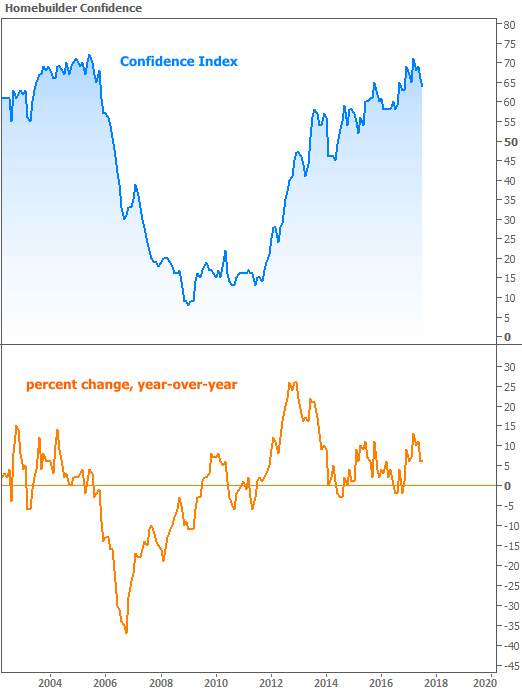

Home builder confidence continues backing down from its post-crisis peak earlier this year, although the National Association of Realtors (NAHB) calls results of its July survey "solid." The NAHB/Wells Fargo Housing Market Index (HMI) dropped 2 points to 64, its lowest reading since last November. The June composite index was also revised down, from an original reading of 67. NAHB attributes the slippage to concerns over the costs of construction.

"Our members are telling us they are growing increasingly concerned over rising material prices, particularly lumber," said NAHB Chairman Granger MacDonald. "This is hurting housing affordability even as consumer interest in the new-home market remains strong."

"The HMI measure of current sales conditions has been at 70 or higher for eight straight months, indicating strong demand for new homes," said NAHB Chief Economist Robert Dietz. "However, builders will need to manage some increasing supply-side costs to keep home prices competitive."

Analysts had expected the index to increase to 68. The actual results were at the bottom end of the 64 to 69 range of estimates.

The HMI is constructed from responses to a survey NAHB has conducted for more than 30 years among its new-home builder members. They are asked to provide their perceptions of current single-family home sales and sales expectations for the next six months as "good," "fair" or "poor." The survey also asks builders to rate traffic of prospective buyers as "high to very high," "average" or "low to very low." Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components registered losses in July. The current sales condition component and the index charting sales expectations for the next six months each fell 2 points to 70 and 73 respectively. Meanwhile, the component measuring buyer traffic slipped one point to 48.

Indices for three of the four regions also lost ground. The three-month moving average in the Northeast rose 1 point to 47 while the West and Midwest each edged 1 point lower to 75 and 66, respectively. The South dropped 3 points to 67.