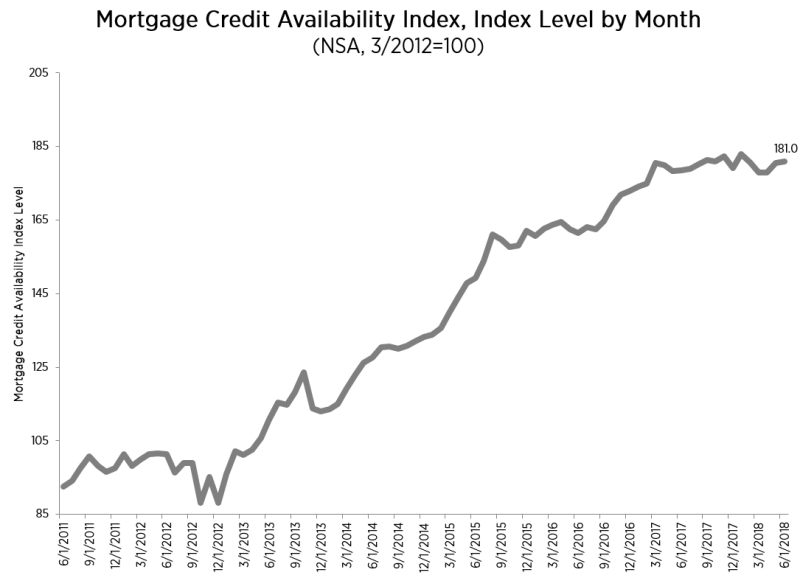

The Mortgage Bankers Association attributed an increase in its Mortgage Credit Availability Index (MCAI) last month to increased competition among lenders for the jumbo prime mortgage market. MBA said its index increased 0.2 percent in June to 181.0. An increase in the Index indicates that credit standards are loosening.

Due to competition which MBA's Chief Economist and Senior Vice President Mike Fratantoni categorized as "fierce," the Jumbo MCAI rose 9.3 percent from May to June and is now over 300. The Index was benchmarked to 100 in March 2012. The increase in that index component was offset by a decline in the Government MCAI which was down 3.9 percent. Fratantoni attributed recent tightening in government lending, which put that index, at its lowest point since the summer of 2016, to policy actions by the VA. The agency has been seeking to reduce churning in its Interest Rate Reduction Refinance Loan program. It said actions by some lenders to push borrowers into multiple transactions was stripping them of equity and contributing to poor loan performance.

The Conventional MCAI increased by 5.5 percent, largely because of its jumbo component. The second component, the Conforming MCAI, rose 1.0 percent.