Did the housing happy talk just get a little less so?

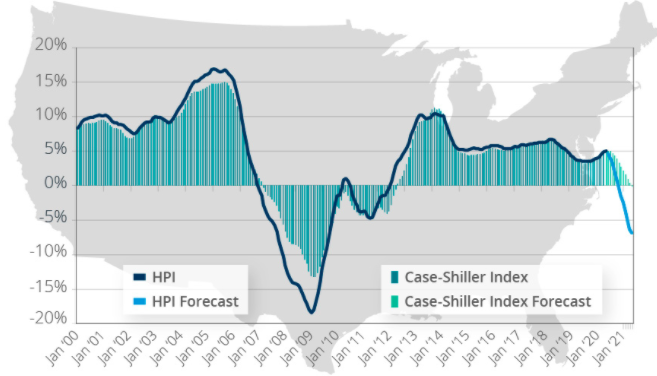

CoreLogic's Housing Price Index Forecast (HPI) over the May 2020 to May 2021 window is seeing more rapid price deceleration in the face of the COVID-19 situation than did their previous 12-month forecast that ended in April of next year.

In its report last month CoreLogic said it expected that "the housing market may be equipped to lead the broader economy through the recovery" but that home prices increases would slow and that the gain from April to May would be only 0.3 percent. They went on to predict that 2021 would bring the first decline in nine years, and by April 2021 the national price gain would turn negative, down 1.3 percent.

Today the company says that pent-up demand and tightening supply continued to prop up home prices in May even as the number of coronavirus cases and levels of unemployment soared. However, the downturn is expected to be reflected in the June data and will continue throughout the summer as unemployment persists and dampens buying. CoreLogic now anticipates that home prices fell 0.1 percent in June and forecasts the decline to reach 6.6 percent by May 2021.

Unlike the Great Recession, the current economic downturn is not driven by the housing market, which continues to post gains in many parts of the country. While activity up until now suggests the housing market will eventually bounce back, the forecasted decline in home prices will largely be due to elevated unemployment rates. Those rates are expected to remain in the double digits throughout the end of the year and may be exacerbated by the recent spike in COVID-19 cases.

However, that decline isn't here quite yet. There was a 4.8 percent increase in the HPI on a year-over-year basis in May and the monthly increase was even better than expected at 0.7 percent.

"Home-purchase activity, bolstered by record-low interest rates, continues to exceed expectations despite the severe recession," said Frank Martell, president, and CEO of CoreLogic. "Pent-up buyer demand was delayed from spring to summer and is reflected in the latest price data. But with elevated unemployment, purchase activity and home prices could fall off after summer."

The price decline is expected to be widespread. CoreLogic's Market Risk Indicator predicts 125 metro areas have at least a 75 percent probability of price decline by May 2021 and prices are expected to retreat in every state. In overvalued markets like Las Vegas, where the local tourism economy took a hit due to COVID-19, home prices are expected to drop by 20.1 percent by May 2021. Meanwhile, in San Diego-where the market conditions are considered normal- the downturn is expected to be only around 1.3 percent over the next 12 months.

While harder-hit areas may also experience a slower comeback after the crisis is over, factors like low mortgage interest rates and a shortage of for-sale supply have already supported prices in some metros and may also encourage home price stabilization nationwide.