The Mortgage Bankers Associations National Delinquency Survey provides another measure of the declining rate of distress in residential mortgages. The second quarter report shows the delinquency rate for mortgages on one-to-four unit properties at the lowest level since the second quarter of 2007, 5.30 percent. This is a drop of 24 basis points (bps) from the first quarter of 2015 and 74 bps from the second quarter of 2014.

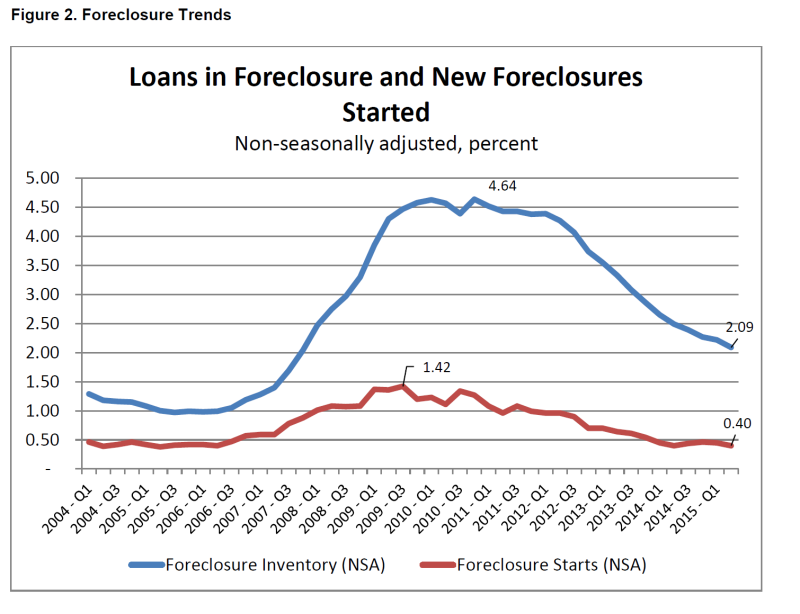

MBA measures delinquency based on loans that are 30 or more days past due but not yet in the foreclosure process. The percentage of loans in foreclosure during the quarter was 2.09, down 13 bps quarter-over-quarter and 40 from a year earlier. This was also the lowest rate since 2007, in this case the fourth quarter of that year.

Serious delinquencies, those more than 90 days past due or in the process of foreclosure, fell 29 bps to 3.95 percent, the lowest rate since the fourth quarter of 2007, and 85 bps compared to the second quarter of 2014.

The foreclosure start rate was 0.40 percent, unchanged from a year earlier but down 5 basis points from the prior quarter.

Marina Walsh, MBA's Vice President of Industry Analysis, said, overall delinquency rates and the percentage of loans in foreclosure continued to fall in the second quarter and are at their lowest levels since 2007. Even more telling, nearly every state in the nation reported declining foreclosure inventory rates over the second quarter, reflecting a nationwide housing market recovery and strong job market that provide opportunities for distressed loans to be resolved rather than be put into foreclosure.

Walsh said that FHA loans can be expected to display volatility as more recent loan originations age and older loans enter the foreclosure process. During the second quarter the overall delinquency rate for FHA loans dropped to 9.01 percent from 9.10 percent due to a decline in the seriously delinquent category. The 30-day and 60-day delinquency rate was up by a combined 10 basis points from the previous quarter and FHA's foreclosure inventory rate rose 4 bps to 2.68 percent, remaining 13 bps lower than a year ago.

Walsh continued, "While only 40 percent of loans serviced are in judicial states, these states account for a growing majority of loans in foreclosure. For states where the judicial process is more frequently used, 3.41 percent of loans serviced were in the foreclosure process, compared to 1.15 percent in non-judicial states. States that utilize both judicial and non-judicial foreclosure processes had a foreclosure inventory rate closer that of the non-judicial states at 1.36 percent.

New Jersey, New York, and Florida continue to have the highest percentage of loans in foreclosure as they have since the fourth quarter of 2012. Although it dropped by 36 basis points from the first quarter, New Jersey's foreclosure inventory rate was still 7.31 percent. New York's rate was 5.31 percent despite a 20 bps quarterly decline. Both states primarily use a judicial foreclosure process. While it was still in third place among the states a 58 bps drop (the largest of any state) took Florida's rate down to 4.24 percent.

"Legacy loans continued to account for the majority of all troubled mortgages," Walsh said. 'Seventy-three percent of the loans that were seriously delinquent, either more than 90 days delinquent or in the foreclosure process were originated before 2008, even as the overall rate of serious delinquencies for those cohorts decreased."