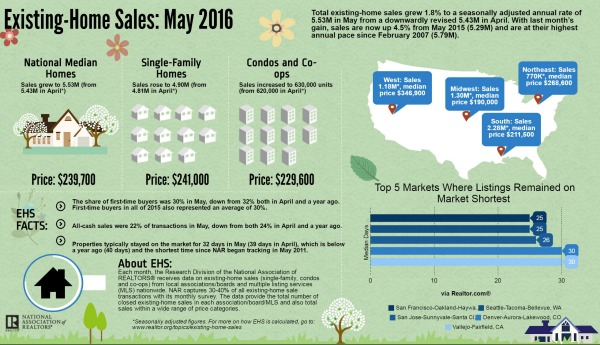

The median price of an existing home reached an all-time high in May and sales hit their highest pace in nearly a decade. The National Association of Realtors® (NAR) said on Wednesday said completed sales of single-family homes, condominiums, and cooperative apartments rose by 1.8 percent from April to a seasonally adjusted annual rate of 5.53 million units, the highest annual rate since sales set a 5.79 million pace in February 2007. April sales were revised down to 5.43 million from 5.45 million.

Despite the increase, sales in May were below what analysts had expected although within the range of 5.35 to 5.68 million. The consensus of those surveyed by Econoday was 5.57 million.

Sales rose on a year over year basis by 4.5 percent compared to a year-over-year gain of 6.0 percent in April. Last May the rate of sales was 5.29 million.

NAR said home prices during the month surpassed the peak of $236,300 set in June 2015, largely due to rising demand in the face of lagging supply levels. The median price of all homes sold during May was $239,700, up 4.7 percent from May 2015 ($228,900). May's price increase marks the 51st consecutive month of year-over-year gains.

Lawrence Yun, NAR chief economist, says existing sales continue to "hum along," rising in May for the third consecutive month. "This spring's sustained period of ultra-low mortgage rates has certainly been a worthy incentive to buy a home, but the primary driver in the increase in sales is more homeowners realizing the equity they've accumulated in recent years and finally deciding to trade-up or downsize," he said. "With first-time buyers still struggling to enter the market, repeat buyers using the proceeds from the sale of their previous home as their down payment are making up the bulk of home purchases right now."

Adds Yun, "Barring further deceleration in job growth that could ultimately temper demand from these repeat buyers, sales have the potential to mostly maintain their current pace through the summer."

Single-family home sales increased 1.9 percent to a seasonally adjusted annual rate of 4.90 million in May from 4.81 million in April, and are now 4.7 percent higher than the 4.68 million pace a year ago. The median existing single-family home price was $241,000, representing 4.6 percent appreciation over the previous year.

Existing condominium and co-op sales rose 1.6 percent to a seasonally adjusted annual rate of 630,000 units in May from 620,000 in April and gaining 3.3 percent from the May 2015 rate of 610,000 units. The median existing condo price was $229,600 in May, a 6.0 percent annual gain.

The number of homes available for sale at the end of May was estimated at 2.15 million units, a 1.4 percent increase over the April inventory but 5.7 percent lower than a year earlier. The unsold inventory represents a 4.7-month supply at the current rate of sales, unchanged from the previous month.

"Existing inventory remains subdued throughout much of the country and continues to lag even last year's deficient amount," adds Yun. "While new home construction has thankfully crept higher so far this year, there's still a glaring need for even more, to help alleviate the supply pressures that are severely limiting choices and pushing prices out of reach for plenty of prospective first-time buyers."

The share of first-time buyers was 30 percent in May, down from 32 percent both in April and a year ago. First-time buyers in all of 2015 also represented an average of 30 percent. Individual investors purchased 13 percent of the homes sold in May, the same share as in April and 63 percent paid cash. All-cash sales made up 22 percent of all sales during the month, down 2 percentage points from both April 2016 and May 2015.

Foreclosures and short sales together represented only 6 percent of all sales, down from 7 percent in April and 10 percent a year earlier. Only 1 percent were short sales. Foreclosures sold for an average discount of 12 percent below market value in May (17 percent in April), while short sales were discounted 11 percent (10 percent in April).

The typical marketing time for a May sale was 32 days, the shortest time since NAR started tracking the number in May 2011. Marketing time was 39 days in April and 40 days in May 2015. Short sales were on the market the longest at a median of 103 days in May, while foreclosures sold in 51 days and non-distressed homes took 30 days. Forty-nine percent of homes sold in May were on the market for less than a month - the highest percentage since NAR began tracking.

NAR said a survey it released earlier in June showed that high levels of student debt are a partial cause of the low homeownership rate among young adults and the continuing low share of first-time buyers. NAR President Tom Salome said, "At a time of historically low interest rates, responsible student loan borrowers should have the opportunity to refinance their loans from their current rates, which can oftentimes run over double-digit percentage points." He said NAR supports policy proposals that streamline income-based repayment programs and allow student loan borrowers the ability to refinance into lower rates. Furthermore, he said, "It's important that mortgage underwriting guidelines related to student loan debt are standardized and do not impair homeownership opportunities."

Existing home sales rose in every region by the Midwest, where they were down 6.5 percent on a monthly basis to an annual rate of 1.30 million in May. Those sales however were still 3.2 percent higher than the previous May. The median price in the Midwest was $190,000, up 4.8 percent from a year ago.

Sales in the Northeast increased 4.1 percent to an annual rate of 770,000, and are now 11.6 percent above a year ago. The median price in the Northeast was $268,600, an annual decrease of 0.1 percent.

The South saw sales rise 4.6 percent to an annual rate of 2.28 million in May, and are now 6.5 percent above May 2015. The median price in the South was $211,500, up 5.9 percent over the previous 12 months.

Existing-home sales in the West jumped 5.4 percent to an annual rate of 1.18 million in May, but remain 1.7 percent lower than a year ago. The median price in the West was $346,900, up 7.7 percent year-over-year.