The theme of every sales and price report for the last several years has been the shortage of homes for sale. While new home inventories have held steady over the six-month supply considered a balanced market, existing homes have hovered near record lows for several years. Shu Chen, writing in CoreLogic's Insights blog says that increase in home prices since the recession has pushed affordability rates down, taking sales lower as well. Now the lower sales are being reflected in rising inventories. After hitting historic lows last year, the number of homes for sale in June was at a 3.3-month supply, up from 2.8 months the previous June.

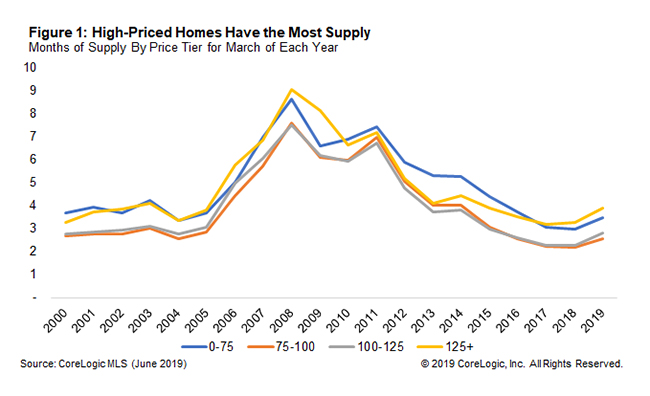

The months of supply is calculated as the ratio of the for-sale inventory at the end of the month to the number of homes sold during the same month and represents the number of months it would take to sell the inventory at that month's sales pace.

The demand for homes and thus the supply available are, of course, not even, with the greatest pressure existing on the low end. The bottom price tier, defined as 0-75 percent of the median list price, had a 3.5-month supply, up from 3 months in June 2018 but only about a third of the inventory available at the peak in January 2008.

The low to middle tier of homes, those from 75 to 100 percent of the median, had the shortest supply, 2.6 months, about a half month increase over the last 12 months but one-fifth of the pre-crisis supply. Middle-to-moderate priced homes (100 to 125 percent) was also up about half a month from a year earlier to 2.8 month while the largest inventory was in the highest priced category, 125 percent or more of the median. At 3.9 months, it was still only a quarter as large as the inventory pre-recession.

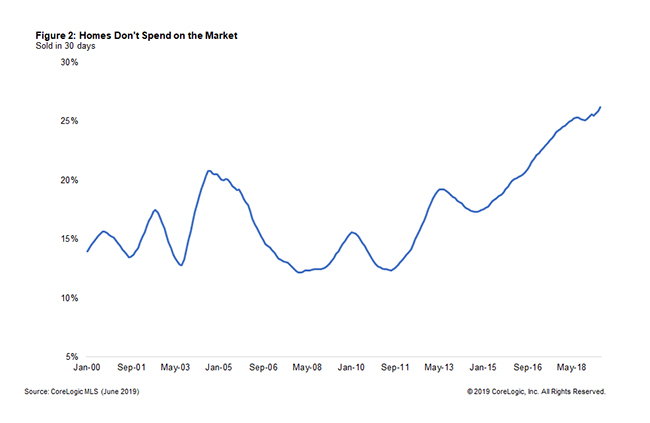

With this kind of inventory homes don't spend long on the market. Over the past two years, the share of homes that were sold within 30 days of being listed was at the highest level since 2000. In June the share that sold within 30 days was 26.2 percent higher than the share at the last peak in August 2004. Just over 20 percent of homes stayed on the market for more than 180 days.

But with home price increases slowing and interest rates way down from a year ago the uptick in inventories may be short lived.