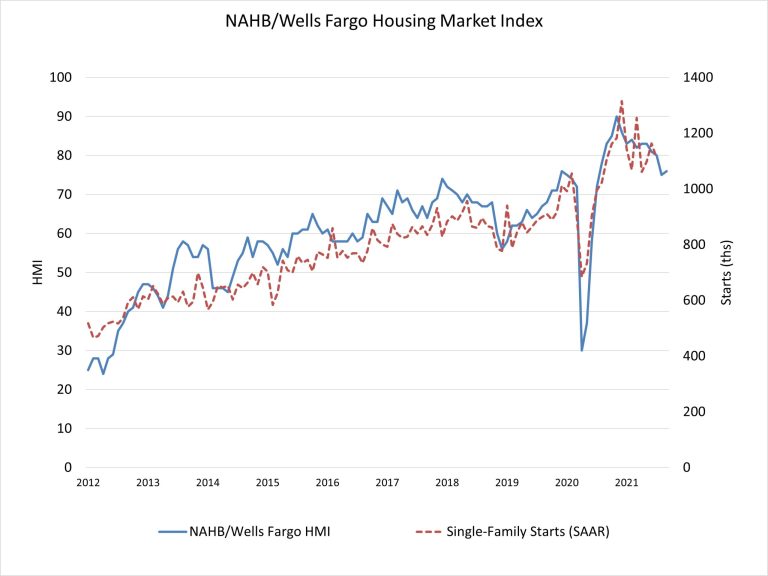

Builder confidence edged its way higher in September, ending a three-month slump. The National Association of Home Builders (NAHB) reports that the NAHB/Wells Fargo Housing Market Index (HMI) rose a single point to 76 in September. The HMI is a measure of home builder attitudes toward the new home sales market.

NAHB chief economist Robert Dietz says, "Builder sentiment has been gradually cooling since the HMI hit an all-time high reading of 90 last November. The September data show stability as some building material cost challenges ease, particularly for softwood lumber. However, delivery times remain extended and the chronic construction labor shortage is expected to persist as the overall labor market recovers."

The HMI is constructed from results of a survey NAHB has conducted among its new home builder members for more than 35 years. They are asked to categorize their perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor" and to rate prospective buyer traffic as "high to very high," "average" or "low to very low." Their answers to each set of questions are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions rose 1 point to 82, the component measuring traffic of prospective buyers posted a 2-point gain to 61 and the gauge charting sales expectations in the next six months held steady at 81.

The three-month moving averages for regional HMI did not improve. Three regions posted 2-point declines while the Midwest was unchanged at 68. The Northeast's moving average was 72; it was 80 in the South, and 83 in the West.

Dietz says he expects housing affordability to be a key demand-side challenge in the coming quarters, given the rapid rate of growth in home prices and construction costs over the last year. Building is continuing to grow in the South and the West, particularly the Mountain West. While exurban markets have expanded the most over the last year, inner suburbs are now experiencing an acceleration, and townhouse construction had the best quarter in 14 years this spring.