The first Conservator's Report on the Enterprises' Financial Performance issued by the Federal Housing Finance Agency on Thursday makes an argument that the Government Sponsored Enterprises' role in the housing market was and still is vital. It also paints a picture of their fall prior to being placed in federal conservatorship in the fall of 2008. Some observers are already pointing to it as a map for the eventual reorganization of the two government sponsored enterprises. Another way of viewing the report is that is presents a strong argument for leaving the GSEs in charge.

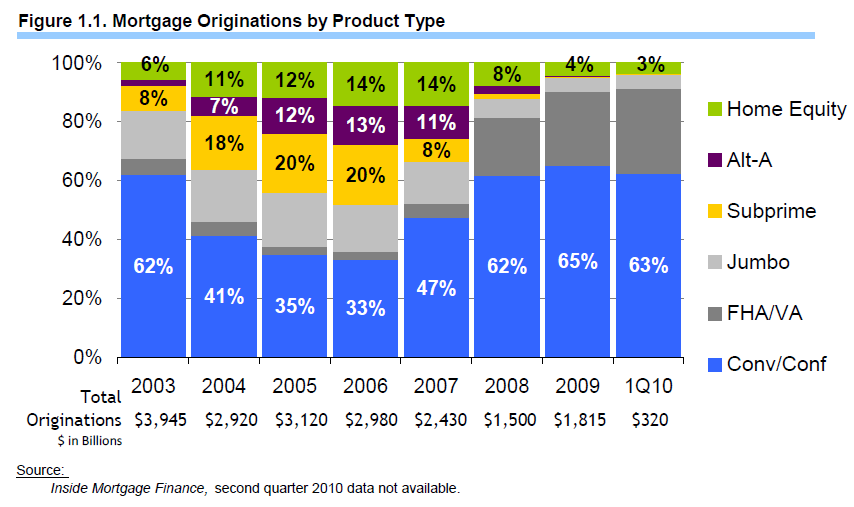

According to the report, in 2003, 62 percent of all mortgages originated in the country were conventional/conforming loans. Another 20 percent or so were FHA or jumbo loans; only 8 percent were subprime and Alt-A loans were virtually non-existent. By 2006 the conventional loan share had dropped to 33 percent while subprime loans had ballooned to 20 percent and Alt-A represented 13 percent of the market and the Home Equity share of the pie had more than doubled to 14 percent. During this same period the Enterprise's share of the MBA market literally fell off a cliff.

In 2003 the combined enterprises issued over two-thirds of the almost $300 billion MBS volume, in 2004, the volume dropped dramatically to under $200 billion and the Enterprises had ceded over half of that to private issuers. When the size of the market shot back up in 2005, it was the private market driving it; the Enterprises participation remained relatively flat. According to the report, the Enterprises were guaranteeing primarily traditional mortgages while the private market took the lead in securitizing higher-risk products. It is no coincidence that the trouble began when the Enterprises no longer dominated the market.

When the crash came, however, Freddie and Fannie were among the early casualties. The report indicates that the cause of their collapse was apparently different from what has been popularly reported.

At the end of 2007, the GSEs had combined capital of $71 billion (Fannie Mae $44b, Freddie Mac $27b). From that point through the end of last quarter the two have suffered capital reductions totaling $225 billion (Fannie, $136b; Freddie $90b). However, the bulk of the losses, $166 billion ($109b & $58b) came from the Enterprises' Single Family Credit Guarantee segment. This is 73 percent of the capital reduction to date.

This is particularly interesting in light of the frequent and loud warnings circa 2005 to 2007 from Federal Reserve Chairman Alan Greenspan and others about the dangers of the large investment portfolios owned by the Enterprises. In the portfolio segment of their businesses, they bought and held mortgage securities, some of which were guaranteed and some of which weren't; these portfolios ultimately accounted for $21 billion or 9 percent of the capital reduction.

Since the conservatorship began in 2008, the mortgage market has swung back to the model that existed pre-2003, with 63 percent represented by conforming/conventional loans and FHA absorbing a large share of the remaining market; Alt-A, Subprime, and home equity loans have virtually ceased to exist, and the private MBA market has also disappeared. The Enterprises and Ginnie Mae are now almost the entire market, which is itself shrunken to around $100 billion in volume.

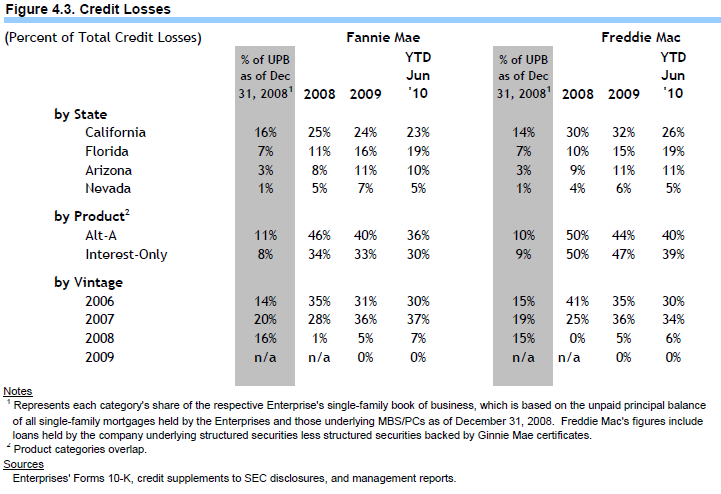

The source of credit losses suffered by the Enterprises are disproportionately concentrated in loans originated in 2006 and 2007, but they are even more heavily skewed toward Alt-A loans and interest only loans and to loans written in four states - California, Florida, Arizona, and Nevada. While the unpaid principal balance of loans in those states is only 27 percent of Fannie Mae's Single Family Book of Business and 25 percent of Freddie Mac's, those states account for 49 percent of the Fannie's 2008 vintage loans and 58 percent of the 2009 vintage and for Freddie, 53 percent and 64 percent respectively. Alt-A and interest-only loans represent 19 percent of each Enterprise's Book, but between 73 and 100 percent of the delinquent loans.

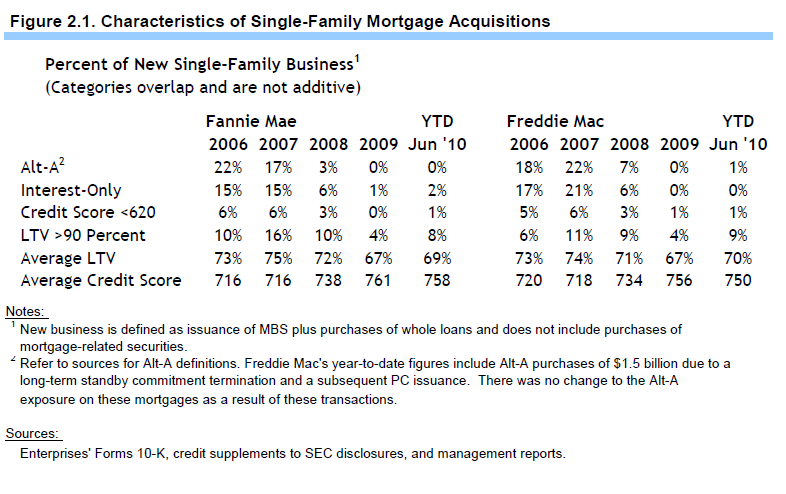

With the Enterprises and FHA virtually the only game in town, the conservators have been able to insist on strengthened underwriting, and are now touting the safety of the newest loans it has acquired or guaranteed. The current loan profile is quite different than it was pre-conservatorship. For example, around 20 percent of the loans acquired by the Enterprises in 2006 were Alt-A and 15-17 percent were interest only. Today those two loan types combined are around 1 percent of Freddie and Fannie's single family business. The average LTV of a new loan in 2006 was 73 percent; today it is 69-70 percent. The average credit score in 2006 was under 720, today it is over 750.

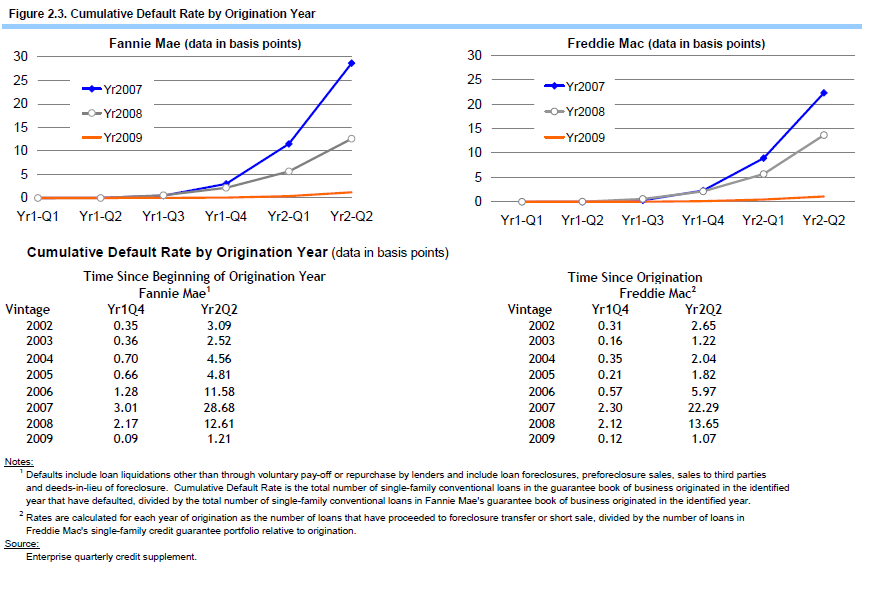

While these loans are still young, there are some promising indications of their safety. For example, loans originated in 2007 had a delinquency rate of 22.29 percent by midway through the second year following origination. The 2008 vintage loans had a 13.65 rate at the same point in the lifecycle, while loans written in 2009 are running a 1.07 delinquency rate.

Regardless of the form the Enterprises take under eventual reform, it appears that their role should return to what it had traditionally been; a virtual gatekeeper for the industry. At the recent "Future of Housing Finance" conferece, hosted by the Obama Administration, Treasury Secretary Timothy Geithner was quoted saying there would be a "wind down" of the Enterprises' portfolios, but, "There is a strong case to be made for a carefully designed guarantee in a reformed system, with the objective of providing a measure of stability in access to mortgages, even in future economic downturns."