RealtyTrac estimated that home sales in July were at an annualized rate of 4.63 million units, a decrease of 3 percent from June and down 12 percent from July 2013. This would be the third consecutive month in which RealtyTrac has projected a decrease in sales volume and the report is sharp contrast to the Existing Home Sales report issued last week by the National Association of Realtors® (NAR). That report showed existing home sales rose 2.4 percent from June to July, the fourth straight month-over-month increases, to an annualized total of 5.15 million sales and a rate down only 4.3 percent from the previous July.

The RealtyTrac report points to a decreasing share of distressed sales - bank owned real estate (REO) and short sales - in the transaction mix. REO accounted for 8.0 percent of all single-family and condo sales during the month, down from 8.1 percent in June and 9.1 percent in July 2013. Short sales accounted for 4.5 percent of all single family and condo sales in July, up from 3.5 percent in the previous month but down from 5.2 percent a year ago.

As the share of distressed sales has shrunk so has the discount that traditionally accompanies them. The median price of short or REO sales was $128,000 in July, up 3 percent from the previous month and up 11 percent from a year ago, but still 37 percent below the median price of non-distressed sales: $204,000.

The waning influence of distressed sales is contributing to rising housing prices. The median price of U.S. residential properties sold in July - including both distressed and non-distressed sales - was $191,000, up 3 percent from the previous month, and up 12 percent from a year ago to the highest level since September 2008, a 70-month high.

"As distressed sales continue to decline, the share of sales is tilting toward more expensive homes, boosting the nationwide median sales price," said Daren Blomquist, vice president of RealtyTrac. "The nationwide home price increase, however, masks slowing home price appreciation in the majority of housing markets across the country. This slowing appreciation was expected and provides another sign that the real estate recovery thus far is behaving rationally. Still, the housing market is entering a dicey transition phase where it is becoming much more reliant on first-time homebuyers and move-up buyers to sustain the recovery as investor involvement wanes."

Eighteen of the 183 major markets reached new median home price peaks in the last two months, including Denver, San Jose, Columbus, Ohio; and Charlotte. States with the biggest annual increase in median sales prices were Michigan (+24 percent) and Ohio and Virginia (tied at +20 percent). Metros with the biggest annual increase in median sales price included Detroit (+33 percent), Dayton (+31 percent), and Stockton (+24 percent),

Properties selling in the $200,000-and-below price range accounted for 49 percent of all sales in July, down from 52 percent of all sales a year ago, while properties selling above $200,000 accounted for 51 percent of all sales in July, up from 48 percent of all sales a year ago

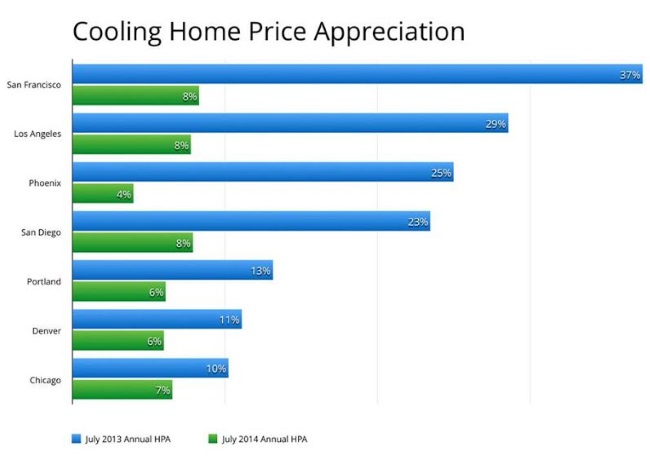

Still the RealtyTrac data concurs with most other analytic sources; the rate of appreciation is slowing. Markets where annual home price appreciation in July 2014 dropped to single digits from double digits a year ago included San Francisco, San Diego, Los Angeles, Chicago, Portland, Denver and Phoenix. Among metro areas 65 percent (119) saw lower home price appreciation than they did one year earlier.

Despite national trends, sales of REO and short sales continue as a major influence in some markets. In Las Vegas those sales had a 40.3 percent market share and they made up more than 30 percent of sales in Stockton and Modesto California and in Lakeland Florida. Distressed sales increased in some markets as well, notably New Haven, Louisville, and Boston.

Sales at foreclosure auctions accounted for 1.2 percent of all single family and condo sales in July, up from 1.1 percent in June and up from 0.8 percent in July 2013. The highest share of these sales were in Miami, Lakeland, and Orlando, Florida but none rose above a 5 percent market share.