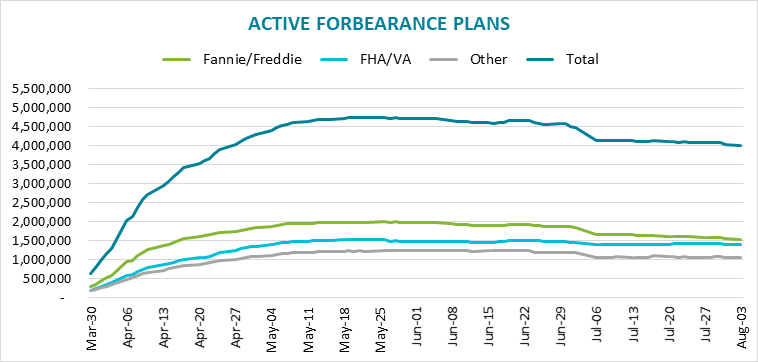

There was a significant decline in the number of active COVID-19 related forbearance plans over the past week, but that decrease did not necessarily mean homeowners were emerging from financial difficulties. Black Knight said its weekly survey found 101,000 fewer loans in forbearance, leaving just over 4 million or 7.5 percent of servicer portfolios in active plans, the smallest share since late April. Those loans represent $852 billion in unpaid principal.

The company says that one reason behind the reduced number was the expiration of initial plans. It estimated that about a half million were set to expire at the end of July. An initial wave of 2.5 million expirations hit at the end of June. More than two-thirds of the plans that remain in forbearance have had their plans expanded, most for another 90 days. This will mean another wave of expirations involving about 2.2 million plans will arrive in September and October.

Loans serviced for the GSEs, Fannie Mae and Freddie Mac, saw the greatest decline, 56,000 fewer loans than the previous week. This left 1.542 million loans remaining. The percentage of the GSE portfolio in plans fell from 5.7 percent to 5.5 percent. FHA/VA loans, which had been bucking the tide, fell for the first time in four weeks, from 1.435 million to 1.402 million loans and from a 11.9 percent share to 11.6 percent. Portfolio-held and private labeled security loans declined more modestly, from 1.072 million or 8.2 percent of total loans to 1.057 million and 8.1 percent.

Black Knight estimates that the GSE loans should generate monthly advances to investors of $1.7 billion in principal and interest (P&I) payments and another $.7 billion in tax and insurance (T&I) payments. Servicer obligations to advance P&I has been capped by Fannie Mae and Freddie Mac at four months. FHA and VA loans have P&I obligations of $1.3 billion and T&I of $.5 billion. Loans serviced for others may require advances of $1.8 billion and $.6 billion, respectively.

The company notes that the current spikes in coronavirus cases around the country and the expiration at the end of July of expanded unemployment benefits represent significant uncertainty for homeowners, servicers, and guarantors for the weeks ahead.