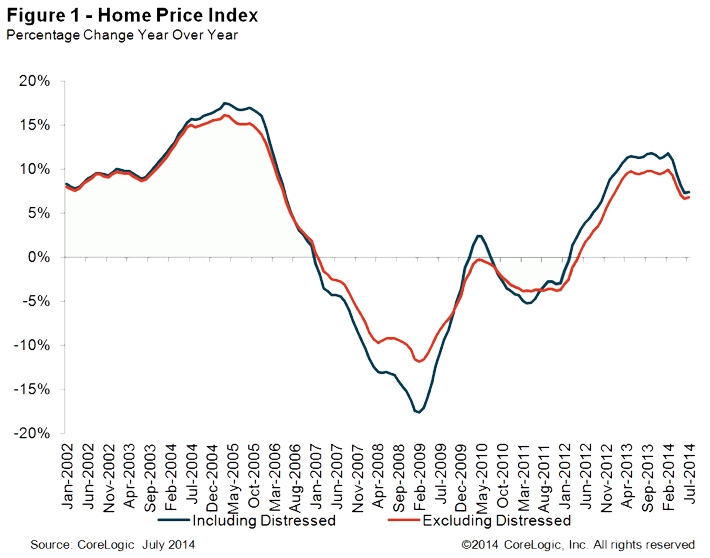

Home prices increased continued in July and those increases continue to be broad-based CoreLogic said on Tuesday. The company's Home Price Index (HPI) report says that prices nationwide including distressed sales (short sales and sales of bank-owned real estate) were up 1.2 percent from June to July and increased 7.4 percent compared to July 2013. July thus becomes the 29th month in which prices increased on an annual basis. CoreLogic points out however that these are no longer double-digit increases. The HPI which excludes distressed sales gained 6.8 percent on a year-over-year basis and was up 1.1 percent from June.

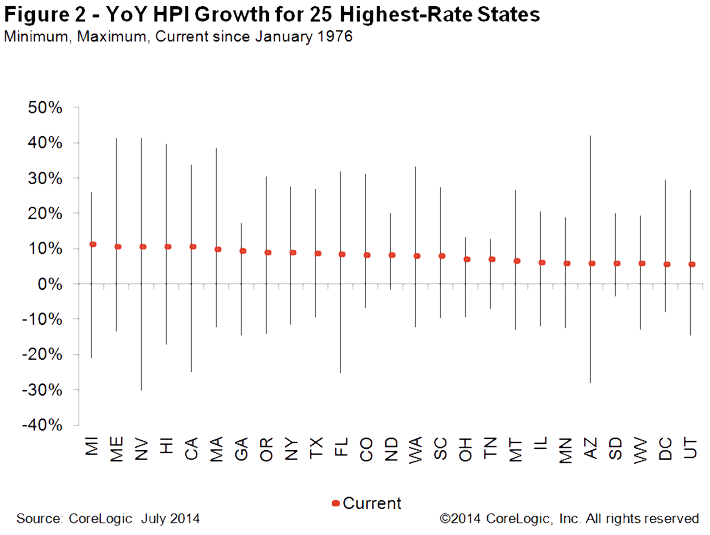

The HPI which excludes distressed sales increased in every state and the District of Columbia. Arkansas was the only state to post a decline - 0.9 percent - when distressed sales were included. Eleven states and the District of Columbia reached new highs on that index which contains data back to 1976. Those states are Alaska, Colorado, Iowa, Louisiana, Nebraska, North Dakota, Oklahoma, South Dakota, Tennessee, Texas and Vermont.

The largest annual increases in home values including distressed sales were in Michigan (+11.4 percent), Maine (+10.6 percent), Nevada (+10.6 percent), Hawaii (+10.5 percent) and California (+10.5 percent). Excluding distressed sales the biggest gains were in Massachusetts (+11.2 percent), New York (+9.7 percent), Maine (+9.5 percent), Hawaii (+9.2 percent) and Florida (+8.8 percent).

"While home prices have clearly moderated nationwide since the spring, the geographic drivers of price increases are shifting," said Sam Khater, deputy chief economist for CoreLogic. "Entering this year, price increases were led by western and southern states, but over the last few months northeastern and midwestern states are migrating to the forefront of home price rankings."

CoreLogic is forecasting that home prices including distressed sales will increased 0.6 percent from July to August and will be 5.7 percent higher in July 2015 than in July 2014. Excluding distressed sales the monthly increase is projected at 0.5 percent and by 5.2 percent year-over-year. The Forecast is a monthly projection of home prices built using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

"Home prices continued to march higher across much of the U.S. in July. Most states are reaching price levels not seen since the boom year of 2006," said Anand Nallathambi, president and CEO of CoreLogic. "Our data indicates that this trend will continue, with more states hitting new all-time peaks this year and into 2015 as the recovery continues."

Home prices are now down 11.9 percent from the peak in the national HPI that includes distressed sales. The peak-to-current change for the index excluding distressed sales is -8.3 percent. The peaks were established in April 2006. Some states however still substantially lag the national recovery. In Nevada prices are still 36.4 percent below the peak and in Florida 33.0 percent. Other states well below peak prices are Arizona (-28.9 percent), Rhode Island (-26.9 percent), and New Jersey (- 20.6 percent).

Only two of the 100 Core Based Statistical Areas with the largest populations failed to post year-over-year increases (those numbers were provided for June.) These were Worcester Massachusetts and Little Rock Arkansas.