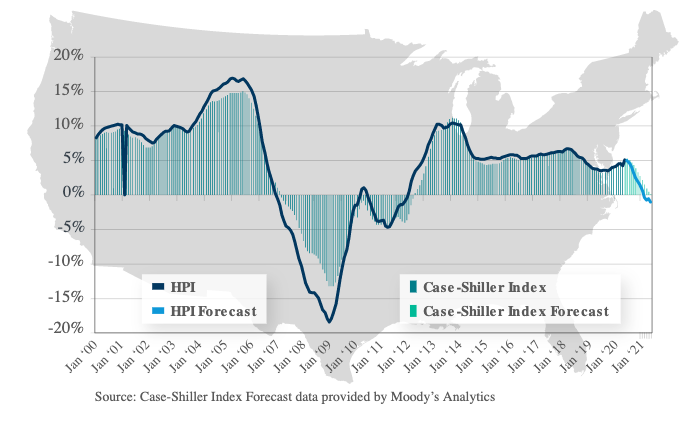

Home prices increased in June at the fastest pace in more than seven years. CoreLogic said its Home Price Index (HPI) rose 1.0 percent from May, the largest month-over-month gain since January 2013. The appreciation from April to May was 0.7 percent. Prices rose year-over-year by 4.9 percent compared to 4.1 percent in May.

"Home price appreciation continues at a torrid pace reflecting fundamental strength in demand drivers and affordability," said Frank Martell, president and CEO of CoreLogic. "As we move forward, we expect these price increases to moderate over the next twelve months. Given the economic outlook, housing remains a bright spot for the foreseeable future."

CoreLogic is still anticipating a COVID-19 induced downturn in prices over the next year, but it has substantially moderated its forecast since last month. In July it predicted that June's HPI would decline 0.1 percent and that prices would drop 6.6 percent by next May. Now, with the June HPI posting a very strong increase the company is anticipating only a 1.0 percent decline in prices over the next year and calls this "A sign of a strong foundation and resiliency in the housing market in the face of the pandemic."

The continued strong home prices, the company says, reflect improved affordability, demographic demands, supply constraints and continued strong interest in purchasing a home. These factors combined to keep home prices steady despite the continued pressure of the pandemic and its related economic fall-out.

There is a lot of local variability both in current home price growth and that which is predicted for the future. Philadelphia saw prices surge by 8.4 percent year-over-over in June, driven by an uptick in New York City residents purchasing homes, likely in an effort to migrate from the coronavirus hotspot. Meanwhile, affordability constraints in San Francisco led to an annual decline in home prices of 0.2 percent.

In markets like Las Vegas, where the local tourism economy and job market continue to suffer due to the pandemic, home prices are expected to decline 11.3 percent over the next year. San Diego, on the other hand, is predicted to have 4.2 percent growth due to a lack of inventory.

The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that metro areas with an elevated resurgence of COVID-19 cases-like Prescott and Lake Havasu, Arizona-are at the greatest risk (above 60 percent) of a decline in home prices over the next 12 months. Other metro areas at high risk include Las Vegas, Nevada; Peoria, Illinois; and Worchester, Massachusetts.