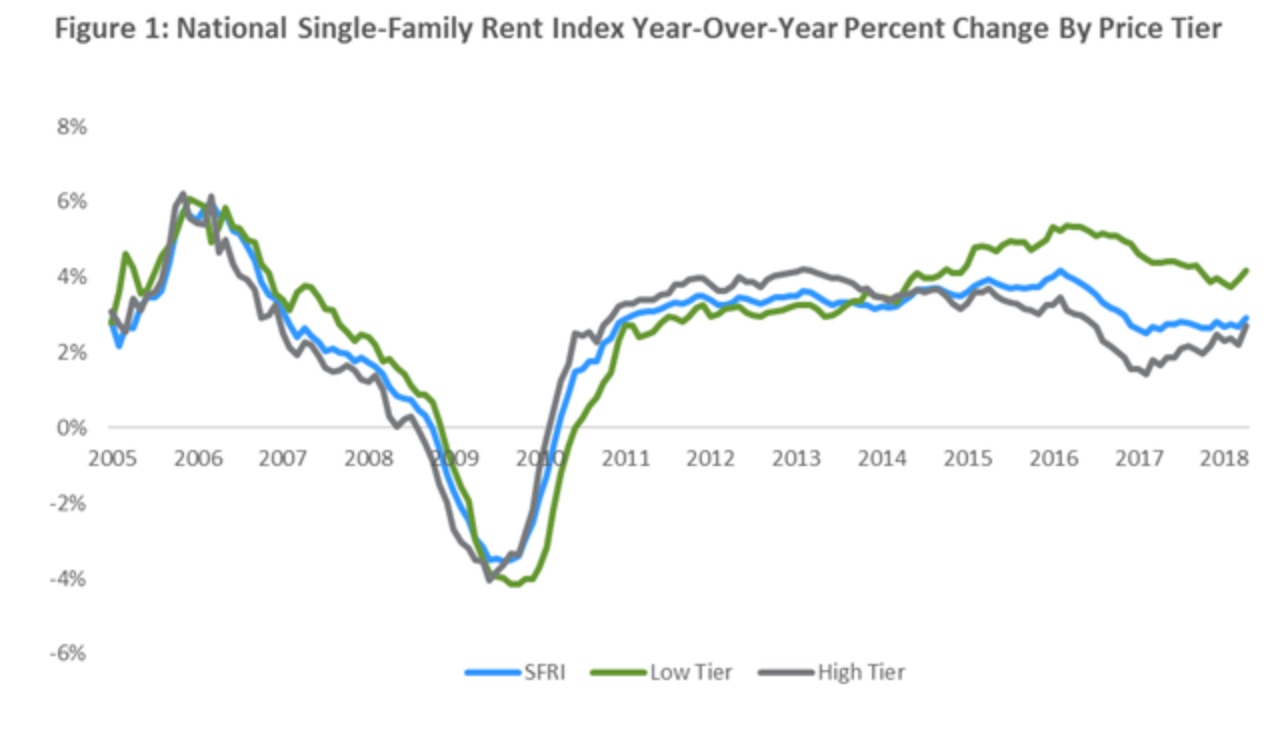

CoreLogic is noting a subtle change in rent growth for single-family houses. Its Single-Family Rental Index (SFRI) has logged a steady increase in those rents since 2010, peaking in February 2016 at a 4.2 percent annual gain. Since then rents have stabilized, with average year-over-year increases of 2.7 percent. The last data released was for April and showed a 2.9 percent annual change. The SFRI measures rent changes among single-family homes and condos, using a repeat-rent analysis to measure the same rental properties over time.

Molly Boesel, writing in the CoreLogic Insights blog, says looking at specific price tiers reveals a more significant change. Since soon after the recovery began, rent increases have been driven by low-end rentals, those properties where rents are 75 percent or less than a region's median rent. Those increased 4.2 percent for the year ended in April, while higher priced home rentals, those with rents more that 125 percent of that median, were up 2.7 percent. But rent growth is now accelerating for the higher priced tier, up 1.1, while the low-end increases are slowing; they were 0.2 percentage points lower this April than the year ended in April 2017.

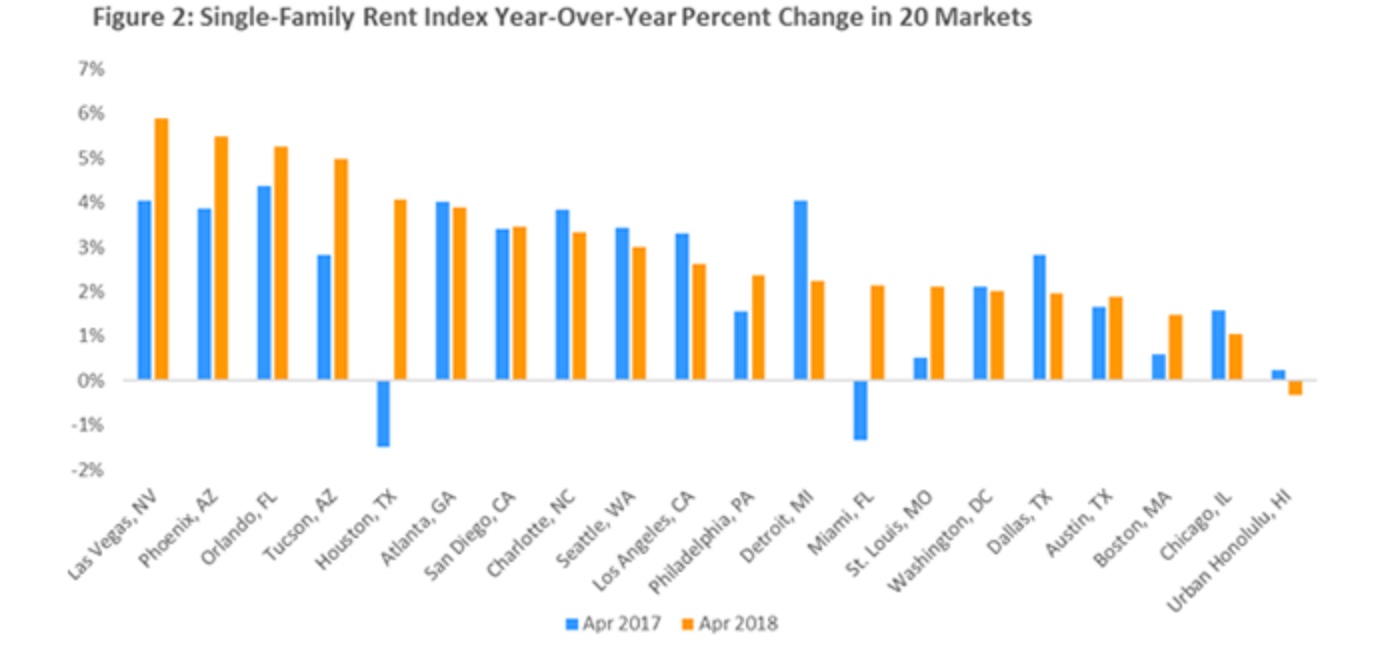

Rent growth remains variable across metro areas. Las Vegas had the highest year-over-year rent growth in April with an increase of 5.9 percent, followed by Phoenix (+5.5 percent) and Orlando (+5.3 percent). Not surprisingly both Phoenix and Orlando are enjoying strong growth in employment as well with job gains of 2.8 percent and 3.2 percent respectively, well above the national rate of 1.6 percent.

A less positive reason than strong employment is driving rents elsewhere such as in Houston and Miami. Both were hit by hurricanes last year and left with tighter rental supplies. Consequently, Houston saw an annual increase of 4.1 percent and Miami rents were up 2.1 percent. Prior to last year's late-summer storm damage rents had been declining in both areas. Honolulu was the only metro among the 20 where the rent index was down, losing 0.3 percent year-over-year.