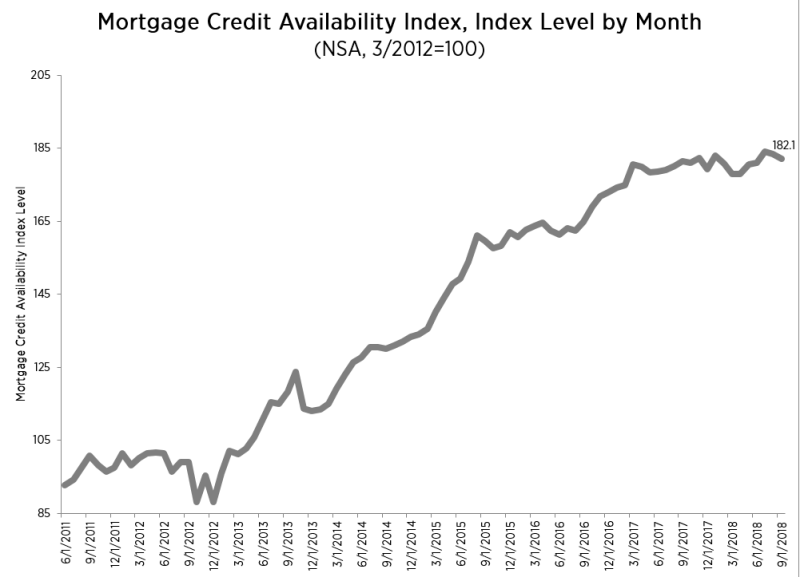

The availability of mortgage credit at least as measured by the Mortgage Bankers Association's (MBA's) Mortgage Credit Availability Index (MCAI) pulled back in September, with the government component of the index falling to the lowest level in four years. The MCAI registered 182.1 at month's end, an 0.8 percent decline. An increase in the index indicates a loosening of credit, a lower number indicates standards have tightened.

The components, representing different loan programs, largely offset each other, making substantial moves in both directions. The Conventional MCAI rose 1.2 percent and one of its components, the Jumbo Index increased by 2.7 percent. The Conforming MCAI, the second part of the Conventional Index, decreased by 0.7 percent and the Government MCAI lost 2.5 percent.

"Credit availability moved lower in September, as tightening in the government index offset an increase in conventional credit availability. The decline in government credit was driven by fewer streamline offerings as well as a decline in loan programs with lower credit requirements. The government index is at its lowest level since July 2015. The jumbo subindex increased for the fifth time in six months and reached its highest level since we started tracking jumbo credit," said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.) and data collecting from 95 lenders and investors. The base period for the main and component indices is March 31, 2012. The base values vary; the component is 100, the Conventional is 73.5 and the Government is 183.5.