The mortgage servicing industry, which took a beating in the public mind during the housing crisis, has somewhat rehabilitated its image in recent years. However, a recent survey by J.D. Power indicates the improvements have stalled, and in fact the perception of the servicer brand has declined.

The 2017 U.S. Primary Mortgage Servicer Satisfaction Study shows the downturn is driven primarily by a growing number of customers who perceive their mortgage servicer to be focused more on profit than on their customers. J.D. Power said this could have long-term effects on future business.

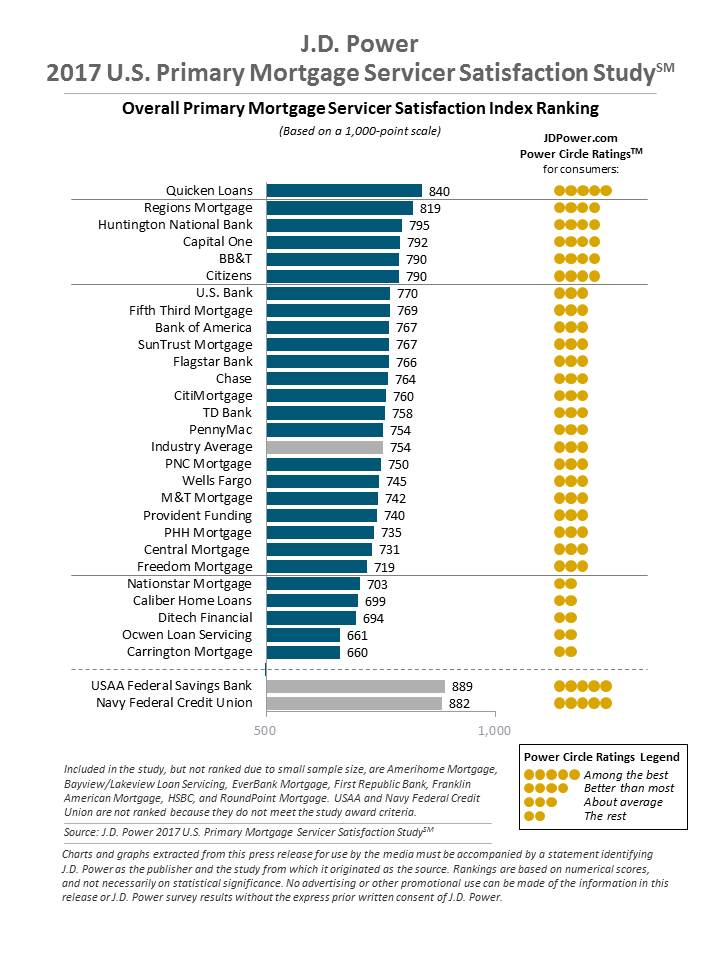

The Study measures customer satisfaction with their mortgage servicing experience in six areas; new customer orientation; billing and payment process; escrow account administration; interaction; mortgage fees; and communications. Satisfaction is calculated on a 1,000-point scale.

J.D. Powers ranked the largest servicers by their customers' satisfaction level. Quicken Loans was on top for the fourth straight year, scoring 840. It was followed by Regions Mortgage and Huntington National bank, which scored 819 and 795 respectively.

The study found notable improvement year-over-year by Bank of American, Nationstar Mortgage, and Ditech Financial. Those firms as respective increases of 26, 29, and 37 points respectively.

The company highlighted some key findings from their study:

- Onboarding as an opportunity: The first step in the consumer's experience is the effective onboarding of his or her loan. When that is done well, it leads to a greater likelihood the customer will use the servicer's website as their primary communications channel and submit payment via the web. They are less likely to have used a call center, experienced a problem, or paid their bill via check.

- Time is money: Ten percent of all mortgage customers say their time was wasted during their most recent interaction with their mortgage servicer. Of those, 66 percent say they waited five minutes or more to speak with a customer service representative. Overall satisfaction drops 285 points when customers believe their time is being wasted.

- Digital becomes key to effective customer contact: The average satisfaction among those who do not use the website is 43 points below those who visited it in the previous 12 months. A customer who visited three or more times in that period scored a satisfaction level of 789 points; the industry average was 754.

- Mobile satisfaction grows, but usage still lags: Mobile usage is associated with significantly higher satisfaction, compared with those who don't use this channel (786 vs. 748, respectively). However, customers who used mobile fell from 22 percent in 2016 to 19 percent this year.

"The past few years have not been easy for mortgage servicers as they've struggled with regulatory and market pressures, but still managed to deliver on customer satisfaction. Now, as that trend starts to shift and customer satisfaction levels off, it is critical that mortgage servicers continue to balance the demands of this tough marketplace with the needs of their customers," Craig Martin, senior director, mortgage practice at J.D. Power said. "Based on our research, mortgage servicers have three very clear areas of opportunity to help drive success: effective onboarding, high-functioning self-service tools and call center best practices that optimize customer contact in step with changing customer demographics and needs."

The 2017 U.S. Primary Mortgage Servicing Satisfaction Study is based on responses from 7,374 mortgage servicing customers, and was fielded in March-April 2017.