Nearly all of America's home builders say they are facing significant shortages of skilled labor, both in the form of direct labor and as subcontractors. The lack of all types of carpenters is especially critical.

The National Association of Home Builders (NAHB) included a set of special questions about labor availability in its NAHB/Wells Fargo Housing Market Survey in July and found that an inadequate supply of both labor and subcontractors was even more widespread than in July 2017. Paul Emrath, writing in NAHB's Eye on Housing blog says builders were asked about labor availability in 15 specific occupations and found shortages of labor directly employed by builders were at least fairly widespread for each of the 15 occupations, ranging from a low of 47 percent for building maintenance managers to a high of 83 percent for rough carpenters. Builders expressed what they considered a serious lack of workers ranging from 9 percent for weatherization workers to 42 percent for framing crews.

Emrath says however that three-forths of the construction costs on a typical home build goes to work performed by subcontractors. For that reason, it is particularly significant that, in the 2018 survey, the incidence of shortages was higher for subcontractors than for labor directly employed by builders in 14 of the 15 occupations.

The shortage incidence was the same (47 percent) for building maintenance managers, whether subcontracted or directly employed by builders. For weatherization workers, the spread was 2 percentage points (50 percent for subcontractors vs. 48 percent for labor directly employed). For the other 13 occupations, the incidence was 4 to 9 percentage points higher for subcontractors.

For the first time in any NAHB survey on the topic, one shortage, that of subcontractors for rough carpentry work, reached 90 percent. This was only one point higher than expressed the shortages of framers, and there were far more builders calling the lack of that labor "serious."

Emrath puts forth one possible explanation for the relatively severe lack of subcontractors. Workers who were laid off and started their own trade contracting businesses during the housing downturn may have now returned to work for larger companies. That would add to the pool of workers available for builders to employ directly, while subtracting from the number of owners running their own trade contracting businesses. An earlier blog entry, he said, has shown that the number of one-person trade contactors has actually declined slightly, even while the number of homes under construction was increasing by 131 percent.

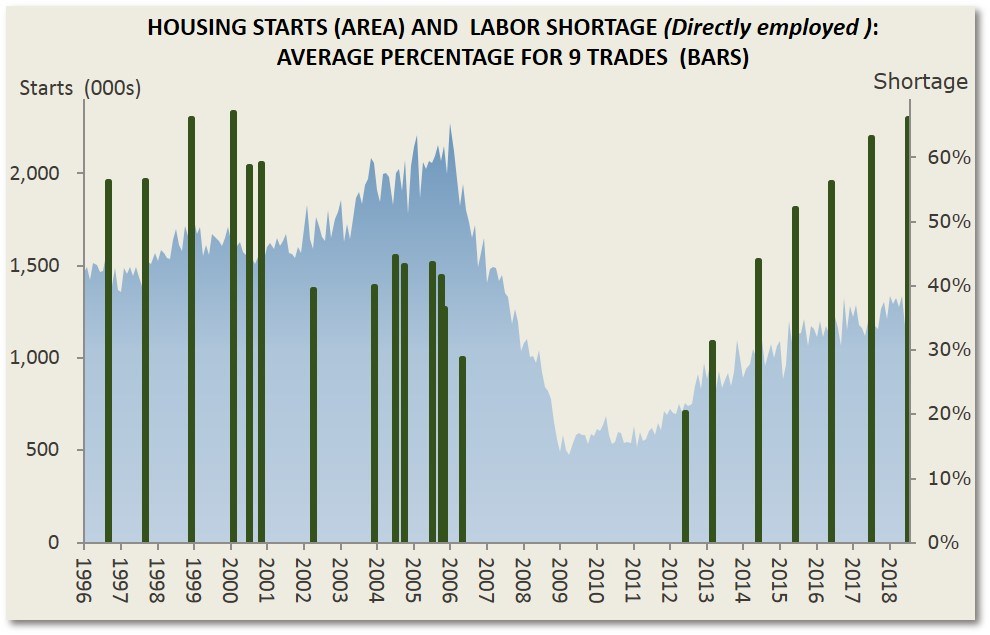

NAHB has been collecting information from builders about labor shortages in a consistent way since the 1990s. An average shortage percentage for the nine occupations that have appeared on every survey over that span can be calculated and tracked over time.

The nine-occupation shortage for labor has now skyrocketed from a low of 21 percent in 2012 to 56 percent in 2016, 63 percent in 2017, and now 67 percent in 2018. This is as high as that average has ever been. The shortages seem especially severe relative to housing starts, which still have not fully recovered from their historically low 2009-2011 trough.

The author says the NAHB results are consistent with the latest numbers from the Job Opening and Labor Turnover Survey (JOLTS) conducted by the Bureau of Labor Statistics. That report shows that the number of unfilled jobs in the construction industry has reached a cyclical high.