Fannie Mae's monthly Economic Development papers always have the best headlines, pithy and to the point. The August one reads. "Growth Picks Up as Expected, No Thanks to Housing." Sort of says it all.

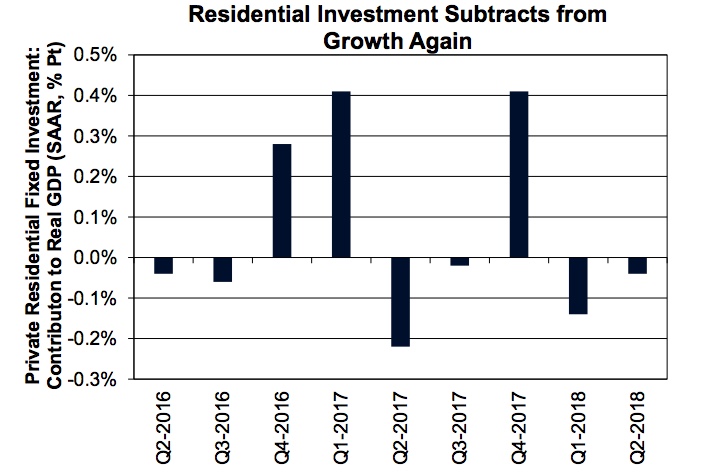

The company's Economic and Strategic Research (ESR) Team is upgrading its estimate of third quarter growth based on the acceleration of headline economic growth in the second quarter. Consumer spending and net exports drove the action although business inventories declined and dragged on growth. So too did residential investment, which had a negative impact for the fourth time in five quarters, subtracting 0.04 percentage point from the GDP. The residential investment component includes homebuilding, renovations, and brokerage commissions. Home building was lackluster, posting the largest monthly decline in June (over 12 percent) since November 2016, affecting both single- and multifamily starts.

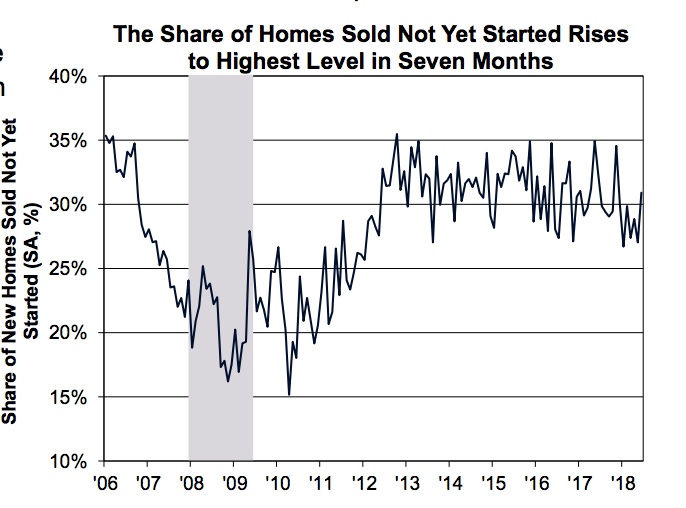

Home sales (and thus commissions) weakened toward the end of the quarter with June new home sales falling to the lowest level since last October and existing home sales down for the third straight month. The for-sale inventory of existing homes did post a year-over year increase in June, ending three years of annual declines and pushing the months' supply to the highest level in almost a year. The new home inventory has performed better, increasing on an annual basis every month for the last five years. However, it still remains below the levels in previous economic expansions and more homes are being sold before construction even begins. The share of homes still in the planning stage rose to 31 percent in June.

It is tight inventory rather than weakening demand that likely remains the primary factor restraining sales. According to the National Association of Realtors, homes for sale are going under contract very quickly. Properties typically stayed on the market for a record low 26 days for the third consecutive month. Tight supply continued to support an annual home price gain of more than 6 percent in May, according to the main measures of home prices.

New home builders are still coping with rising materials costs and labor shortages. The Job Openings and Labor Turnover Survey (JOLTS) provided additional evidence of shortages of qualified construction workers, as construction job openings rose in June for the fourth consecutive month to reach an expansion best but hiring fell for the first time in three months.

With the first half of the year in the books, existing home sales were running about 2.2 percent behind those in 2017 compared to a 7.4 percent gain for new home sales. Leading indicators of existing home sales don't predict improvement in the near term. Pending home sales were up in June for the first time in 3 months, but purchase mortgage applications fell in July for the second time in 3 months. Fannie Mae forecasts a decline of nearly 1 percent in existing home sales this year, the first such loss in four years. At the same time, they predict new home sales will grow by 6.5 percent. That surge will result in little change in total sales from 2017 as new home sales have only a small market share.

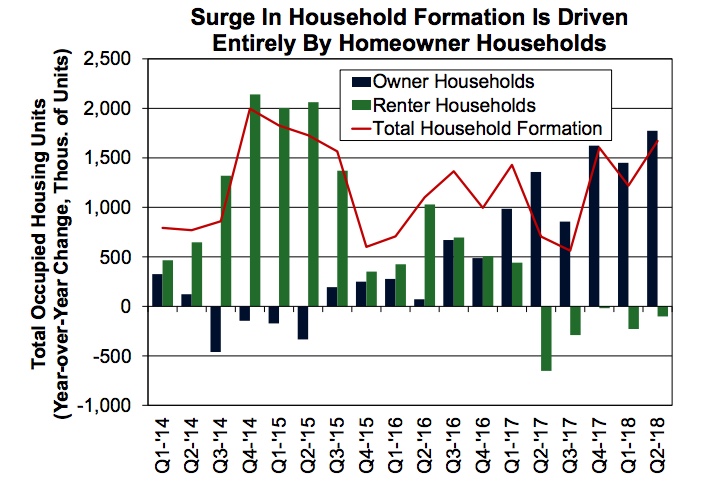

The ESR group sees a housing bright spot in the Census Bureau's Housing Vacancy Survey (HVS). Second quarter household growth is running above 1 million units per year with rapid growth in owner occupant households and modest declines among renters. The unadjusted homeownership rate was up year-over-year for the sixth consecutive quarter, increasing 0.6 percentage points to 64.3 percent, the highest second quarter rate since 2014. The rate for households 35 years old or younger rose 1.2 percentage points from a year ago, marking the third straight quarter of annual increases at or exceeding 1 percentage point. In addition, both homeowner and rental vacancy rates remain at or near multi-decade lows.

The overall weakening of housing conditions in the second quarter has moved Fannie Mae to lower its projections for originations of both purchase and refinancing mortgages. Total originations are expected to fall about 9 percent to $1.67 trillion in 2018. This is based on a 2 percent increase in purchase originations more than offset by a 28 percent drop in refinancing. The refinance share will decline to 28 percent from 36 percent in 2017.

Despite this expected housing-related drag, the ESR sees a swing from an inventory drawdown to a pattern of restocking outweighing other weaknesses and have upgraded their third quarter growth outlook. They now expect full-year 2018 growth of 3.0 percent, compared with 2.8 percent in the prior forecast. As fiscal policy impacts fade and monetary policy continues to tighten, growth is expected to slow to 2.3 percent in 2019.

Trade policy is seen as the key downside risk. Trade tensions with the European Union appear to be easing while those with China have intensified. Although the direct cost of tariffs already in place is small at the national level, indirect costs from uncertain trade policy are probably mounting, with concerns weighing on businesses' decisions to invest and hire.

Real consumer spending surged 4.0 percent annualized in the second quarter after a paltry 0.5 percent gain in the first quarter and added 2.7 percentage points to second quarter growth. Some changes in GDP can be attributed to a benchmark revision; nominal personal income was revised higher as was the first quarter savings rate which more than doubled its early estimate to 7.2 percent growth.

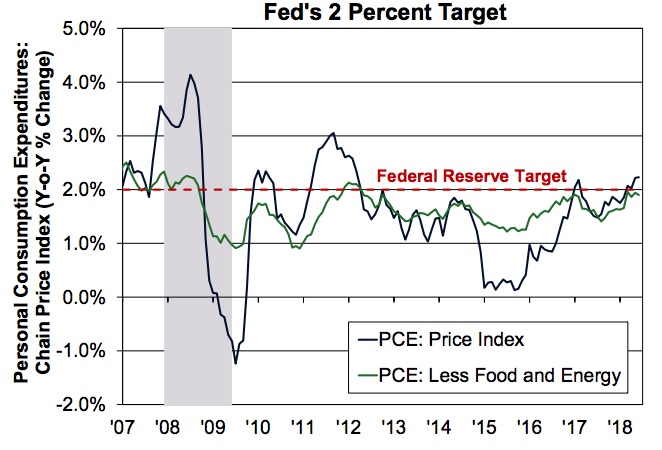

Even though wage growth remains flat, inflation has picked up. The annual gain in the personal consumption expenditures (PCE) deflator-the Fed's preferred measure of inflation-remained at 2.2 percent in June, the fourth straight month at or above the Fed's 2-percent target. The core PCE which excludes food and energy was 1.9 percent for the third month. In July, the core Consumer Price Index posted the expansions largest annual increase, 2.4 percent.

The Federal Open Market Committee's (FOMC's) statement at the end of its August meeting reflected the recent firming in inflation, noting that it has remained "near 2 percent," a change from "moved close to 2 percent" in the June statement. Fannie Mae continues to expect rate increases in September and December of this year. However, if trade tensions intensify, weighing on consumer and business confidences and the equity market, Fannie Mae says the Fed could turn to a wait-and-see mode for the rest of the year.