A set of special questions on a Q1 National Housing Survey asked consumers, who were also recent homebuyers, about their experiences obtaining a mortgage during the pandemic. Fannie Mae was a little surprised by some of the results.

Tim McCallum and Jenney Shen, vice president's for customer management solutions in the company's Single-Family Division, wrote about those results in Fannie Mae's Perspectives blog. They said that the questions specifically asked about mortgage satisfaction and whether the pandemic had encouraged homebuyers to use on-line mortgage resources. "We wanted to better understand how the pandemic may have changed the digital behavior of consumers seeking a mortgage, as it did in many other industries," they said.

They found that consumers were generally satisfied by their mortgage experience even as lenders' staff were working remotely and handling record-high origination volumes. Eighty-eight percent of recent homebuyers said they were satisfied, unchanged from those surveyed a year earlier. The authors say these findings align with Fannie Mae's Q1 2021 Mortgage Lender Sentiment Survey in which 78 percent of lenders said the consumer mortgage experience had improved or remained the same during the pandemic.

Recent homebuyers (those who bought between May 1 and December 1, 2020) were slightly more satisfied with traditional banks (90 percent) and credit unions (93 percent) than mortgage banks (85 percent). Additionally, when segmented by size, small and mid-sized lenders had significantly more "very satisfied" consumers compared to larger lending institutions.

To the company's surprise, however, the survey revealed indicated only a slight increase in on-line use compared to a survey conducted in 2018. The authors say there were differences among consumer segments, but the results indicate that a "one size fits all" approach may not meet the needs of all consumer groups.

Fannie Mae had assumed that the COVID-19 crisis would push many consumers to conduct all mortgage tasks on line, but the percentage doing so only increased from 7 percent the previous year to 12 percent. Most homebuyers said they wanted the ability to speak with a mortgage professional throughout the process. The authors say that a mortgage is a big expense and obtaining one is somewhat complicated, so an unwillingness to abandon in-person discussions makes sense.

They also found that first-time homebuyers were more willing to authorize electronic access to their records than were repeat homebuyers (41 percent and 33 percent, respectively). This could indicate a future shift in digital usage as younger consumers, who are more accustomed to allowing digital apps and online company access to information, buy more homes.

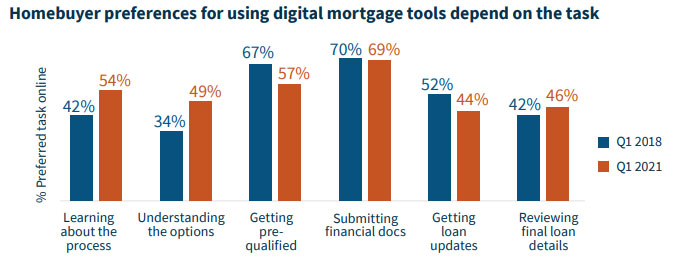

Among those who did use digital channels, 57 percent said the pandemic did not influence their doing so while 38 percent said it had some influence on their decision. Those tasks for which digital use did increase from 2018 were those of an informational nature and occurred early, such as learning about the process and about mortgage options, but some later (and perhaps more complex) tasks, including pre-qualification or getting updates about their loan, were used less. Overall, online preference continued to hover around 50 percent or lower for most tasks, except submitting financial documents, which was nearly 70 percent. The authors said this was further confirmation of borrowers' desire for continued in-person help and support throughout the process.

Levels of digital use also differed by race and income levels. Of the 2020 homebuyers surveyed, higher-income, Asian, and Black respondents showed a stronger preference for online usage, while lower-income and Hispanic consumers were more likely to conduct tasks in person or by phone. Again, this weighs against the "one size" approach and indicates businesses and lenders should be sensitive to the diverse needs of individuals and groups.

The shift to digital continues to be a gradual process, with certain segments showing different online servicing/in-person needs, the authors say. Since buying a home is an infrequent and complicated expense, shifting to online-only channels appears to be an imperfect solution for many borrowers who have questions and want to make the right choices. Such a large expense item may also require a higher level of service for some consumers than they may expect for their everyday online purchases.

McCallum and Shen write that Fannie Mae will continue to monitor consumer preferences as demographics shift and more younger consumers move into homebuying to see if online preferences increase or plateau. They conclude that, "The industry may need to think about ways to further streamline and uncomplicate the process for consumers, as well as make costs, rates, and information more transparent, so that consumers feel comfortable with a fully online mortgage experience."