A large contingent of new homes started in 2015 were purchased using non-conventional financing according to a new analysis by the National Association of Home Builders (NAHB). The association's Assistant Vice President for Housing Policy Research, Natalia Siniavskaia writes that more than a third (34.4 percent) of newly constructed homes started last year did not use conventional financing. This includes purchases using all cash, FHA, VA, and Rural Housing Service (USDA) loans.

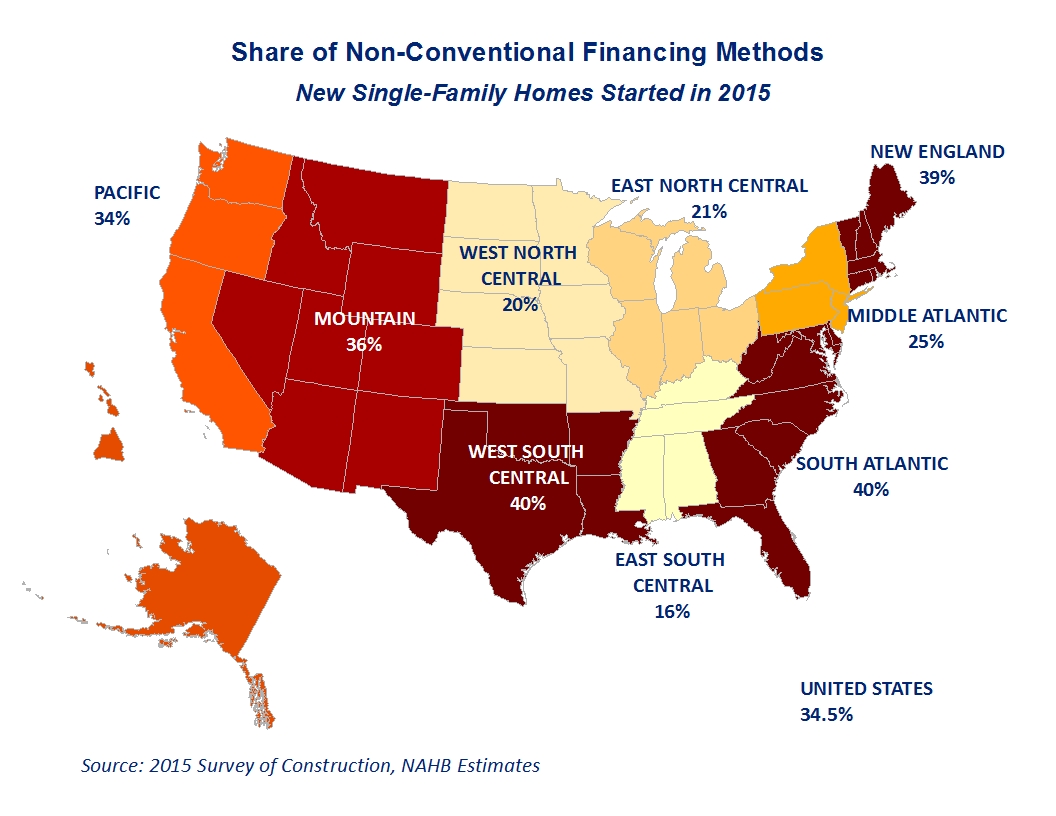

Siniavskaia used the U.S Census Bureau Survey of Construction (SOC) data and found that the use of non-conventional financing varied widely across census divisions, from a low of 16 percent of new home purchases in the East South Central division (Alabama, Mississippi, Tennessee, and Kentucky) to 40 percent in both the West South Central (Texas, Oklahoma, Louisiana and Arkansas) division and the South Atlantic division which includes coastal states from Delaware south and West Virginia. \

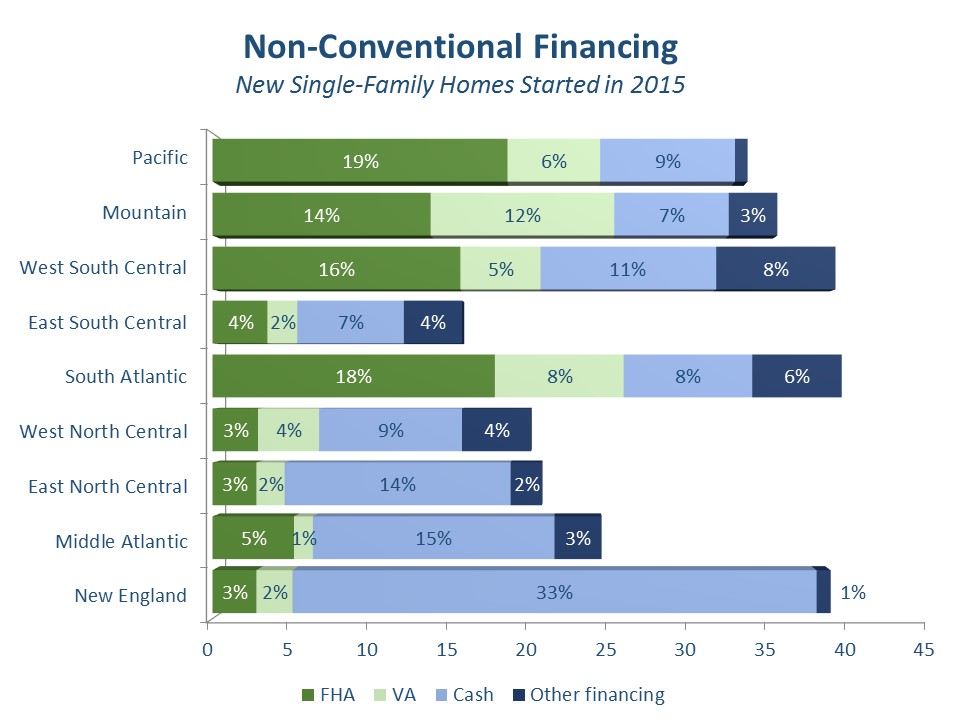

There was also substantial variation in the types of non-conventional financing used. For example, in the six New England states 39 percent of new homes were purchased using non-conventional financing, but FHA, USDA, and VA loans played only a tiny role - an aggregate of 6 percent while 33 percent of all new homes were financed with cash. The author speculates that this ratio as well as the high level of cash purchases in the Middle Atlantic (New York, New Jersey and Pennsylvania) and East North Central (Michigan, Illinois, Wisconsin, Indiana, and Ohio) divisions were due to their having the highest levels of custom building in the nation. Siniavskaia says custom homes are more likely to be financed with cash, especially if built by the owner acting as the general contractor. In 2015, more than 36% of custom homes built by the owner were financed with cash, while less than 7 percent of spec homes were purchased with cash.

In contrast, homebuyers in the South Atlantic and West South Central division relied more heavily on FHA- and VA-backed loans that together accounted for more than 26% and 21% of the market, respectively.

FHA got a larger share of new home financing in 2015, especially in the Pacific (California, Oregon Washington, Hawaii, and Alaska) and South Atlantic divisions where FHA loans accounted for 19% and 18%, respectively. NAHB attributed this to the reduction in FHA mortgage insurance premiums implemented at the beginning of the year. This helped FHA loans regain their status as the most prevalent form of non-conventional financing of new home purchases. Those loans had fallen behind cash financing a year earlier after their loan limits were reduced.

The share of VA-backed loans remained relatively stable in 2015, accounting for just over 6% of the market. However, their share was almost twice as high, approaching 12%, in the Mountain division (Montano, Idaho, Utah, Colorado, Nevada, Arizona and New Mexico) the only region in the nation where the share of VA-backed loans exceeded that of cash purchases and other types of financing combined.

There was a sharp decline in the share of cash purchases nationwide in 2015, especially in the Mountain division where cash purchase declined by 50 percent. Nationally only 10 percent of new homes were purchased with cash.

Other types of non-conventional financing methods - such as the Rural Housing Service, Habitat for Humanity, loans from individuals, state or local government mortgage-backed bonds and other sources claimed a 4.5 percent national share. The highest share, 4 percent, of this "other" financing was in the East South Central division, where more than 30% of new home starts were in rural areas. Siniavskaia speculated that this "other" financing in the region, which was accounted for one-quarter of its non-conventional share, was most likely through the Rural Housing Service.