This month's Mortgage Monitor Report from Black Knight, Inc. is again about equity, but this time with a twist regarding the way homeowners are treating it. The company says that the tappable equity held by homeowners increased by $820 billion dollars over the 12 months that ended in March, $380 billion in the first quarter of 2018 alone. Those numbers equate to 16.5 percent growth year-over-year, and 7 percent for the quarter.

Equity growth is generally highest in the first and second quarters of the year, but the first quarter growth this year was up 30 percent from the same quarter in 2017. It was the highest single-quarter increase recorded by Black Knight since it began keeping records in 2005.

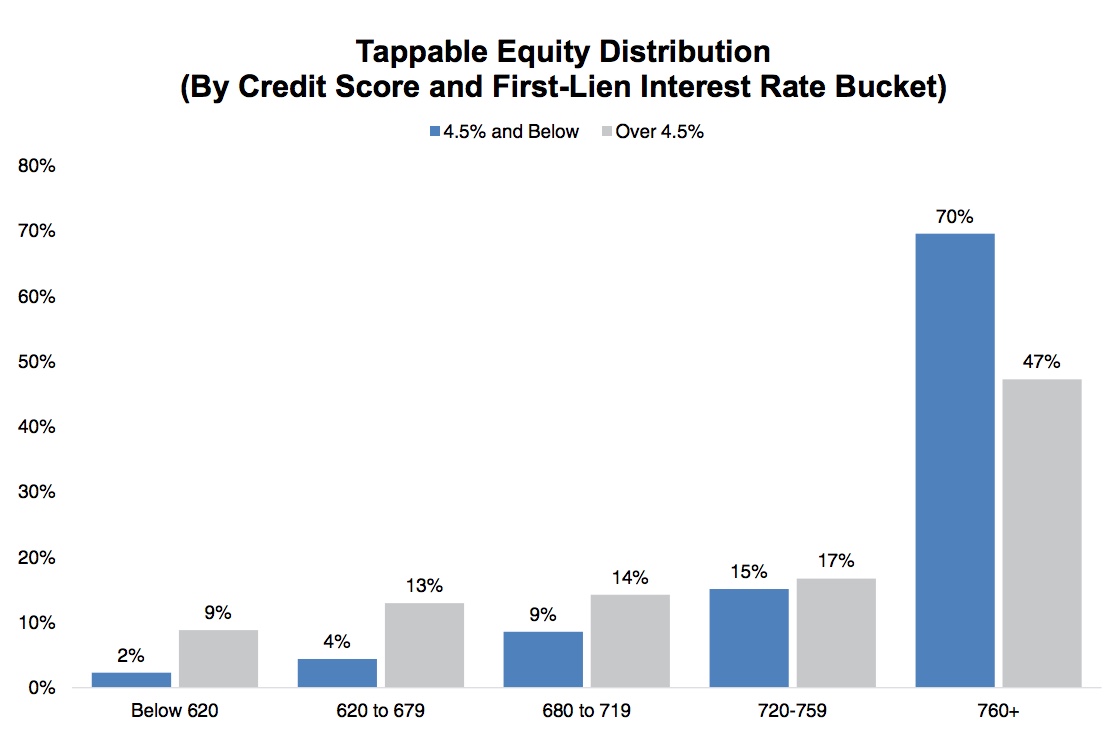

Tappable equity is the share of equity that a homeowner can borrow before reaching a maximum combined loan-to-value (CLTV) ratio of 80 percent. That equity now totals $5.8 trillion nationwide, the highest volume every recorded and 16 percent higher than at the mid-2006 peak. The majority - nearly 80 percent - of the tappable equity nationwide is held by borrowers with mortgage rates under the current prevailing rates of around 4.5 percent and 60 percent have rates under 4 percent. The average mortgage holder gained $14,700 in tappable equity over the past year and has $113,900 in total available equity to borrow against.

Current CLTVs average 52 percent, the lowest ever recorded by Black Knight. This means that about 70 percent of the growth in home prices, 2.5 percent in the first quarter or about $6,900 for a median-priced home, becomes immediately available to be tapped under an 80 percent CLTV limit, another post-recession high.

Black Knight says homeowners sitting on large amounts of tappable equity and with now-enviable first mortgage loan rates should be a prime audience for home equity lines of credit (HELOC) loans. And lenders presumably would love them have them. They are a relatively low-risk group, 70 percent of equity holders with low interest mortgages have credit scores above 760. Yet, these homeowners are not biting.

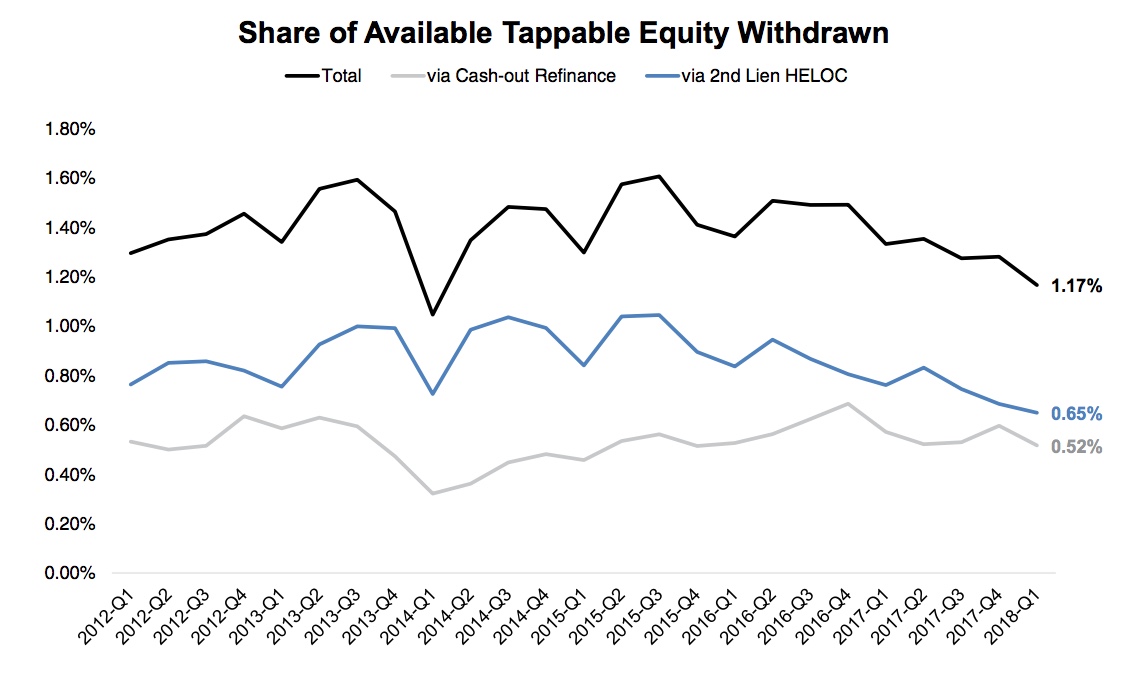

Homeowners with first mortgages withdrew $63 billion in equity via either HELOCS or cash-out refinances in the first quarter of the year, a 7 percent decline from the previous quarter. The company notes that the first quarter is generally the year's low point for cash-out lending, so the decline itself is not surprising. Yet there was only a 1 percent increase from the first quarter of 2017, despite the more than 16 percent increase in the available pool of equity over the same period. Of the $5.4 trillion in that pool at the beginning of the quarter, borrowers tapped a total of 1.17 percent; the second lowest level of borrowing since the recovery began. And even though rising interest rates normally favor HELOC borrowing, the volume of equity withdrawn this way dropped 1 percent year-over-year, to a two-year low while cash-out withdrawals are up 5 percent. HELOCs accounted for 56 percent of equity withdrawn during the quarter.

Black Knight says the new tax law may have had a small impact on HELOC lending. It limits interest rate deductions in some cases, but it is not the primary driver of the subpar HELOC performance. The share of equity drawn down by these loans has been on the decline for three years even as the cash-out share of withdrawals has remained steady. Another factor may be interest rate shock as happened with the "taper tantrum" in 2014 when interest rates rose a point in under a year and equity withdrawal dropped sharply.

The primary driver, according to Ben Graboske, executive vice president of Black Knight's Data & Analytics division, is the increasing spread between first-lien mortgage interest rates - which are tied most closely to 10-year Treasury yields - and those of HELOCs - which respond to the federal funds rate. "As of late last year, the difference between a HELOC rate and a first-lien rate had widened to 1.5 percent, the widest spread we've seen since we began comparing the two rates 10 years ago. The distance between the two has closed somewhat in Q2 as 30-year mortgage rates have been on the rise, which does suggest the market remains ripe for relatively low-risk HELOC lending expansion. Still, increasing costs in the form of higher interest rates do appear to have impacted homeowners' borrowing decisions in Q1 2018. We should also remember that the Federal Reserve raised its target interest rate again at its June meeting, which will likely further increase the standard interest rate on HELOCs in Q3 2018. Black Knight will continue to monitor the situation moving forward."

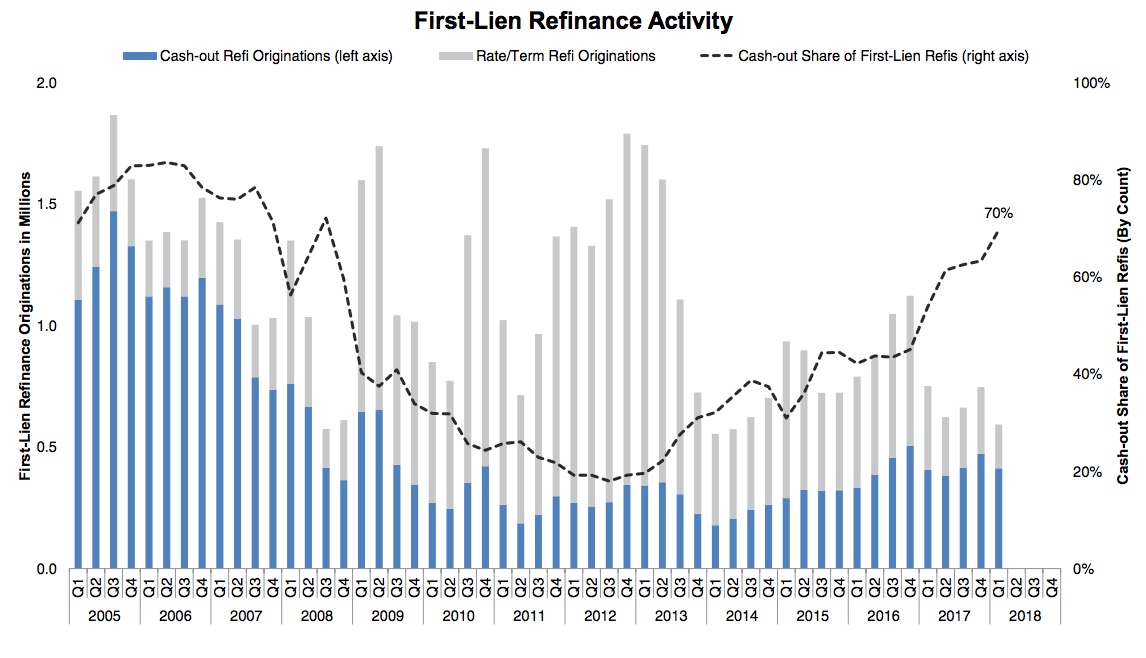

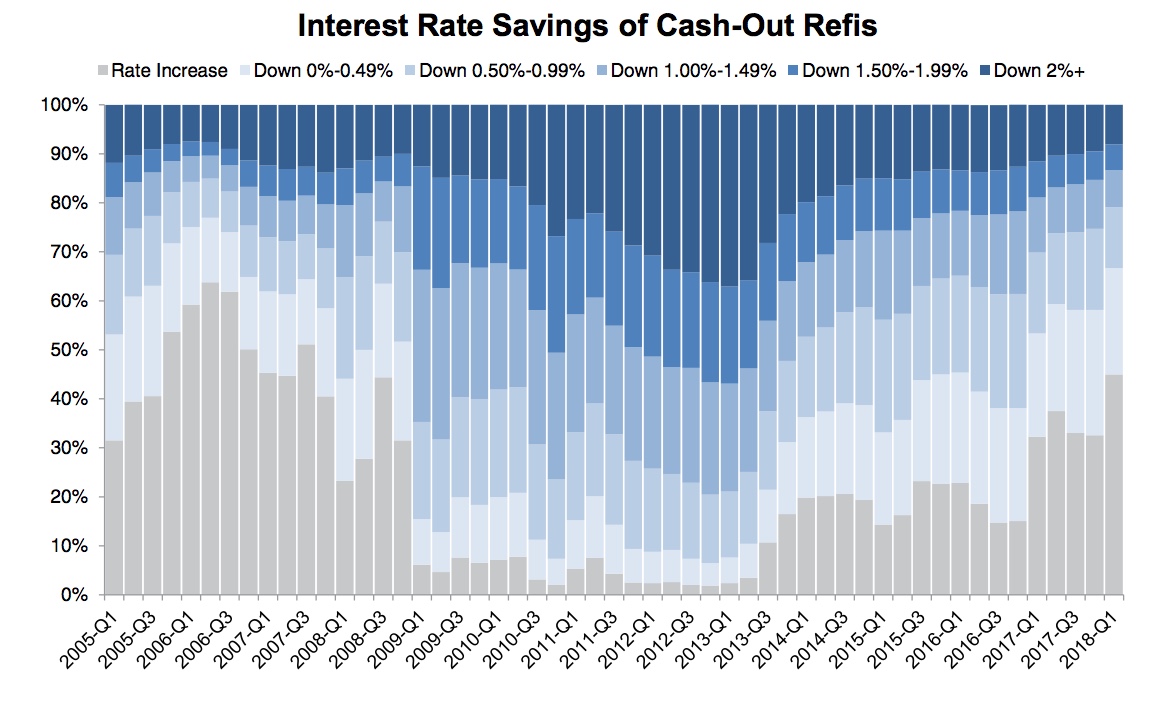

Turning to refinances, the Monitor notes that their number in the first quarter was down 21 percent from both the fourth quarter of 2017 and that entire year. However, there was a notable difference in behavior and volume of rate/term refinances and those featuring a cash-out component. The former fell 34 percent quarter-over-quarter and 48 percent on an annual basis, while cash-out versions were down 13 percent for the quarter and rose slightly compared with Q1 2017. Cash-out refis made up 70 percent of all refinances in the first quarter and accounted for 74 percent in March, the highest monthly share in nearly 10 years, but falling short of the 84 percent recorded in 2006.

Forty-five percent, about 186,000, of those who took a cash-out refinance in the first quarter had to increase their interest rate, taking an average hit of 70 basis points. They also tended to withdraw the largest amount of money. Of those who did see a rate reduction, it averaged 21 basis points, the lowest savings since 2007.

Black Knight concludes that, as short-term rates continue to rise, it appears as though traditional HELOC candidates may be opting for cash-out refinances instead. If this is the case, a counter-intuitive picture emerges. "Federal funds rate increases may actually be buoying the refinance market."