The national delinquency rate declined by another 0.7 percent on an annual basis in April. Mortgage loans that were 30 or more days past due, including those in foreclosure, accounted for 3.6 percent of all outstanding mortgages.

The overall delinquency rate, according to CoreLogic's April Loan Performance Report, is now at about a 20-year low. The early delinquency rate, loans 30 to 59 days past due ticked down to 1.7 percent from 1.8 percent a year earlier but the 60-89 and 90-119-day delinquency buckets have shrunk to the point there is little room for improvement. Those rates were unchanged at 0.6 and 0.3 percent respectively. The serious delinquency rate fell to 1.0 percent from 1.6 percent and the foreclosure inventory, those loans in process of foreclosure, was at 0.5 percent of outstanding mortgages compared to 0.4 percent the prior April.

CoreLogic President and CEO Frank Martell said, "The U.S. has experienced 16 consecutive months of falling overall delinquency rates, but it has not been a steady decline across all areas of the country. Recent flooding in the Midwest could elevate delinquency rates in hard-hit areas, similar to what we see after a hurricane."

The delinquency rate was down in every state and in most metropolitan areas, while 27 were unchanged. Where the rates increased, as serious delinquencies did in 10 metro areas, it was usually due to natural disasters. Hurricanes Michael and Florence which made landfall in the late summer of 2018 account for an annual increase of 1.4 percent in the delinquency rate in Panama City, Florida, an increase of 0.6 percent in Albany, Georgia, and 0.5 percent Jacksonville, North Carolina. As noted by Frank Nothaft, CoreLogic's chief economist, the rate was also up in Northern California where the deadly Camp Fire devastated communities in 2018.

Nothaft noted that the 50-year low unemployment rate along with rising home prices and responsible underwriting has driven the overall national delinquency rate to the lowest in more than 20 years. "However, a number of metros that suffered a natural disaster or economic decline contradict this national trend. For example, in the wake of the 2018 California Camp Fire, the serious delinquency rate in the Chico, California, metro area this April was 21% higher than one year ago."

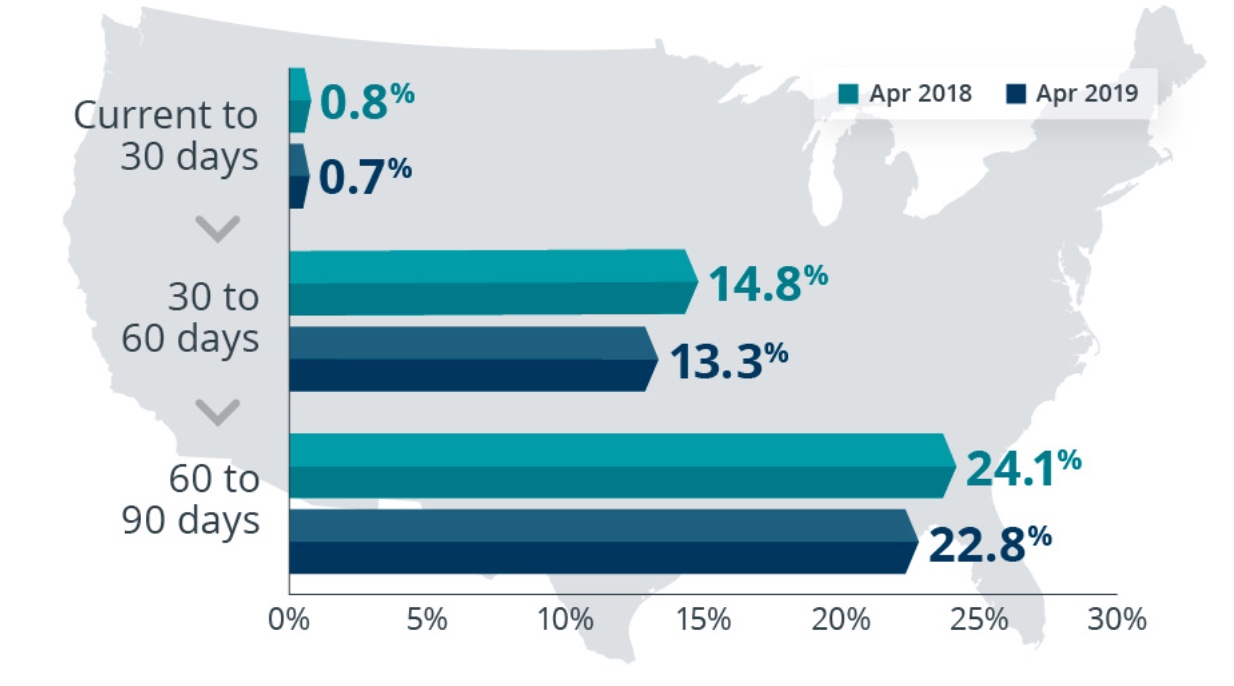

In addition to tracking the various stages of delinquency, CoreLogic also examines the transition rates as past due loans move from one bucket to another. The 30-plus delinquency rate is the most comprehensive measure of mortgage performance and the share of mortgages that transitioned from current to 30-days past due was 0.7% in April 2019, down from 0.8% in April 2018. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2% and peaked in November 2008 at 2. Transition rates between other stages was also lower than in 2018.