If you are looking for an upbeat assessment of consumer sentiment regarding housing, a recent survey by the MacArthur Foundation is not the place to go. Its most recent survey of housing attitudes shows many Americans feel that home ownership is increasingly out of reach and close to a third of respondents don't think the housing crisis is over.

The 2016 How Housing Matters Survey is the fourth annual national poll of housing attitudes commissioned by the MacArthur Foundation, this year with additional support from the Kresge Foundation and the Melville Charitable Trust. Hart Research Associates interviewed 1,200 adults, via landlines and cell phones, between April 28 and May 10.

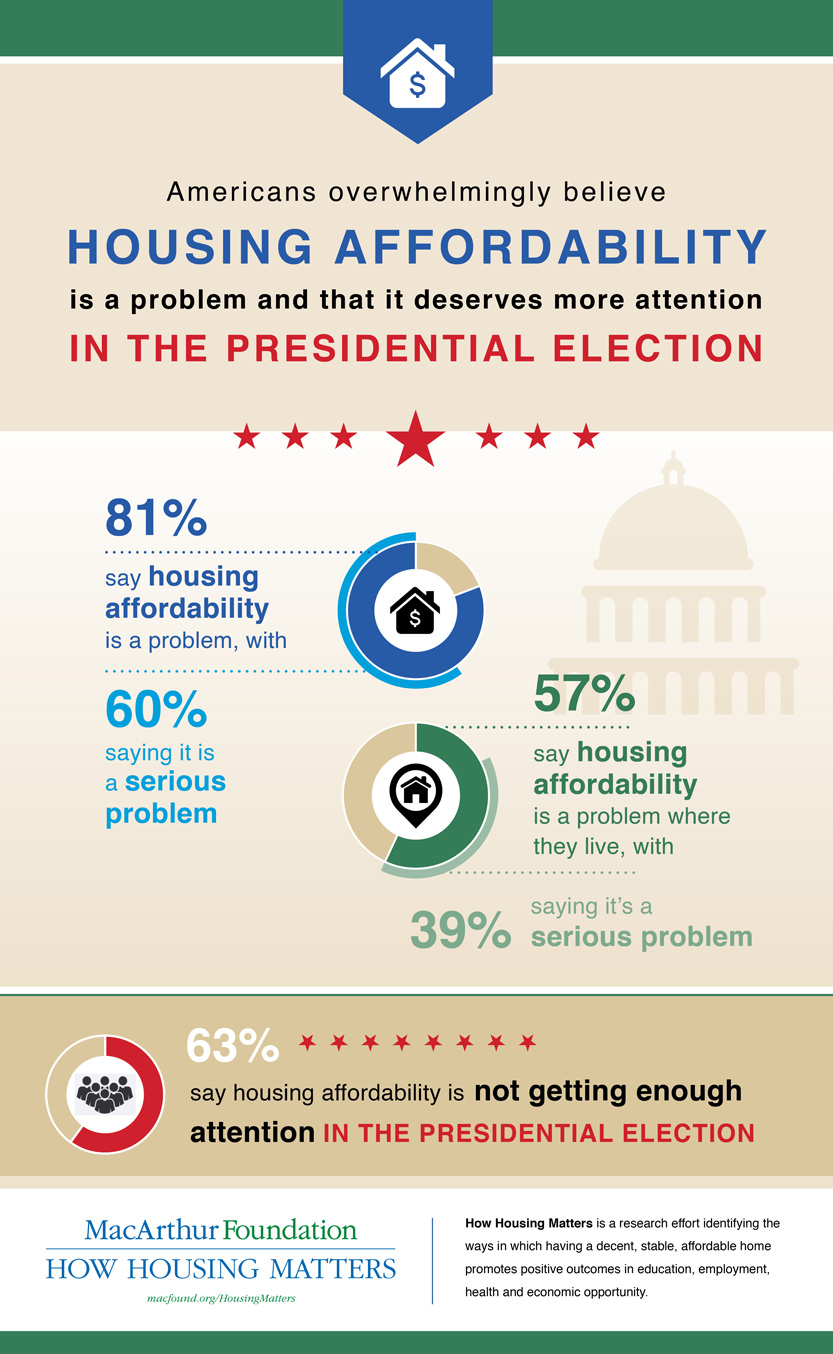

Americans overwhelmingly consider stable, affordable housing as essential to economic security for families, tying with saving for retirement at 85 percent, behind only having a good job at 90 percent. Yet 81 percent of respondents believe that housing affordability is a problem and six in ten called it a serious problem. Sixty-eight percent believe that it is more challenging to secure affordable housing today than it was for previous generations, a belief held across all educational, income, regional, and demographic cohorts.

"Too many Americans today believe the dream of a decent, stable home, and the prospects for social mobility, are receding," said MacArthur President Julia Stasch. "Having a decent, stable, affordable home is about more than shelter: It is at the core of strong, vibrant, and healthy families and communities. This survey demonstrates that the public wants action to address the nation's real and pervasive housing affordability challenges."

While 35 percent of respondents told pollsters in 2015 that they thought the housing crisis was pretty much over, there was a six percentage point drop in those responses this year. In fact, 44 percent believe the country is still in the middle of the crisis and 19 percent think the worst is yet to come. The proportion of Americans who believe the crisis is over had been steadily rising to its 2015 peak, from 20% in 2013 to 25% in 2014. The recent drop prevails across most segments of the public and is especially pronounced among Hispanics and city dwellers with a 13 percent drop in each group and renters and those 65 and older whose positive responses were down 12 points.

Still, Americans are optimistic that the problems are solvable. Nearly two-thirds believe there are actions that can be taken to increase affordability with 76 percent believing it is at least fairly important for their elected leaders in Washington to do so. The view that affordable housing should be a priority among policymakers is strong across the political spectrum - from most Democrats (88% say it is very/fairly important for leaders to act) to three-fourths of Independents (75%) to a solid majority of Republicans (62%). Both homeowners (71%) and renters (86%) agree as well. Yet 63% of adults say this issue has not received enough attention from the 2016 presidential candidates, including half of Republicans (49%), two-thirds of Independents (66%), and three-quarters of Democrats (74%).

Among possible solutions supported by strong majorities were tax changes to help lower middle-income home buyers, expanding housing support for low-income families with children, and requiring local communities to ensure 20 percent of housing is affordable to those earning less than $50,000 a year. At least three-quarters of respondents supported each of this changes.

A third of respondents said they know someone who has been evicted, foreclosed upon, or otherwise lost their housing in the last five years and over half indicated they have themselves sacrificed to cover their mortgage payments or rent over the last three years. This has including taking on additional work, ceasing to save for retirement, accumulating credit card debt, or cutting back on healthy food or healthcare. Thirty-one percent say they paid more than half of their monthly income on rent or mortgage payments.

The survey finds that 16% of adults feel only somewhat stable and secure or unstable and insecure in their current housing situation - this represents more than 37 million Americans. One third of renters expressed such vulnerability and 42 percent of those who spend more than 30 percent of their income on rent.

Despite the pessimism, the survey found the pendulum is continuing to swing back to the belief that owning a home is an excellent long-term investment. That sentiment has risen 10 percent since 2014 to 60 percent.

Geoffrey Garin, President of Hart Research Associates, said, "This year's How Housing Matters survey reveals a surprising reversal of the trend in which Americans have been feeling more optimistic about the housing recovery, and concerns about housing affordability have remained remarkably durable. It is understandable why so many Americans are still skeptical about the housing recovery. Stable, affordable housing equates to feelings of security and having achieved a middle-class lifestyle, yet as Americans continue to make sacrifices to keep their homes. Americans want their elected officials to focus more on the challenge of affordable housing, and they think the issue has not so far received the attention it deserves from the candidates."