Strong home sales, near-historic low interest rates, a burst of refinancing, and continued home price growth are moving Freddie Mac's economic team to predict that mortgage originations will top $2 trillion this year. That will be the highest volume since 2012. The prediction comes in the current edition of the company's Economic and Housing Research Outlook despite what the authors term overall weak economic growth.

The mortgage markets continue to feel the impact of the United Kingdom's Brexit vote. The report says the continued flight to safety it, along with other global factors, triggered held the average 10-year Constant Maturity Treasury yield to 1.5 percent in July although that is higher than the low or even negative yield in much of the developed world. Those rates are continuing to keep downward pressure on U.S. rates and with the outlook for a rapid global recovery muted, Freddie Mac says that pressure is likely to persist for an extended period.

Mortgage rates have followed the Treasury note descent. The 30-year fixed-rate mortgage (FRM) averaged only 3.44 percent in July, the lowest monthly average since January 2013.

Given the global outlook, Freddie's economists have lowered their interest rate estimates for the second month in a row. Last month they cut both the 2016 and 2017 estimates by 40 basis points. This month they cut the projection for 2016 by another 10 basis points to an average of 1.8 percent and knocked 30 more basis points off the 2017 projection bringing it to 2.1 percent. They held the 30-year FRM forecast steady at 3.6 percent after downgrading it by 30 basis points last month, but the 2017 projection has been lowered by another 30 basis points on top of the 50 in July, to 3.7 percent.

Total sales of new and existing home sales in the first six months of the year hit the fastest pace since the first six months of 2007, 2.9 million on an unadjusted basis. With continued job market growth, a slight improvement in wages, and the interest rate picture cited above, the Outlook projects the second half of the year will best the comparable period in 2007, reaching the highest rate since 2006.

The tight inventory remains a concern. Housing starts have averaged a rate of 1.16 million this year and are projected to rise to an average of 1.2 million by year's end, the highest number since 2007 but well below long-term demand which the economists put at between 1.5 and 1.7 million units.

Home prices keep rising, averaging 6.2 percent in June. The pace of appreciation has moderated slightly in recent months, but remains well above income growth which is rising at 2 to 3 percent. Increasing inventory could further moderate price growth and if interest rates should creep higher those price gains could decelerate quickly.

But returning to the projected boom in originations, the report estimates the volume in the second quarter was $535 billion; the highest since the second quarter of 2013, and declining interest rates should boost them higher this quarter. The Mortgage Bankers Association Weekly Mortgage Applications Survey has refinance applications up over 50 percent from a year ago and strong refinance and purchase mortgage activity should generate total originations of $595 billion in third quarter of 2016, a level not seen since the fourth quarter of 2012.

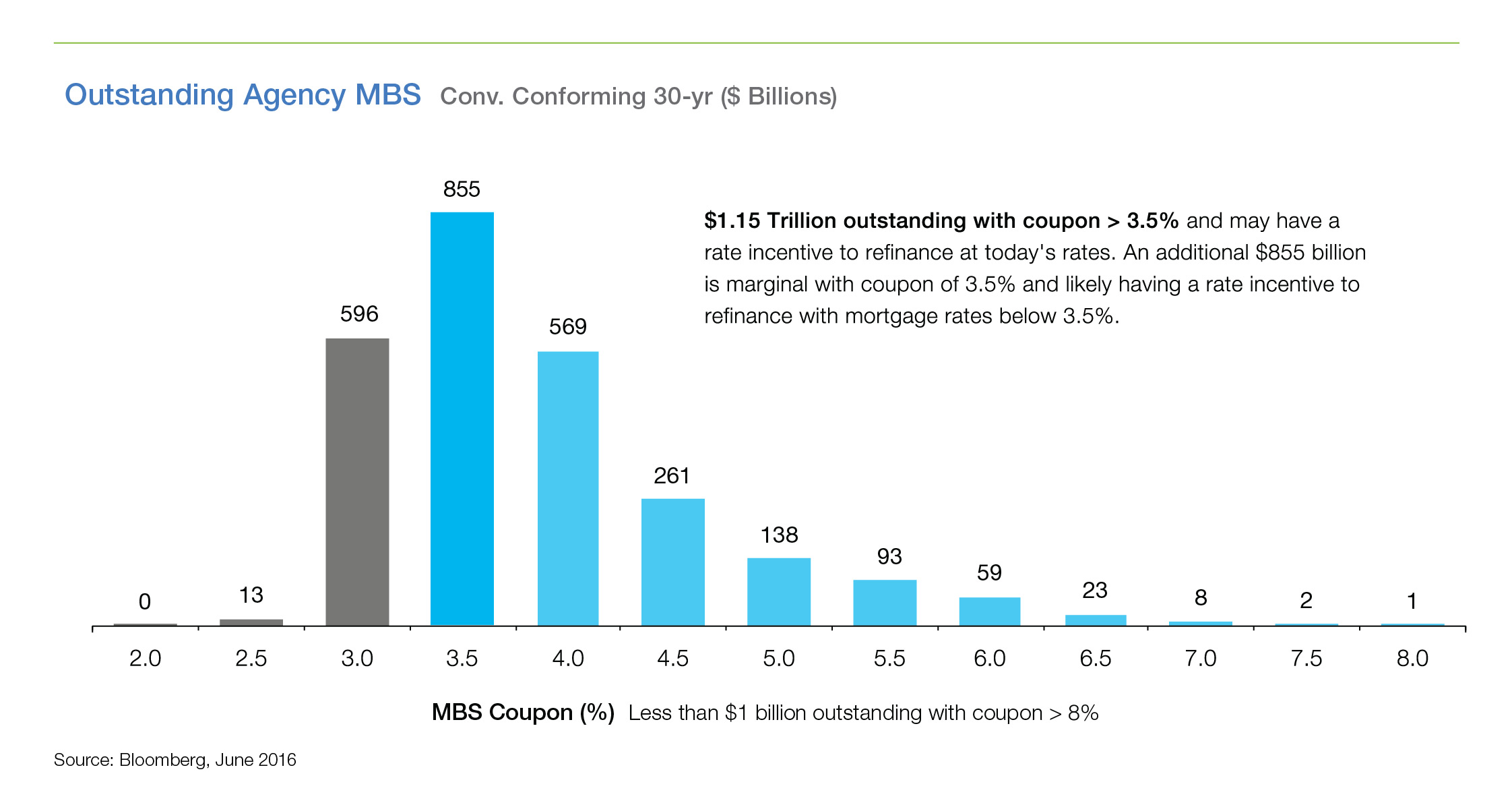

Freddie Mac analyzed the refinance potential early this year when rates dropped back below 4 percent for the 30-year fixed-rate mortgage. At that time, in the February Outlook, it estimated there was about $655 billion in outstanding conventional 30-year mortgage-backed securities (MBS) with a coupon greater than 4 percent. Now, with 30-year FRM rates falling below 3.5 percent, even more borrowers have a rate incentive to refinance. Currently, there is about $1.15 trillion in outstanding 30-year MBS with a coupon greater than 3.5 percent.

This figure is a rough upper bound on the potential rate refinance volume from conventional conforming 30-year fixed-rate loans in agency MBS and realistically not all of them are likely to be refinanced this year despite the rate reduction potential. Some borrowers have ignored other opportunities and are through to be "burned out," others have paid down loans to the point that refinancing costs outweigh the benefits, and some are afraid they cannot qualify for a new loan. Still, the company estimates the interest rate incentivized refinancing potential from these loans for the rest of next year at $530 billion.

They add that there are other refinancing originations that are outside of their calculations - some from loans that are not in 30-year agency securities and others that will be refinanced out of a desire to shorten the mortgage term or take out cash. The estimate also does not include many mortgage products including loans guaranteed by FHA, VA or RHS and loans, such as jumbos, held in portfolio.

Chief Economist Sean Becketti said, "At the current pace, we're likely to see the mortgage market top $2 trillion in originations for the first time since 2012. And unlike in 2012, when the market was driven largely by refinances, today's market is more balanced between home refinances and purchases; nearly 50-50. This is good news for home sales as we're likely to see the best year in home sales in a decade. This is a good sign for the housing market as it continues to be an even brighter spot in the economy.

"However, the housing market still has challenges, which is reflected in our housing starts forecast. Low levels of inventory across many markets will continue to put upward pressure on house prices for the foreseeable future."