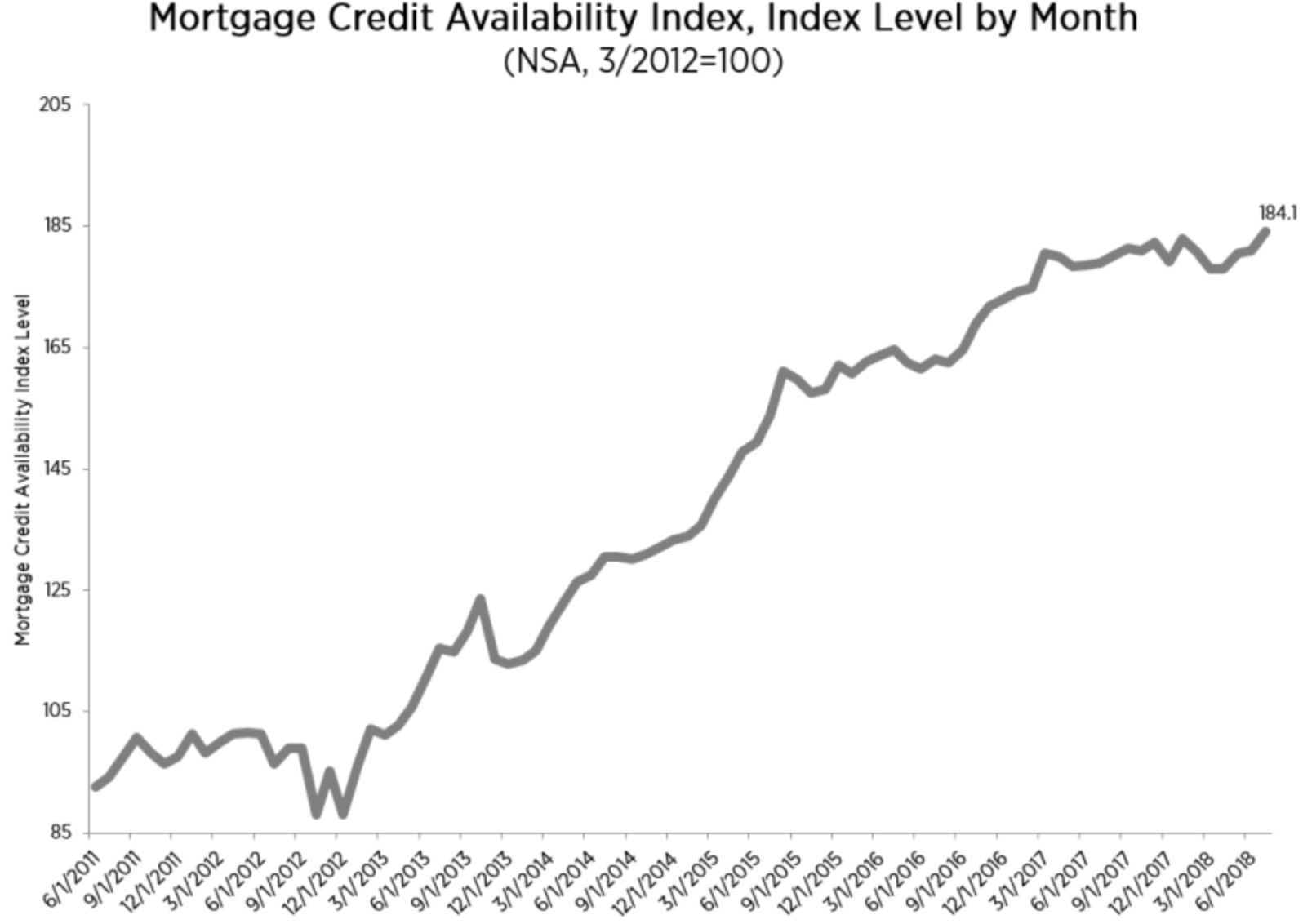

Mortgage credit availability scored a significant gain in July. The Mortgage Bankers Association (MBA) said its Mortgage Credit Availability Index (MCAI) rose 1.7 percent in July to 184.1, apparently the highest level since MBA began publishing it in 2012. An increase in the MCAI indicates that lending standards are easing while a decline is indicative of tightening credit. The index was benchmarked to 100 in March 2012.

"Credit availability continued to expand, driven by an increase in conventional credit supply. More than half of the programs added were for jumbo loans, pushing the jumbo index to its fourth straight increase, and to its highest level since we started collecting these data. There was also continued growth in the conforming non-jumbo space, which reached its highest level since October 2013," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting

The Conventional MCAI increased by 4.2 percent while and the Government MCAI was down 0.4 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 5.8 percent while the Conforming MCAI increased by 2.0 percent.

MBA gathers borrower eligibility data, (credit score, loan type, loan-to-value ratio, etc.) from more than 95 investors and lenders. These are combined with information from AllRegs® to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. The component indices utilize the same computations as the main index but with different benchmarks. The Conventional Index is March 31, 2012=73.5 and the Government MCAI is March 31, 2012=183.5.