Oh those Baby Boomers. Even as they age they don't retire, at least not from the public stage. This week those over age 55 were the subject of Freddie Mac's Insight report.

Freddie Mac Chief Economist Sean Becketti says the conventional wisdom is that Boomers, those born from the time World War II ended through 1964, are like Peter Pan, they refuse to grow older, not retiring but launching instead second and third careers, shunning senior centered communities in favor of aging in place or moving into center cities. "It seems like," he says, "you have to be a lot older these days to be a senior citizen."

Thus, he says, Boomers remain important. When it comes to housing those over age 55 make up a quarter of the population but control roughly two-thirds of single-family home equity. Despite the dip in home prices starting ten years ago, today's 65-year old who bought an average house 35 years ago has seen the home increase in value 3.7 times. If that homeowner refinanced a reasonable number of times and took advantage of the homeowner tax deduction "the rate of return on this investment is hard to beat."

Becketti says the size of the generation and their housing wealth means their decisions will continue to play an outsized role in shaping the housing opportunities for the two generations, Gen X and the Millennials, that follow and their influence could last a long time. Today's 65-year-old can expect to live to 84 and in those remaining years some may buy and sell several more homes.

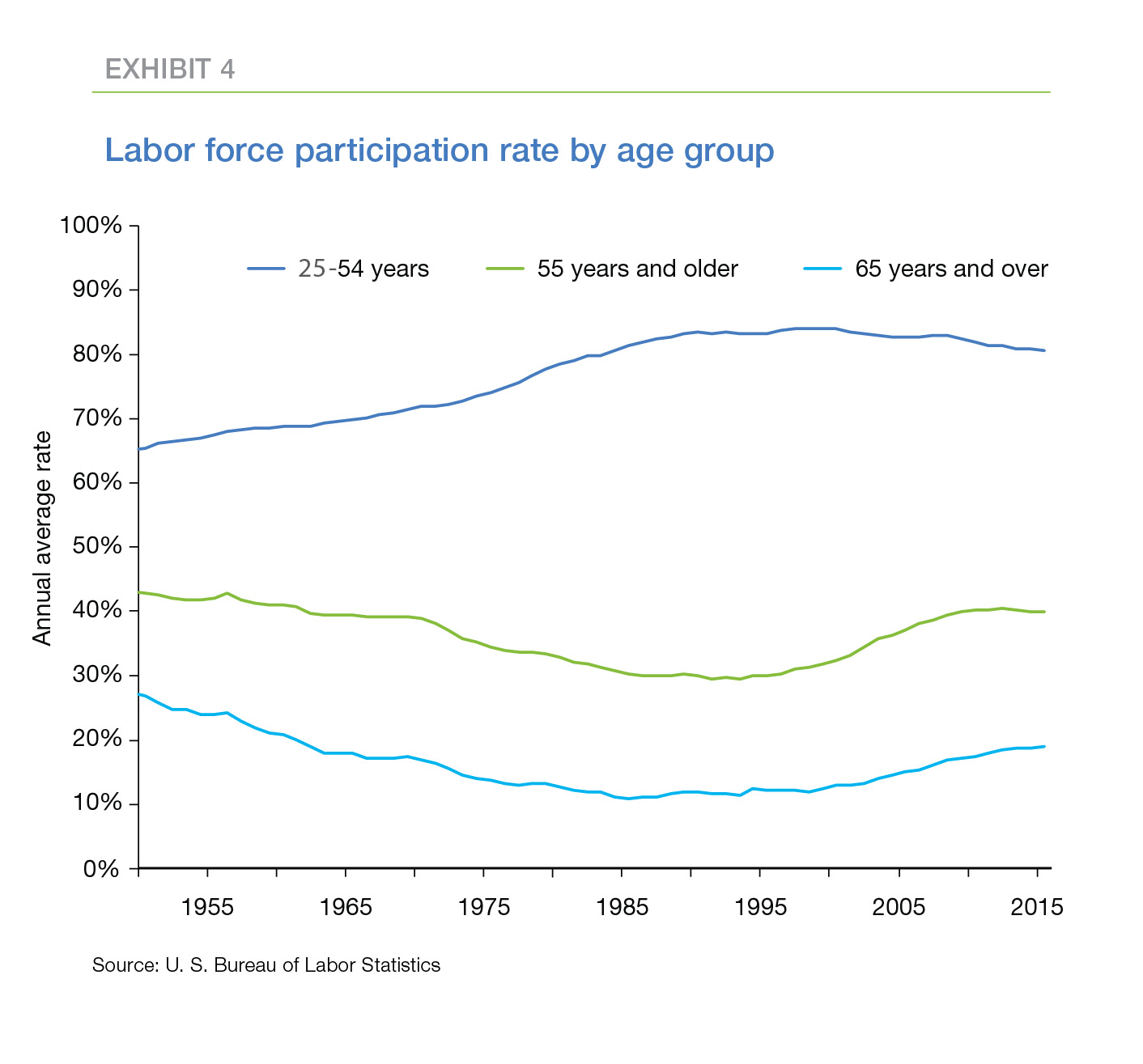

The generation looks quite different from those that follow it. Those over age 55 are more likely to have married than their younger or older cohorts; all but 8 percent have wed at some point - and considerably less diverse than the generations that follow - 75 percent are white non-Hispanic compared to 57 percent of those under 55, and are staying in the labor force longer than those who preceded them, both because they are staying healthy longer and because they need more money to support their longer life expectancy.

In order to anticipate the influence of this older population vis-à-vis housing, and Becketti says, to separate facts from some of the myths about them, earlier this year Freddie Mac commissioned a survey of their attitudes towards their current and future housing options. Survey respondents were homeowners, potential homeowners, and a representative share of renters.

One opinion about older homeowners proved true. Two-thirds of homeowners in the survey said they want to age in place; preferably in their current residence. The majority express satisfaction with both their communities and their homes.

However, the survey also found that nearly a quarter of respondents realized that they may need major renovations to stay in the current house and many may face financial problems in doing those retrofits. Becketti notes that other studies have indicated that respondents may also underestimate the extent and financial costs of needed changes. Among those who anticipate major renovations, almost half expressed concerns about their ability to afford them.

Aging in place doesn't necessarily mean staying put. Many homeowners, including some from the even older Silent Generation, say they plan to move again and almost three-quarters of those say they will buy rather than rent. That suggests roughly 18 million homeowners over age 55 may be shopping for another house in the next few years. Surprisingly, a desire to downsize doesn't play a major role in that decision. Affordability of the community, the need for retirement amenities, and less maintenance lead the reasons for moving; downsizing is only number eight.

The survey found that respondents for the most part felt financially secure. Over three quarters of homeowners were at least somewhat confident they could fund a comfortable retirement. However only half of renters shared this conviction. Even among homeowners the perspective on an affordable retirement splits between those still working and those already retired. One fifth of working homeowners are very confident they will be financial comfortable in retirement while over a third of those who are already retired strongly agree they are financially secure. Confidence among both groups increases with income

While older Americans are frequently advised to pay off their mortgages, Becketti says they don't appear to be listening. More than a third of homeowners responding to the survey still have a mortgage and a majority of those have ten years remaining on the term.

Other survey findings:

- Only 15 percent of respondents have an adult child living in their home and only 4 percent thought it was very likely that a child would move in with them in the next 5 years. Only 1 percent thought a parent would do so.

- Very few respondents have provided (22 percent) or expect to provide down payment assistance to a child. Twenty percent said they had received such assistance from their own parents. Fifteen percent indicated that they are not willing to provide such assistance although they are financial able to do so. Becketti called the relatively low level of parental assistance one of the surprises of the survey.

The author concludes "In the conventional wisdom on the housing life cycle, the Millennials should be providing a surge in first-time homebuyers, while older generations should be moving to the next stage of their housing life: Gen Xers should be trading up from a starter home to a larger home. Baby Boomers should be selling their homes to Gen Xers and downsizing, renting, or moving to an age-specific community. And the Silent Generation should be thinking about moving to assisted living or moving in with adult children.

"With the possible exception of Gen X, people are ignoring the conventional wisdom. Millennials are taking longer to marry, start families, and buy their first homes. And the 55+ population are working longer, aging in place, or buying an additional home (or two) rather than winding down. Furthermore, they expect to be an active part of our housing economy for quite a while longer."