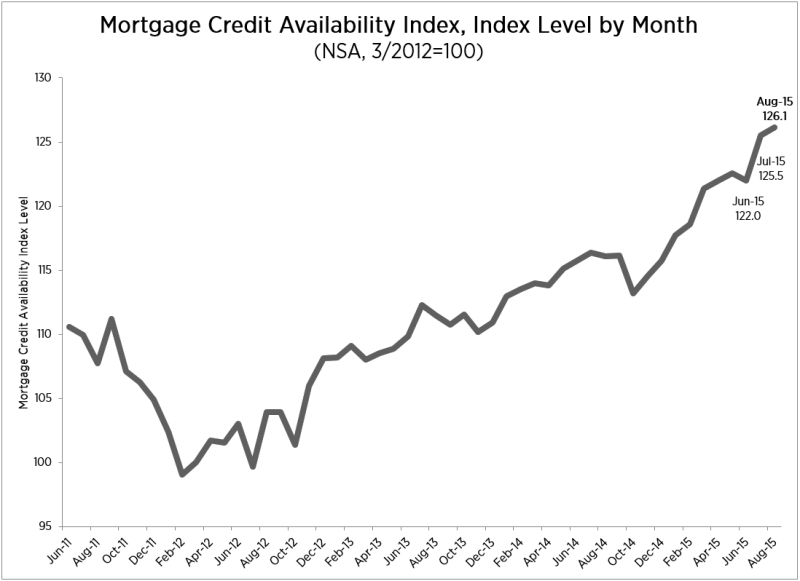

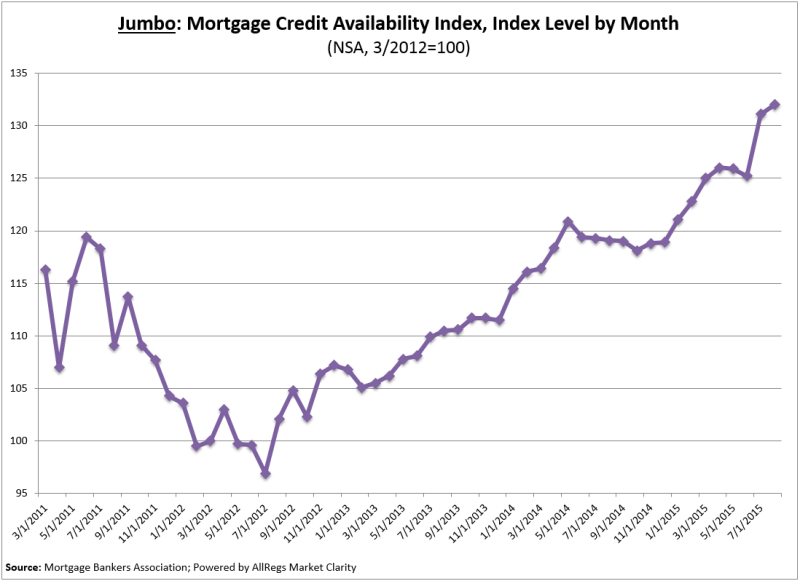

Mortgage credit access continued to improve again in August the Mortgage Bankers Association (MBA) said on Thursday. The trade group's Mortgage Credit Availability Index (MCAI) gained 0.5 percent compared to July and is up more than four points since June. MBA said August was the eighth month out of the last nine that the index has posted an increase. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

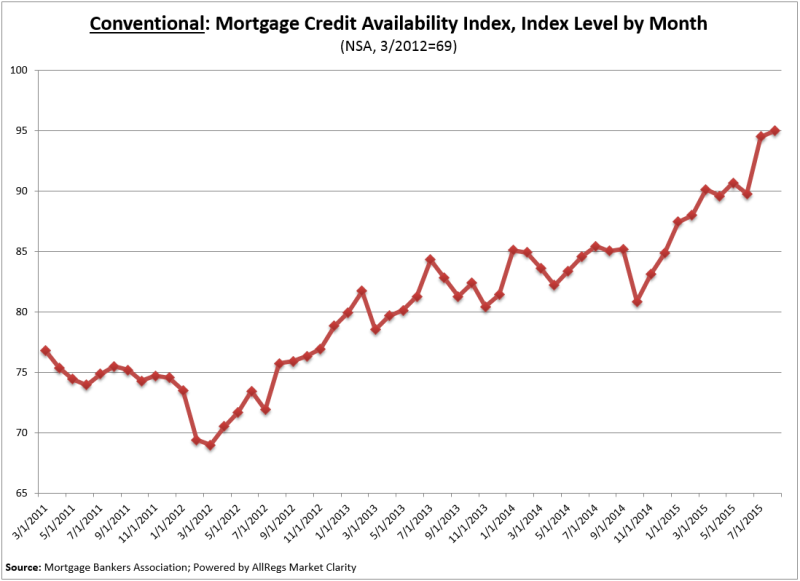

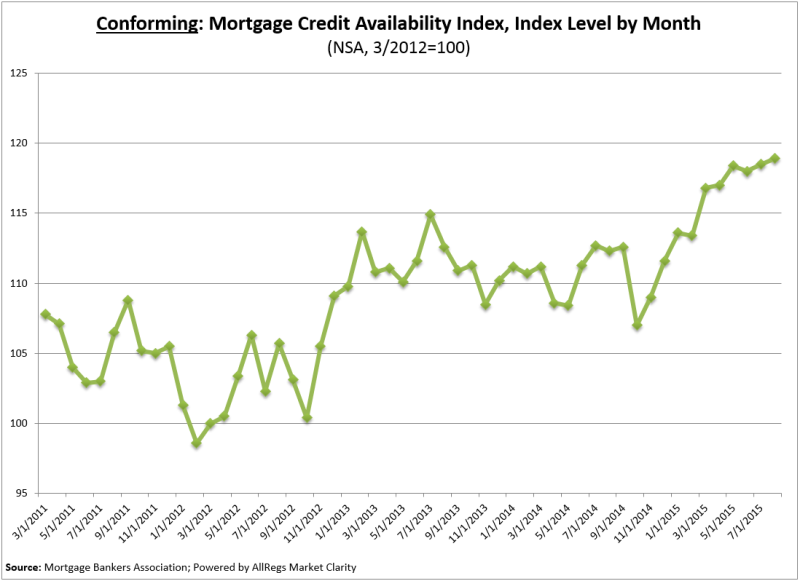

Mike Fratantoni, MBA's chief economist said the jumbo loans have been the source of most of the loosening credit. He added "The availability of conforming conventional mortgage credit has also somewhat increased, including for mortgages with higher loan-to-value ratios and borrowers with lower credit scores. Fannie Mae recently announced changes to their affordability suite of products, but those changes have not yet impacted the MCAI."

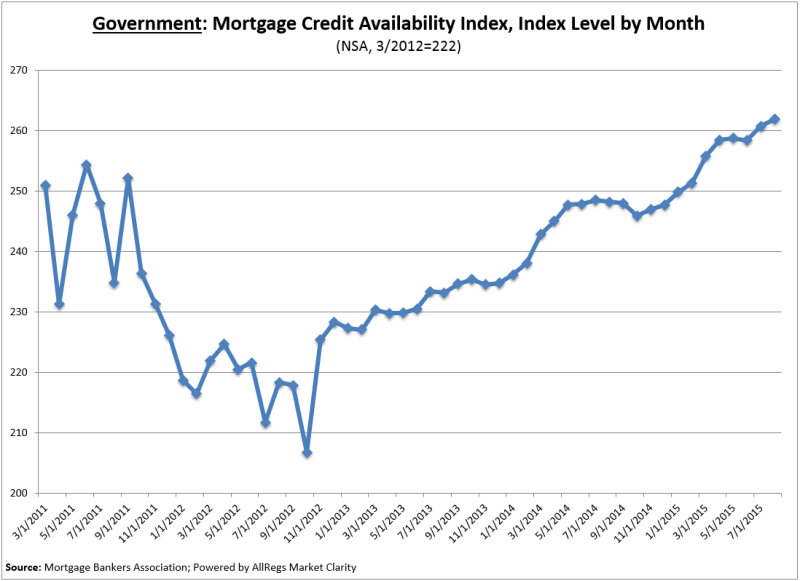

All of the MCAI's component indices also gained ground with, as Fratantoni indicated, the Jumbo MCAI loosening the most, up 0.7 percent. The Conventional MCAI rose 0.5 percent, the Government index was up by 0.4 percent and the Conforming MCAI by 0.3 percent.

The composite MCAI and the Conforming and Jumbo indices have a base period and value of March 31, 2012=100. The base for the Conventional MCAI March 31, 2012=69 and the Government MCAI is March 31, 2012=222.