Fannie Mae used a fair number of trade-offs in while coming up with its revised outlook for the real gross domestic product (GDP) this year. The company's economists, headed by Chief Economist Doug Duncan, upgraded its full year forecast from 2.1 percent to 2.2 percent while at the same time painting a darker picture for the second half of the year.

Second quarter growth beat expectations, according to Fannie's August Economic Developments report, largely because of strong consumer spending which is expected to have continued into this quarter. Nonresidential fixed investment and government spending are expected to weaken however, so the third quarter GDP has been downgraded from 1.9 percent to 1.8 percent. The economists continue to believe growth will slow next year, but that forecast has been raised from 1.6 percent to 1.7 percent based on higher government spending due to the recently passed budget act.

The report says that while it is more optimistic this month than last, it also sees greater risks to its outlook, the most serious being further escalation of the trade war. Fears of growing problems with China sent the stock market tumbling last week, and 10-year Treasury yields falling as low as 1.6 percent, the lowest level since October 2016. The tariff announcement came a day after the Federal Reserve cut the federal funds rate as "insurance" against downside risks, such as the trade tensions between the U.S. and China. Any further escalation of the trade war will likely force the Fed to cut rates again and Fannie Mae expects quarter-point reductions in both September and December rather than the single December cut it predicted last month

Residential fixed investment weighed down growth for the sixth straight quarter and was far more negative than anticipated, however, there are signs of improvement. The forecast is for moderate housing activity with some growth in single-family housing starts and increasing home sales. This should push residential fixed investment into positive territory. While mortgage rates are likely to follow the recent Treasury rate decline in the third quarter, the benefits to affordability will be limited as home price appreciation is expected to accelerate after five quarters of deceleration and the chronic issue of limited housing stock remains. Further, the labor market will probably soften, reducing housing demand and construction.

The number of workers still "on the sidelines" is dwindling and payroll growth should slow from the 176,000 per month average over the first half of the year to around 107,000 for the second half. This would cause the unemployment rate to bump up to around 4.3 percent, slowly reducing consumer confidence, spending, and limiting the growth of residential investment.

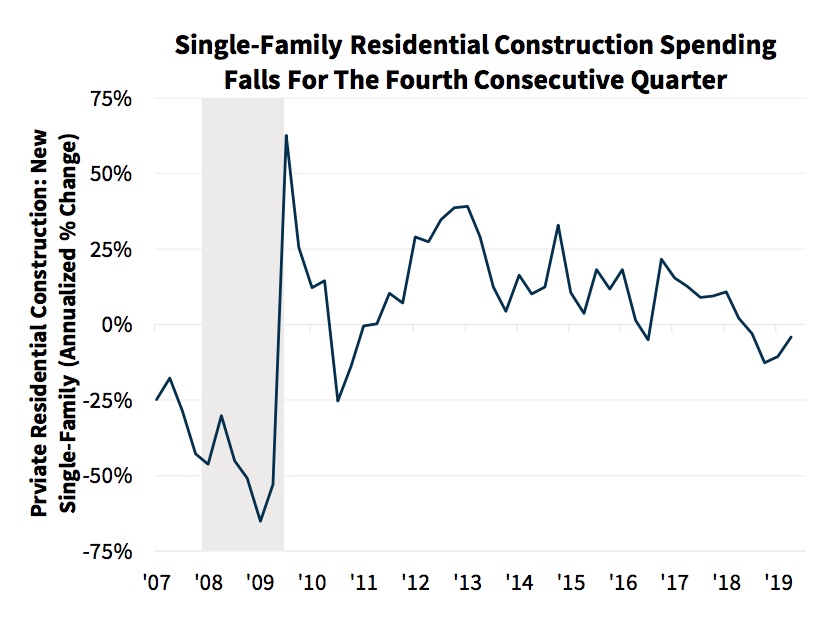

While GDP growth was better than Fannie Mae's economists had anticipated, housing activity was down 1.5 percent from the second quarter of 2018. After surging at the beginning of the year, single-family housing starts pulled back in the second quarter and, when combined with the trend of builders toward smaller homes, weighed on the total dollar value of single-family construction. Growth in single-family construction has declined over the past year, but deceleration was fastest at the end of 2018, easing over the last two quarters. The forecast is for single-family construction spending to turn modestly positive as starts perk up during the latter half of this year. Multifamily construction, while it was the sole driver of an overall increase in housing starts, was not enough to counter single-family weakness, as those starts contribute less per unit to residential investment.

Residential improvement spending also fell over the second quarter for the first time in a year. Major renovations often come shortly before or after a home sale, so improvements are highly correlated with total home sales and house price growth. The expected growth in home sales through the first quarter of next year should boost that spending as well. During the second half of 2019 residential fixed investment should edge up into positive territory, modestly contributing to GDP growth as starts, broker commissions, and improvements spending begin to improve slightly.

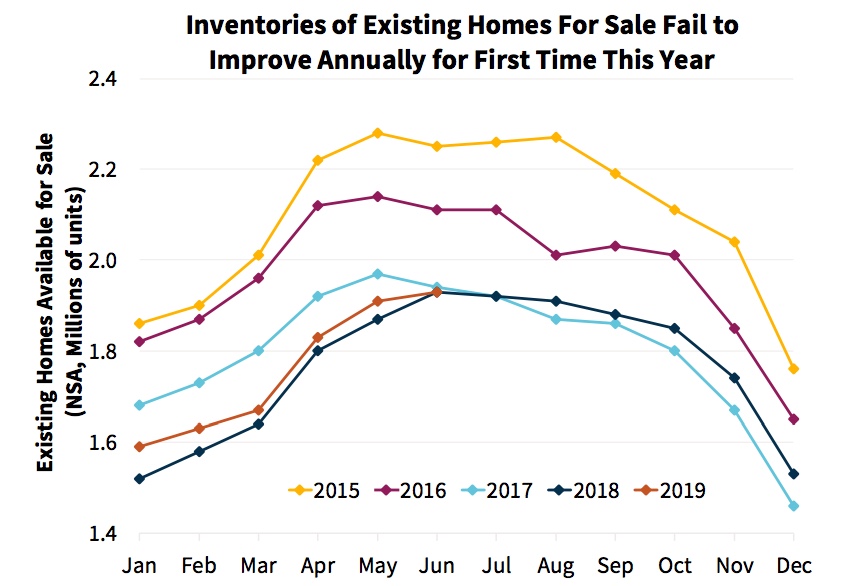

Existing home sales improved during the second quarter, although the June sales were not as good as expected. Fannie Mae expects a good July report given the 2.8 percent gain in the National Association of Realtors® Pending Home Sales Index (PHSI) and Fannie Mae's Home Purchase Sentiment Index hit a survey high in July, showing strong homebuying interest. However, despite positive sentiment and a continued decline in mortgage rates over the month, purchase mortgage applications have declined in every week since mid-July. This is probably due to the persistent issue of limited housing supply. On a year-over-year basis inventories of existing homes for sale, which rose steadily over the past year, were unchanged in June, tying the lowest level seen in any June since the series began in 2000. While believing home sales will improve in the third quarter, Fannie Mae revised its forecast for existing home sales over the remainder of the year. It now reflects an annual decline of 0.1 percent in contrast to the previous forecast of an 0.2 percent gain.

New home sales were up in June but sales from March through May were revised down substantially. This suggests homebuilders did not draw down inventories during the first half of the year as much as previously believed and thus have larger inventories of homes under construction. With this new information the forecast for new home sales has been raised and the one for housing starts revised down. Sales should average 659,000 units for the year with 1.241 million starts.

Building permits, which tend to be less volatile than starts, have edged up for two consecutive months, and the number of new homes sold that have yet to be started surged at the end of the second quarter to the highest level since November 2017, suggesting that builders will soon have to increase the pace of starts.

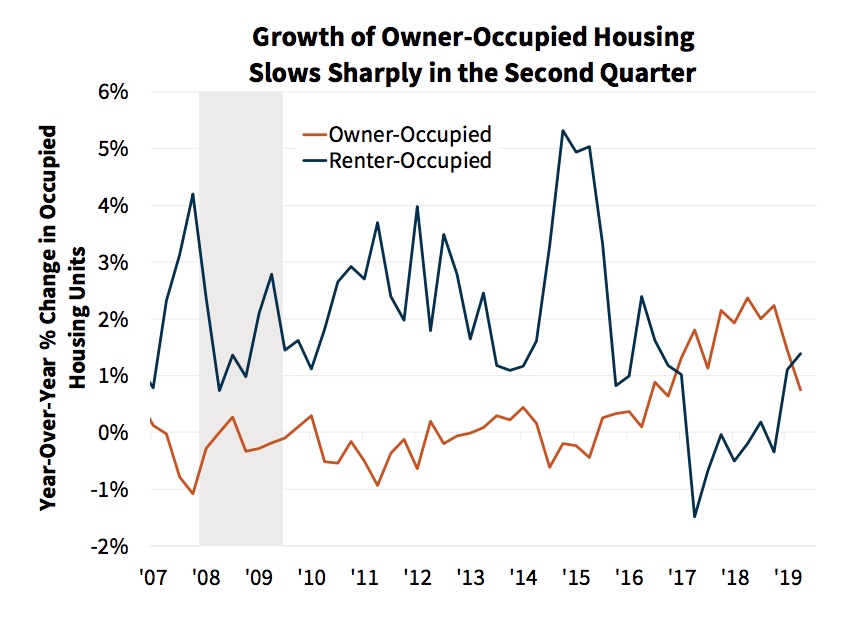

With sales slowing compared to the first half of 2018, it's no surprise that the Census Bureau showed a second quarterly decline in the homeownership rate which it now at its lowest since the end of 2017. Owner-occupied household growth decelerated sharply while the growth of renter households is at the fastest pace in almost three years. The Census report also showed the rental vacancy rate at 6.8 percent in Q2, just above the post crisis low. This should continue to support multifamily construction although it too will probably slow.

The Federal Reserve Board's Senior Loan Officer Opinion Survey indicates residential mortgage lending standards easing and the largest net share of banks reporting higher demand in seven years due to lower mortgage rates. At the time Fannie Mae's forecast was written 30-year rates were at 3.60 percent so the authors have increased their estimate of single-family mortgage originations for the remainder of the year. They expect a 12.3 percent increase from 2018 to $1.84 trillion, driven largely by refinances, which will account for 35 percent of total mortgage originations in 2019, up from 29 percent in 2018. They currently estimate that approximately 35 percent of outstanding mortgages, or about $3.6 trillion of unpaid principal balance, would experience a significant benefit from refinancing. While refinance applications pulled back slightly in July, they remained at the second highest level since October 2016 and were 123 percent higher than average applications in December 2018.