While home sales are sailing, recently closing in on numbers last seen before the Great Recession, CoreLogic Senior Economist Frank Nothaft, points out that one group of buyers is sitting on the sidelines. Foreign buyers have substantially diminished in market share.

While home sales during the first four months of 2015 were 9 percent higher than a year earlier, the National Association of Realtors® (NAR) says the portion of those buyers self-identified as foreign dropped 19 percent. These buyers are not a huge sector - the decline took the market share from 2.5 percent to 2.0 percent, but they are important in some cities.

The decline has occurred even as interest rates dropped, down about a half percent from the same period in 2014, and NAR says its agents report it is apparently the result of the strong American dollar. About three-quarters of agents who work with international clients report that foreign exchange rates have had a significant impact on housing purchases.

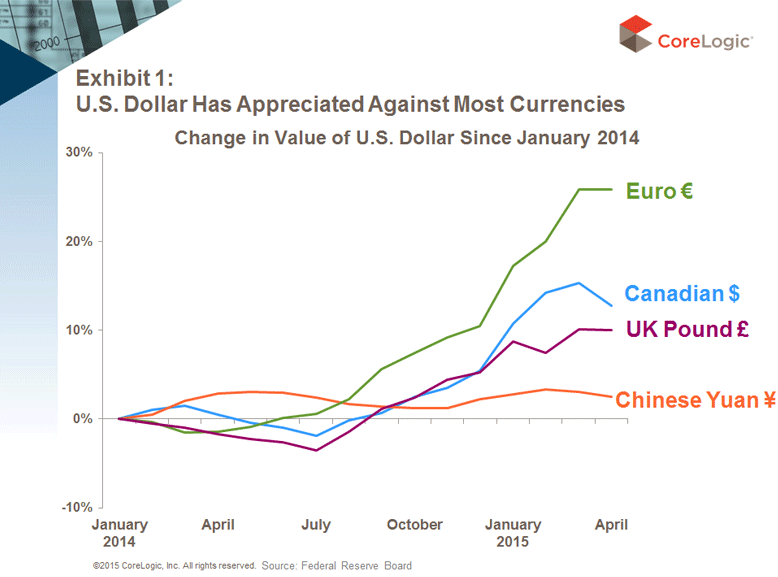

Of course when the dollar strengthens relative to other currencies that money, Japanese yen. Chinese yuan, the euro, buy less in this country while the dollar buys more in those countries. As exhibit 1 shows, from the beginning of 2014 through April 2015 the dollar gained 10 percent relative to the United Kingdom pound and 13 percent on the Canadian dollar. The euro has been particularly affected, losing 26 percent in buying strength, most of it since the beginning of this year when the financial situation in Greece became more critical. The yuan and the Hong Kong dollar have better held their value over that period.

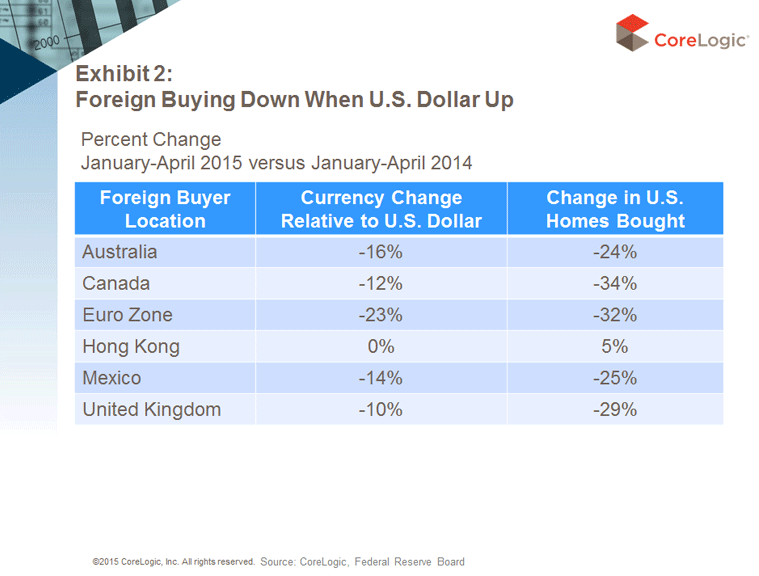

As Exhibit 2 shows, those countries where currencies have depreciated the most have been those whose citizens have most pulled back from buying properties in the U.S.; down between one-quarter to one third during the period in selected locations. Buyers from the aforementioned Hong Kong have increased their market share.

Nothaft says the sticker shock caused by the stronger dollars is further aggravated by strong price appreciation in those U.S. markets that tend to attract foreign buyers such as the Southeast coast. Many Canadians, Europeans and South Americans gravitate to that area for the beaches, cultural amenities, warm winter temperatures and accessibility. Canadians made roughly two-thirds of their U.S. home purchases during the first four months of both 2014 and 2015 in Florida, nearly half of them in the Miami-Fort Lauderdale-Palm Beach area. Prices there rose about 7 to 8 percent from April 2014 to April 2015. Coupled with the effect of a stronger dollar the average Canadian considering a home purchase in south Florida saw a jump in purchase cost of 20 to 25 percent in the past year.

Of course currencies fluctuate on a nearly daily basis and Nothaft points out that foreign buying could continue to decline, level off or increase in 2016 depending on the relative value of the dollar against the various currencies. He adds, "The uncertainties surrounding how the Eurozone will resolve the debt crisis in Greece has made it more difficult to project foreign currency movements."