Attitudes about buying and selling a home degraded in July. Fannie Mae said its National Housing Survey (NHS) for the month found a net decrease among respondents of 4 percentage points who thought it was a good time to buy a home and a net decrease of 6 points in those who think it is a good time to sell.

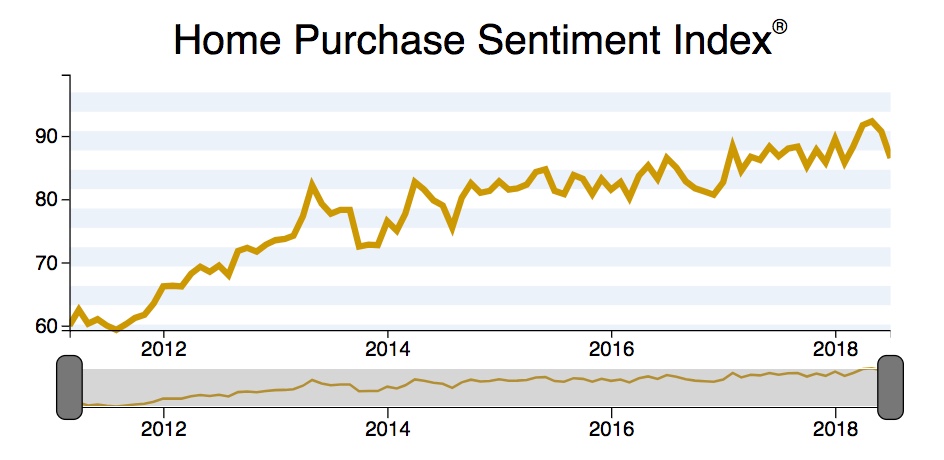

Those two components of the company's Home Purchase Sentiment Index (HPSI) helped pull it lower for the second consecutive month. The Index dropped 4.2 points to 86.5, after reaching survey highs in April and May. Two others of the six components fell as well.

The net responses that it is a good time to sell have trended higher since January of last year and hit a survey high in June, but the 6-point drop last month took the net down to 41 percent. Positive sentiments about buying netted out at 24 percent after the July survey.

Attitudes about housing prices also shifted abruptly. The net share who said that home prices will go up in the next 12 months dropped from 46 percent in June to 39 percent. In January a net of 52 percent were betting on higher prices and Fannie Mae said it was the first time the number had fallen under 40 percent since December 2016.

The fourth component to decline was the respondents' sense of job security. The net share who said they are not concerned about losing their job fell 11 percentage points in July. Overall attitudes remain upbeat however. Eighty-two percent still said they were not concerned about losing their jobs and the net who felt secure was 65 percent.

The two components shoring up the HPSI posted only small gains. The net share of Americans who say mortgage rates will go down over the next 12 months rose 1 percentage point remaining far into negative territory at -52 percent. Those who said their household income is significantly higher than it was 12 months ago gained 2 percentage points to a net of 21 percent, matching the survey high from May of this year.

"Home purchase sentiment seems to have reached a plateau, with potential home sellers likely struggling to find a home to buy amid slow supply growth, expectations for rising mortgage rates, and significant home price increases," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "Survey respondents cite 'high home prices' as the top reason why it is both a good time to sell a home and bad time to buy a home. This suggests a contributing factor to the low supply of existing homes for sale is that current owners are reluctant to trade up in a rising price market. Additionally, the shares of consumers citing favorable mortgage rates as a reason why it's a good time to buy or sell a home both dropped to fresh survey lows."

The Home Purchase Sentiment Index (HPSI) distills information about consumers' home purchase sentiment from six questions asked in Fannie Mae's NHS into a single number. Those questions solicit consumers' evaluations of housing market conditions and address topics that are related to their home purchase decisions.

The NHS is a monthly phone survey of approximately 1,000 households, both home owners and renters, to assess their attitudes toward owning and renting a home, home and rental price changes, homeownership distress, the economy, household finances, and overall consumer confidence. Respondents are asked more than 100 questions used to track attitudinal shifts, six of which are used to construct the HPSI. The survey began in June 2010. The July 2018 National Housing Survey was conducted between July 1, 2018 and July 22, 2018. Most of the data collection occurred during the first two weeks of this period. Interviews were conducted by PSB, in coordination with Fannie Mae.