Foreclosure activity increased significantly in August according to the U.S. Foreclosure Market Report released Thursday by RealtyTrac. The increase included the first year-over-year uptick in scheduled foreclosure auctions in nearly four years.

There were foreclosure filings on a total of 116,913 properties during the month. Filings include default notices or foreclosure starts, scheduled auctions, and bank repossessions or completed foreclosures. While there was a 7 percent increase from the total number of filings in July, it was 9 percent below the level of activity one year earlier. The number of filings in August translates to one in every 1,126 U.S. housing units.

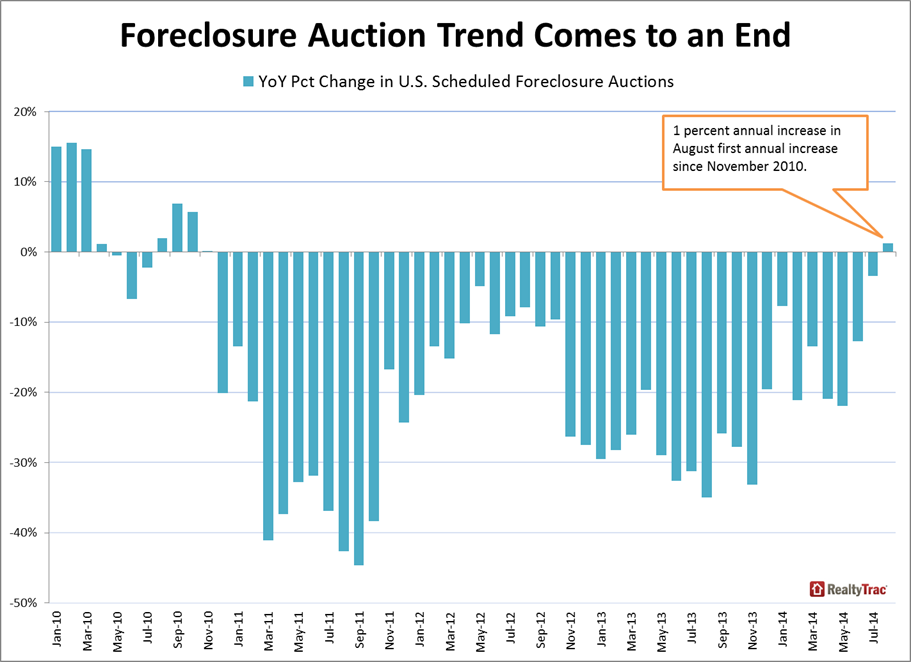

There were 51,192 properties on which foreclosure auctions were scheduled for the first time in August. This was 1 percent fewer than in July but was a 1 percent increase over the number scheduled in August 2013, the first annual increase in this figure after 44 straight months of decline. Scheduled auctions in judicial foreclosure states increased 5 percent from a year earlier.

Daren Blomquist, RealtyTrac vice president said, "The August foreclosure numbers demonstrate that although the foreclosure crisis is well behind us, the messy business of cleaning up the distress lingering from the housing bust continues in many markets. The annual increase in foreclosure auctions - the first since the robo-signing controversy rocked the foreclosure industry back in late 2010 - indicates mortgage servicers are finally adjusting to the new paradigms for proper foreclosure that have been implemented in many states, whether by legislation or litigation or both."

Foreclosure starts and bank repossessions also increased. Starts were up 12 percent from July to 55,000. It was the second consecutive monthly increase in starts and their number was virtually unchanged from one year earlier. Completed foreclosures totaled 26,343, up 2 percent from July but 33 percent lower than in August 2013 and the 21st consecutive year-over-year decline.

Scheduled auctions were up from a year earlier in 24 states. The largest annual increases were in Colorado (+160 percent), Oregon (+117 percent), and New York (+81 percent.) Of the 19 states where foreclosure starts increased on an annual basis the greatest gains were in Oklahoma (+147 percent), Indiana (+136 percent) and New Jersey (+115 percent). Bank repossessions increased in seven states with Georgia having far and away the largest increase at 146 percent. It was trailed by Hawaii (+42 percent) and Oregon (+20 percent.)

Six of the nation's 20 largest metro areas posted year-over-year increases in foreclosure activity: Washington, D.C. (+18 percent); New York (+18 percent); Baltimore (+12 percent); and Atlanta and Philadelphia (+11 percent each).

Florida with a filing on one in every 400 housing units, three times the national average, had the highest rate of foreclosure activity in the nation for the 11th consecutive month. The state saw a 74 percent month-over-month jump in foreclosure starts in August to a total of 6,368, the first increase after 17 months of decline.

Nevada moved back up the list from third to second in foreclosure activity in August with one in every 524 units receiving a foreclosure filing and a 36 percent increase from July in foreclosure starts. It was the state's worst month for starts since October 2013.

Foreclosure starts increased 72 percent during the month in Maryland and were up 20 percent from a year earlier. The state ranked third in foreclosure activity; one in every 532 housing units received a filing.

New Jersey and Georgia rounded out the top five states for foreclosure activity. In New Jersey the rate was one in every 553 housing units and in Georgia it was one in every 582.

One of Georgia's larger cities, Macon, had the highest foreclosure rates among metropolitan areas with a population over 200,000. One in every 154 housing units received a filing in August. The second most active area was Atlantic City, New Jersey where filings have increased on an annual basis for 28 of the last 30 months. There were filings in August for one in every 292 housing units, nearly four times the national average.

One in every 294 Orlando housing units had a foreclosure filing in August, the nation's third highest metro foreclosure rate and overall activity was up 33 percent from a year ago. The increase affected year-over-year numbers for all three filing types. Foreclosure starts increased 18 percent, scheduled auctions 63 percent. REOs rose 15 percent to the highest level since January 2013.